The Christmas holiday season is a meaningful moment in the year. It is time to rethink values, to ponder on life and everything that surrounds it. It is also time to redo plans, assess decisions we’ve made through the year and resume the path to an increasingly happy life.

Soon there will be 365 new days of opportunities to achieve our goals and dreams, but before that there will be gifts, parties, family gatherings, food, drink, new clothes, and flight tickets – just to mention a few extra expenditures that the holidays bring.

If you are looking for a way to gain some extra for the holidays, selling gold and silver items is a convenient and fast way to do so.

Selling gold and silver in any form (bars, coins, jewellery, etc) is a very straightforward process – and yes, there is still time before Christmas. Just call Gold Smart at 0800 465 376 to make an appointment – after pricing all your items we will pay you on the spot, so why wait?

Avoid starting the New Year with debt. 2015 is a time to start fresh, and to flourish, so give us a call.

MERRY CHRISTMAS AND A HAPPY NEW YEAR from the Gold Smart team!

Construction workers have hit a pot full of 200-year-old gold coins while digging an eight-foot hole to be used as a toilet close to an ancient temple in an Indian village.

According to Bangalore Mirror, the excavation crew found 43 coins inside the buried crock and instead of telling the person who hired them about the discovery, reburied it and told the homeowner that they were unable to finish the work that day.

Later that evening, the men returned to the site and recovered the buried treasure. Then they made their way to the nearby town of Chamarajanagar (Karnataka), taking the coins to a pawnbroker to determine their value.

The lender allegedly sent the workers away, telling them those coins were fake and hence worthless. BM reports the person proceeded to call the local police and inform them of the discovery of ancient coins by a few labourers.

Further digging in the neighbourhood unveiled another 50 gold coins.

Experts are yet to determine the period of the coins but according to sources quoted by The Times of India, most of them are from the late 18th century and early 19th century when this part of the country was under Hyder Ali — ruler of the Kingdom of Mysore.

It is unclear whether the workers may face charges. It is also uncertain if the Archaeology Survey of India will continue to check the area in search of more coins.

Original Source: Mining.com

Gold Smart buys all Platinum labware, which include Platinum Crucibles, Platinum Moulds, Platinum Dishes, Platinum Tweezers, Platinum Spatulas, Platinum Stirring Rods, Platinum Inoculating Loops, Platinum Cones, Platinum Triangles, Platinum Electrode, Platinum-tipped Tongs, Platinum Trays, in any condition, as well as any Platinum lids or any other Platinum scrap labware.

A crucible is a container that can withstand very high temperatures and is used for metal, glass, and pigment production as well as a number of modern laboratory processes. While crucibles historically were usually made from clay, they can be made from any material that withstands temperatures high enough to melt or otherwise alter its contents.

A crucible is a container that can withstand very high temperatures and is used for metal, glass, and pigment production as well as a number of modern laboratory processes. While crucibles historically were usually made from clay, they can be made from any material that withstands temperatures high enough to melt or otherwise alter its contents.

One of the earliest uses of platinum was to make crucibles. Platinum crucibles offer high temperature strength and high melting point as well as oxidation resistance in air and oxygen; and corrosion resistance in acids and melted salts.

For the best prices on Platinum Crucibles and Platinum labware, call Gold Smart today.

If someone ever tells you diamonds are rare and make a great investment for the future, walk away. This is one of the greatest marketing myths of modern times, and it has continued for decades due to the amazingly successful ability of one company to control a worldwide monopoly on the international value of diamonds. What started before the 20th century still continues in 2021 and will likely last for decades longer because the myth is so well-engrained in Western society.

The Short But Powerful History of South Africa’s Diamond Industry

A company called De Beers is said to artificially restrict the supply of diamonds to keep the prices obscenely high. Not only are diamonds artificially high in market value, but they are also a worthless investment. Retail jewellers prefer not to buy back diamonds from customers because they sell them at a 100 to 200 percent markup. Frequent resale transactions would expose the actual second-hand value and undercut the widely-held notion that diamonds eventually go up in value, which couldn’t be further from the truth.

