The carat (abbreviation ct or kt) is a measure of the purity of gold alloys, 24-carat being pure gold. The carat system is increasingly being complemented or superseded by the millesimal fineness system, in which the purity of precious metals is denoted by parts per thousand of pure metal in the alloy.

Where did such an unusual unit of purity come from?

The word carat is derived from the Greek kerátion (κεράτιoν), “fruit of the carob”. Carob seeds were used as weights on precision scales because of their reputation for having a uniform weight. (However, a 2006 study by Lindsay Turnbull and others found this not to be the case). This was not the only reason. It is said that, in order to keep regional buyers and sellers of gold honest, potential customers could retrieve their own carob seeds on their way to the market, to check the tolerances of the seeds used by the merchant. If this precaution was not taken, the potential customers would be at the mercy of “2 sets of carob seeds”. One set of “heavier” carob seeds would be used when buying from a customer (making the seller’s gold appear to be less). Another, lighter set of carob seeds would be used when the merchant wanted to sell to a customer.

In the distant past, different countries each had their own carat, roughly equivalent to a carob seed. In the mid-16th century, the Karat was adopted as a measure of gold purity. The most common carats used for gold in jewelry making are 9 and 10 carat in New Zealand.

The value of your gold is determined by three things – the weight, the carat and the current market price. Higher carats of jewellery contain more gold (e.g. 18ct has two times more gold than 9ct) and the heavier the total weight means more cash for you.

At Gold Smart you will receive the highest price for your gold and silver because we are transparent about the entire pricing process.

Original Source – http://en.wikipedia.org/

Silver has been that grumpy relative that everyone invites to the family dinner, but he doesn’t cooperate or get along with the spirit, instead of being the character that fouled up the punch. While all the other precious metals have skyrocketed up, silver has wallowed in the lower values for a number of years, only recently picking up a pace a bit in Fall 2020. However, like many grumpy relatives, silver is a complicated pest. While it doesn’t necessarily score big price points like its yellow cousin, gold, silver has the ability to produce some very interesting returns regardless. Much of it has to do with how silver fluctuates so much, even at lower values.

What Sells?

Just about anything that is solid silver is salable. Specifically, silver bullion coins and bars are some of the most high-demand types of silver at any given time, and solid silver jewellery does well too. Clearly, the best silver to have for sale will be the high purity grade of 99.9 percent. Sterling silver labels are a giveaway for this standard, especially in silverware for dining settings.

What Makes a Good Sale in Silver?

Timing, timing, and timing make a good sale. The silver metal does not follow and has not followed a predictable arc of appreciation. Instead, its pricing runs up and down like a fidgety monkey, going up and down a tree 50 times in a day. Because of the very nature of how silver fluctuates in price, that means there are lots of opportunities to catch a good price point for a sale, and a lot of risky moments to make a mistake. And that same frequency makes it hard for an occasional buyer to be able to do anything with silver as an investment. Gold tends to be a general appreciation upward over the years, or at least has been, so an argument can be made to hold on for five or seven years and get a return. Silver could actually be lower in five years if one just fixates on a date. Instead, silver is far more suited to someone who watches the metal regularly and sees an opportunity this week but it goes away next week, the metal’s price is literally that volatile.

The other big factor in a good silver sale tends to be where one sells silver. There are a lot of rabbit holes one can fall into with silver selling, and many won’t return a good price, even when the spot price for silver has climbed considerably. Instead, one needs to seek out a good buyer resource who provides as fair a silver recycling price as possible and close to the spot price. Too often people get enamored with the spot price and then get shocked when they show up at a dealer who refuses to pay anything close. They then freeze and accept whatever’s offered. That’s a mistake. A bit of research and understanding what silver buyers are available in New Zealand can make a world of difference.

Pay Attention to the Fluctuations

Silver has bull runs and then drops, even though it seems overall in a big chart to be in a trough at times, day to day it’s up and down. Spending some time watching this behavior is a useful tip and can help spot a building high point as well as a good time to sell. This is a bit of timing a price, but because silver bubbles so much, there are plenty of more opportunities if the first one is missed. And it provides plenty of opportunities to practice monitoring to get price-watching right. Try this tip, you’ll be surprised by how much silver moves day to day, week to week.