Before 1870, diamonds were only worn by royalty, a primary reason why vintage jewellery from earlier times is so different from modern pieces in the 20th century. However, that year an enormous deposit of diamonds was discovered in South Africa. Once the diamonds started to flood the jewellery market, the owners of the mines realized they were making their investment worthless. Cecil Rhodes came in and started buying up all the mines trying control the output and keep the price of diamonds as high as possible. It was a classic supply & demand move. Cut the supply, demand rises, and so does the price. Trickle out supply but just enough to keep the interest up, and the high price pays for everything involved. By 1888 Rhodes controlled the entire South African diamond supply, and in turn, essentially the entire world supply since diamonds were impossible to find anywhere else. By 1902 mining prospectors discovered another massive mine in South Africa that contained as many diamonds as all De Beers’ mines combined. The owners initially refused to join the De Beers cartel, but eventually saw the light three years later.

Today, De Beers owns most of the diamond mines. For mines that they don’t own, they have historically bought out all the diamonds, intimidating or co-opting any independent efforts to resist the South African monopoly. De Beers then transfers all the diamonds over to the Central Selling Organization (CSO), which is also owned by them.

The CSO sorts through the diamonds, packs them in boxes, and delivers them to the 250 partners that they sell to. The price and quantity of the diamonds are non-negotiable – it is a take it or leave it deal. Refuse your box, and you will be out of the diamond industry. Most players count industry survival more important than the principle of the matter. As a result, this system has controlled 90 percent of the diamond trade and has been solely responsible for the inflated price of diamonds consumers pay.

There have been shakeups, however. In 1957 the Soviet Union discovered a massive deposit of diamonds in Siberia. Even though the diamonds were a bit on the smaller side, De Beers still had to swoop in and buy all of them from the Soviets to avoid an uncontrolled market upset. Later, in Australia, a large supply of colored diamonds was discovered. When the mine decided to refuse to join the syndicate, De Beers retaliated by unloading massive amounts of colored diamonds that were similar to the Australian ones to drive down their price. The move immediately crushed the independent player financially. Similarly, in the 1970s, some Israeli members of the CSO started stockpiling the diamonds they were allocated rather than reselling them. This made it difficult for De Beers to control the market price and would eventually cause deflation in diamond prices when the hoarders released their stockpile. De Beers played the long game of attrition since it ultimately controlled the ongoing supply. The offending members were banned from the CSO and they withered being cut off from any new diamond business.

In 2000, notably, De Beers announced that they were finally relinquishing their monopoly on the international diamond business. This move was in response to increased pressure resulting from a U.S. anti-trust lawsuit related to price-fixing industrial diamonds to the tune of $10 million, a pittance on what De Beers could have paid had they been penalized to their company worth.

Cultural Appropriation by Wedding not Industry

Today, over 80 percent of women in the U.S. receive diamond rings when they get engaged. However, provide a partner a cubic zirconia stone, and a suitor might very well get put in the hospital. The cultural rule of the diamond being the elite representation of marital commitment has been practically cemented in Western culture since at least the 1920s, and even estate jewellery gets turned down for opportunities to have new diamond rings and jewellery.

Interestingly, diamonds could be far more valuable today through technology. Diamonds can perform as an outstanding semiconductor material, superior in many ways to silicon, which is currently the most widely used electronic material. Diamond devices could operate at higher temperatures (more than 400 °C) and higher power than those of silicon, as well as being faster, denser, and more resistant to radiation. But practical diamond electronics will need large-area, single-crystal diamond wafers to be fabricated, analogous to the 6–12-inch silicon wafers commonly used in the semiconductor industry. Two papers from Golding and colleagues, in Applied Physics Letters and Diamond and Related Materials, now show that this may be possible if sapphire wafers are used as substrates on which to grow the diamond.

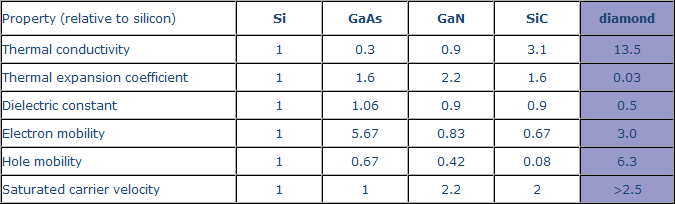

Ask any electronics engineer “what is the ultimate semiconductor material?”, and the majority will say a “diamond”. Take a look at any comparative table of properties and the reason is obvious (strangely exponents of gallium nitride and silicon carbide always omit the diamond column from their presentations).

![]()

Where the diamond really scores high is that it far outperforms any other material in terms of the stone’s ability to insulate very high voltages across very thin layers of the material. The lower the insulation strength the more base material you need to start with (which is a big issue when wide bandgap semiconductors are already at least 10 times the cost of silicon), but more importantly the slower the device operates – which is now why 6,500V appears to be the ultimate practical limit for silicon insulated gate bipolar transistors (IGBTs). Despite its obvious intrinsic advantages, however, the diamond has struggled in the past to make any significant progress as a semiconductor material. The reason for this because of widely held misconceptions.

The simple fact is the diamond is made up of the ideal material to meet the needs of the energy systems of today and tomorrow where the need exists to precisely control the flow of electricity from watts to megawatts. Unlike other wide bandgap materials, the diamond has the potential to be able to clearly differentiate itself against existing silicon on cost (per switched watt) and performance. Beyond power electronics, the diamond also has a wide potential of electronics applications that exploit other facets of diamonds’ superior capabilities including bio-compatible and ultrahard wearing MEMs, photovoltaics, and extreme environment devices. The most celebrated manifestation of this technology is the quantum computer, which could exploit quantum principles to achieve far greater power than the devices.

Unfortunately, yet again, the diamond industry has deftly steered practical engineering away from what works to what is “acceptable,” leaving diamonds to continue to float in the stratosphere of made-up value and luxury.

There’s a pretty predictable pattern that merchandising for anime and youth-oriented movies in Japan follows. New hits get inexpensive trinkets, at a price point where kids can purchase them with their allowance. After a decade or two, higher-quality, items start to show up, like Sailor Moon jewelry and Gundam cars, which are priced more in line with what the franchise’s nostalgic and employed fan base is willing to spend.

Since it’s now been 60 years since the first Godzilla movie, some fans who weren’t even in preschool for the legendary kaiju’s debut are now getting close to retirement. With possibly a whole career’s worth of earning, prudent financial decisions, and wise investments, some Godzilla fans can afford to lay out big money to show their respect for the King of the Monsters, which is where this solid gold Godzilla figurine comes in.

Jeweler Ginza Tanaka opened its first store in 1892. Since then, the company has built a reputation as a reputable provider of high-end, non-reptilian accessories.

To commemorate Godzilla’s 60-year milestone, though, the company has decided to create a 24-centimeter (9.4-inch) recreation of the beloved monster. While it’s not nearly as big as the awesome 8.75-meter-tall, two-ton Godzilla slide we recently visited, Ginza Tanaka’s figurine still tips the scales at 15 kilograms (33 pounds).

The statue’s price tag is even heftier than its weight, though, as Ginza Tanaka’s creation sells for an eye-popping 150 million yen (US $1.47 million). Why so much? Because it’smade entirely out of 24-carat gold.

The design is based off of the creature’s appearance in the 1989 film Godzilla vs. Biollante, although Ginza Tanaka’s designers say they added a bit of extra muscle tone for their sparkly statue.

The golden Godzilla officially goes on sale July 20, but is committed to a series of public appearances soon after. From July 20 to 29, it’ll be on display at the G Haku Godzilla exhibit at the Hikarie building in Tokyo’s Shibuya. Next, it’ll move to the Ginza Tanaka flagship store in Ginza until August 10, before making the trip to Osaka for the G Haku exhibit at the Abe no Harukasu Kintetsu department store from August 14 to 24, then finally making the rounds of other Ginza Tanaka stores across Japan.

Presumably, though, the statue will eventually wind up gracing the home of whatever well-heeled fan steps up to but it. So if you’re a collector who’s been saving up your cash to make a bulk purchase of several thousand plastic Godzilla toys, here’s your chance to throw the same amount of money into your hobby in a way that’ll still leave you plenty of shelf space.

Original Source: Rocket News 24

Being one of the most prolific gold coins issued by the British Empire in history, the gold sovereign can claim the title of being one of the world’s greatest international forms of currency. The Greeks and Romans hold title to their currency being international earlier in time, and so do the Chinese, but the British sovereign was clearly one of the world’s most famous gold coins, being circulated and fabricated in countries all over the world under the British Empire’s flag. Today, gold sovereigns have both a precious metal value as well as a numismatic, collectible worth, which makes having one for sale a bit of a quandary for some. Which is worth more, the gold price, or the historical value, or both?