Don’t Get Greedy

If you’re winning learn to call it with a respectable gain and back off. There’s an old saying in investment that pigs get slaughtered, and it’s very true. People who wait too long just wanting to see the price go a bit higher are oftentimes disappointed. Instead, those who consistently make profits selling silver do so with smaller gains. Think about it. Making a 10 to 20 percent profit 50 times is worth a lot more than one big gain of 50 percent and then a lot of losses right after. These folks don’t get enamored with big figures. They build profit incrementally, one small gain at a time and then adding up the aggregate. And don’t worry, because there tends to be plenty who have overbought, when silver drops there’s plenty of fire sales to take advantage of if you want to get back into silver again with your portfolio.

Don’t Sell When Things Drop Because of Panic

Silver is going to drop, you can bet on it. And for many, silver tends to drop in price right after they just bought it, which can be alarming. However, the biggest mistake you can make with timing silver for a sale is to sell in panic. Don’t fall for the pressure. The beautiful thing about silver is that as fast as it drops, it runs right back up again. So, the loss factor is minimized. Be patient, wait for your time, and then sell when the opportunity presents itself properly. Your patience will pay off handsomely. Experienced silver sellers know this and simply sit back and catch a drink when there’s a drop. They might even use it as a buying opportunity to score a bigger sale a few days later.

Gold Smart Gives You the Silver Sale Advantage

You could time your silver sale incredibly well, follow all silver selling tips, but the gain can be entirely wasted if you sell to the wrong dealer. Remember, a lot of precious metal buyers have no interest in providing an objective recycle price. Taking time to find a good buyer can be a big part of maintaining a solid gain when it is time to sell your silver, providing you the best resale price possible for the precious metal.

Gold Smart can help you as one of New Zealand’s most respected precious metal buyers. Because Gold Smart is both a buyer and consolidator, we are able to regularly price silver at some of the most objective levels versus spot price. That means for sellers some of the best gains possible versus other options for selling silver. Don’t give away the product of your patience unnecessarily. Work with Gold Smart regularly and your research and temperance will pay off with great silver prices and sales.

Recent movement in the markets have caught some by surprise. Technically we are in the summer doldrums for gold prices and as gold buyers we have seen many customers pleasantly surprised by the recent strength in rates.

Recent movement in the markets have caught some by surprise. Technically we are in the summer doldrums for gold prices and as gold buyers we have seen many customers pleasantly surprised by the recent strength in rates.

Again it appears that concerns around the European Union and in particular the downgrade by Moody’s of Portugal’s credit rating to junk has seen markets respond by moving to investments seen as safe (or safer than government bonds). The New Zealand dollar also responded to the earthquake by moving down against the United States dollar – yet has bounced back to record high levels.

When selling gold it’s naturally a benefit to have higher prices because you get more from your items. This can be hard to time perfectly however as markets move quickly and as the common saying goes, “Bulls move up the stairs and bears go out the window”! The ideal timing really depends on what works for you and the benefit of the cash instead of unwanted jewellery.

The diversity of uses for “gold capital” is always something we find interesting and enjoyable to see the benefits Gold Smart is creating.

Selling gold online has continued to be a challenge for many being both being high risk in many of the channels available as well as complicated and difficult to make a profit doing so. To make matters harder, the amount of fraud occurring has increased dramatically in recent years with little help from website owners to regulate the problems. As a result, the odds tend to be working against a personal seller trying to liquidate gold online without knowing exactly how to protect his or her assets and money.