A Little Background on the Gold Sovereign and Rarity

The original gold sovereign was created during the reign of Henry VII in 1489 when the king ordered his officers to produce a new form of currency. Sovereigns were not the first British coin circulated, but no other coin had been as widely distributed. The first coin issued had an image of Henry VII on his throne—beginning the tradition of the reigning sovereign to be depicted on one side of the coin, ergo the name. The reverse image featured the royal coat of arms. The first issue of sovereigns ended in 1604 before getting a revival in 1817. To re-launch the coin, a new picture for the reverse side was selected. This time the image featured St. George slaying a dragon as designed by famed engraver and artist, Benedetto Pistrucci. Going forward, the British had for years relied upon numerous overseas arms of the Royal Mint to create gold sovereign coins, expanding their distribution and use throughout the world. However, the first World War brought the circulation of gold sovereign coins to a grinding halt due to materials shortages. Gold had to be redirected to war supplies and armament purchases being consumed at an incredible rate on the Western Front in France and Belgium at the time. After the first major conflict, minting of the gold sovereign continued until the 1930s when it was found to be too much of an expense and paper notes were far cheaper to circulate.

With World War II ended after the 1940s, the Royal Mint began to again produce gold sovereigns in 1957, but by then they were collector coins versus true currency. Sovereigns are still issued from time to time, especially as commemorative pieces reflecting the history of British coinage from centuries before. One of the latest issues to be released by the Royal Mint was a gold sovereign marking the event of Brexit in January 2020, the economic separation of Great Britain from the European Union.

Rare Sovereign Coin Collectability

Rare sovereigns can sell for exceptional prices at an auction as well as a private sale. For instance, a gold sovereign minted in 1937 of Edward VIII before his abdication sold for 516,000 British Pounds in 2014. Like the Morgan dollars in the U.S., the year of the coin makes a big difference in its value and worth on the numismatic side. Some years are particularly hard to find due to the originally low number of coins issued as well as how many have disappeared over the centuries. The older years obviously tend to average more in value the farther back in history one goes, especially the earliest versions from Henry VII. The Royal Mint on rare occasions releases some extremely hard to find pieces, and they typically demand very high prices. One coin sold for almost 1 million British Pounds at auction.

Gold Value Alone

Sovereign coins are sold in two sizes: half and full. The full coin has a face value of one shilling. The full is also 0.2354 Troy ounces of pure gold and weighs 7.98 grams. In comparison, a half-sovereign has 0.11 troy ounces of gold and weighs 3.99 grams. Gold sovereign coins are produced from 22 carat gold, which automatically commands a high price due to the gold quality involved. Being 92 percent pure, a full sovereign makes up close to a quarter of a Troy ounce, which is the standard for the gold spot price at 24 carats. Work backward with the math and one can roughly get to a ballpark value of a full sovereign very quickly (spot price * 0.2354 * 0.92). As gold continues to increase in price, it’s being bought and sold quite regularly here in New Zealand and all around the world.

Frequently Appearing in the Oddest Places

While the most common situation a gold sovereign appears to tend to be a family estate distribution, sovereigns in full and half form have been so common, they show up all over the world. Sovereigns can be confused sometimes and actually appear in common currency when people aren’t paying attention, and probably the oddest situation was a fowl hunter who found one in the mud one day out while looking for something entirely different at the time. The gold medal sparked just enough to catch his eye while walking around and, sure enough, he had a gold sovereign in his hand after washing it off with some water in the field. So, don’t discount the idea that they can never be found; sovereigns regularly show up anywhere from online auctions to garage sales and buried in homes being resold and where the owners forgot what they hid somewhere in the rafters. A good number of them have been lost at sea too, which occasional samples washing up on shores, just like the Spanish doubloons that appear occasionally on Florida beaches. Who knows, while you won’t necessarily score a $4 million roman coin, a surprise find on a beach could at least pay for a nice weekend vacation on your own.

Gold Smart Will Buy Sovereign Coins

If you’re looking for a reliable vendor with which to evaluate and sell your gold sovereign coins that are not rare, Gold Smart can help. Because we regularly buy resale gold from large and small sellers, we have no issue including gold sovereigns in our inventory of purchasable gold. The pricing will be for the gold value of the coin, however, not the numismatic value. If you are interested in selling your coins to collectors, first get them appraised so you have a good idea of what they are actually worth to the coin collecting market. The small fee you pay for the appraisal can be worth the time. And, you may very well find out that the metal value of the gold pays you better than the collectible value. This can happen a lot nowadays with the high price of spot gold driving resale value much, much higher than in years before.

With all the frenzy over gold these days, selling a non-rare gold coin can seem like a bit of a headache in New Zealand. Don’t be tempted to try to sell your sovereign online via auction websites. More than one seller in New Zealand has been ripped off by supposed buyers who turn out to swindle both the coin and money “paid” for the coin using a credit card feature known as the chargeback. Instead, working with Gold Smart gives you a bona fide relationship with a New Zealand business that has been established for years in Auckland and can handle your coin safely either in person or via secure courier with an online sale. Folks by the hundreds have sold their gold through Gold Smart without issue, achieving competitive gold resale prices and avoiding the risk of private sales altogether. Take advantage of your treasure and get the most out of it the right way by selling your gold sovereign through Gold Smart. You’ll be glad you did, and most of our customers come back for additional sales because our purchasing program works so well and smoothly. Try it and find out for yourself!

Justin Bieber and Adidas

Pop singer Justin Bieber recently inked a deal with shoemaker Adidas to promote a line of shoes from the company and sent his fans on an Internet-based golden sneaker hunt. This information was posted on the Adidas website several months ago, so we are not certain of the status of the contest.

Bieber is a 19-year-old singer from Canada who had his first hit song when he was just 16 years old. His dating life and personal antics are widely read fodder for fan magazines and websites. A Google search of “Justin Bieber Gold Shoes” pulls up 21 million matches.

It seems that Bieber initially had a pair of gold shoe custom made from some Adidas sneakers. This is just hypothetical, but when the Adidas marketing crew found out about the custom kicks, it probably did not take long to sign the singer to a promotional deal.

Get a Pair of Justin Bieber’s Golden Adidas

The “Find My Sneakers” promotion launched in October, so the contest may have run its course. However, if you are a Bieber fan and just now learned of the shoes, we leave it up to you to follow the links and try to score your own pair of Justin Bieber golden Adidas.

Valuable Gold Items

Meanwhile, if you have unwanted gold items and are looking to convert them to cash, whether it’s rose gold, white gold, and yellow gold, as long as the gold is genuine and not plated, sell them to trusted New Zealand based gold buyers.

Gold Smart will walk you through the process of selling your broken or out of style gold jewellery and you can rest easy knowing you are working with a reputable gold buyer.

With gold at $1,600 per ounce, that works out to about $50 per gram and it does not take much to get to more than a few grams of gold. If you have some jewellery, gold coins or gold bars at the back of a drawer or locked in your safe, you just need to follow a few simple steps to find out what your hoard is worth and then make the decision to sell or not.

First, you need to find out how much gold is in your gold. Pure 24 karat gold is too soft for most used of the metal, so your jewellery and coins are probably less than pure gold. A bar should be 99.99 percent pure, but that should be verified. A gold dealer will be able to test your pieces and give you the weight and what percentage of that weight is pure gold.

Get a value quote for your gold pieces. The gold dealer will let you know how much gold you have and the value of that amount of precious metal. Before going into the dealer you can use the Internet look up the most recent spot price for pure gold as it trades on the financial markets. Your local dealer should pay you a value close to the published price of gold. Remember that the dealer must process your gold pieces to extract the pure gold, and those costs will somewhat reduce the price per gram you receive.

Work with a gold dealer you know and trust. It is not a coincidence that Gold Smart puts out this blog and other information to help sellers make smart decisions. If you live in New Zealand, you have found the connection to the right dealer. If you live elsewhere, use the tips provided here to get the best value for your collection of gold objects.

At Gold Smart, we welcome customers to price compare, as time and again they will come back and sell to the company that has the best services and prices. However, companies have a legal obligation under section 9 of the Fair Trading Act 1986 not to be misleading when comparing prices.

It came to our attention that a business operating as “webuyanygold.co.nz” placed an apparently unsubstantiated comparison advertisement on its website which we consider to be potentially misleading. The advertisement lists six gold buying businesses under the heading “Compare the gold market”. Various sums of money, apparently prices paid for gold, are listed against each business name.

We consider the advertisement to be misleading in that it:

- does not state the source of the alleged prices;

- does not state what gold item(s) the alleged prices relate to;

- does not state the dates at which these prices were allegedly offered or obtained; and

- may not reflect the true prices offered by the various named businesses

This advertisement does not necessarily allow consumers viewing it to accurately compare likely prices from the named businesses for gold they wish to sell.

On the website at webuyanygold.co.nz they also make claims about paying 5% more than their nearest competitor and that they pay the most online for gold. Given the fluctuating price of gold and the differing circumstances of each transaction, we consider that these absolute claims are unlikely to always be true.

We have tried to find out more about who’s behind this website, and despite our efforts, we cannot locate any NZ registered limited liability company associated with it. The domain name is registered to “Cash4GoldJewellery”, which is not the name of a New Zealand registered company, and the contact details include a UK telephone number. In our view, this is quite unusual.

Seen on their website are several photos of Josephine Davison, who is listed as an actress under the Auckland Actors website. She has featured in several movies and television shows including Shortland Street, Xena: Warrior Princess and Power Rangers. Josephine is a registered Secondhand Trader as per the Secondhand Dealers and Pawnbrokers Act. Place of business: “Itinerant Secondhand Dealer”.

We have raised our concerns directly with webuyanygold.co.nz. Fair competition through truthful, accurate advertising is an issue taken very seriously at Gold Smart.

It’s our strong advice that gold sellers do homework on who are the legitimate and reputable traders that exist in New Zealand.

Many customers in Christchurch found they have jewellery that they don’t wear, needing repair or they don’t even remember they have.

An easy way to earn some extra cash is to have a clean-up around the house gathering gold and silver items not in use anymore.

We are constantly buying from customers in Christchurch. Our Courier Pack system is easy and efficient and ensures a fast way to turn your unwanted gold and silver items into quick money you can put to use.

If you are looking to sell gold in Christchurch and have no plans of coming to Auckland anytime soon, Gold Smart can purchase from you. With the help of our friendly team Christchurch customers can take advantage of our excellent rates ensuring you are getting more money for your items.

Request a Gold Smart Courier Pack and we will send you everything you need to prepare and send your gold and jewellery items to us FREE of charge.

For more information call us today at 0800 GOLD SMART (0800 465 376).

An easy way to earn some extra cash is to have a clean-up around the house gathering gold and silver items not in use anymore.

Although we love meeting our customers at our head office in Auckland, we know that sometimes this is not always possible. For customers looking to sell gold in Tauranga, we have an efficient Courier Pack System which enables you to do this easily.

If you are in Tauranga and wish to sell gold and/or silver to us, requesting a Gold Smart Courier Pack can be a fast and lucrative option when selling your items. With the help of our friendly team, Tauranga customers can take advantage of our excellent rates ensuring you are getting more money for your items.

A few days ago we received a call from someone wanting to sell gold in Tauranga. Unaware of our courier system, the person was willing to drive 2.5 hours to Auckland in order to take advantage of our high rates. After a quick chat and reading several testimonials from people who have used our courier pack, the customer proceeded and the transaction went fast and smoothly.

Contact Gold Smart

Whenever you are ready to sell your gold and/or silver, all you have to do is visit the contact page on our website and request your pack. A Gold Smart staff member will contact you and guide you further with the process.

You can also call us now on 0800 465 376 and speak with one of our friendly team.

We love meeting our customers. They’re the reason why we enjoy what we do, and it also brings great satisfaction providing excellent rates to anyone who visits Gold Smart to sell gold and/or silver.

You are most welcome to meet with us in person at our Auckland offices. We guarantee a pleasurable experience and you will be under no pressure to sell your items.

If you are looking to sell gold in Wellington and have no plans of coming to Auckland anytime soon, Gold Smart can purchase from you via our Courier Pack System. With the help of our friendly team Wellington customers can ensure they are getting excellent value for their items.

Request a Gold Smart Courier Pack and we will send you everything you need to prepare and ship your gold and jewellery items to us FREE of charge.

For more information call us today at 0800 GOLD SMART (0800 465 376).