Understanding the Digital Basics

Selling gold online requires some kind of sales platform. The most obvious and professional method would be to sell to a registered company with a website offering to buy gold and using a courier method for taking in offers to consider. The second alternative is to utilize auction platforms where bidders pitch their prices and trying to win the gold purchase with the highest sale. Some of these options allow outright sales as well if a person is willing to agree with the desired price. The third alternative involves sales between private parties through the digital version of classified ads. This option essentially involves posting an ad for the gold and then working with a private buyer on the money being sent and the gold item being shipped accordingly. There are other variations and methods, but these three are the most common methods of gold-selling online.

The Risks Involved

Clearly, the most obvious risk with online gold selling is ending up losing the gold and never being paid, a double loss. While some might think it seems simple enough not to ship anything out until getting paid, the digital world has made even getting paid risky. Here’s how.

One of the easiest ways to fool someone out of their gold electronically is with the use of a credit card chargeback. When you buy something with a credit card online, the charge is inputted by the seller and a payment processor registers the expense against your credit card account. This takes a couple of days to clear, but the seller is told he has a credit for the sale, so the assumption is that everything will work out as soon as the item is shipped. However, if a customer is unhappy he or she could tell the credit card company the sale should be reversed as the sale wasn’t what was expected. Even before the seller gets a chance to fix things, the credit card process can then reverse the expense and pull the credit off of the seller’s account. When this happens, it is known as a chargeback.

Scammers and online thieves have used the chargeback method with great success, pull fake purchases again and again through a number of channels including some of the most popular ways of selling online. By doing so they are able to get the gold out of people’s hands who ship the metal thinking the payment process is as good as done with an electronic payment. Then the chargeback hits, and they have no payment and no gold, a double loss. Because a good number of these characters work internationally, it becomes practically impossible to find the characters with law enforcement. As a result, the scammers get away with the gold and never having to pay a dime for it.

Older and more traditional scam methods still work with some success as well. These include the fake check or money order sale where a buyer commits to buying gold but then ends up sending a fake personal check or money order that isn’t real. If a seller isn’t paying attention too closely, he or she may send the gold too early before the check or money order has actually cleared the bank. Again, the scammer has ended up with the gold and the seller lost both the payment and the precious metal at the same time.

The above said online auction sale is probably still less risky than dealing with a private party through a digital classified sale. In these situations, the sale is local but posted online. The parties agree to a date, time, and place and both show up in person to transact the deal. Many think this is safer since a seller is seeing the real cash. However, some parties who have tried such deals have found themselves instead of being robbed by the so-called buyer who turns out to be a criminal. While there are options for proxy sales, these tend to be difficult to make work as most private parties don’t want to pay fees dealing with a proxy agent to handle the sale transaction for them.

Safer Alternatives for Online Gold Selling

Fortunately, gold selling online doesn’t need to feel like a jaunt down the local pirate’s cove. Instead, it’s quite possible to sell all types of gold jewellery as well as bullion coins and bars safely and securely. Gold Smart provides a well-established, reputable channel for digital gold selling that works extremely well at a time when people can’t easily transact in person. With an online platform that provides easy connections and communication, as well as a secure courier method for transfer, people can sell their gold to Gold Smart for some of the best, objective prices for recycle gold in the country. Customers are able to enjoy peace of mind, a solid and fair return for their gold being sold, and avoid the risk of scams and online gold selling fraud completely. Even better, if a customer is not happy with the price offered, the gold sent it in will be securely packaged and sent back without worry or delay.

The condition of your items sent (bullion, jewellery, etc.) don’t matter because our consideration at Gold Smart is related to the actual precious metal value and quality level. As gold buyers, we appreciate you may have concerns around the process which could be a new experience and may have significant financial implications. However, our digital process for buying gold works extremely well, and we have hundreds of customers who have sold to us online safely and easily. The results prove themselves in our customers’ satisfaction and return the business to sell more gold to us again and again.

Final Thoughts on Gold Selling Online

Selling gold online can be extremely convenient and attractive, but it comes with a lot of risks when selling to an unknown party or a fly-by-night operation online. Remember, it only takes about five minutes to set up a website with a payment processing tool included. Just about anyone can do it these days, and they oftentimes do with very little cost and effort. The best way to sell gold online is to work with a gold buyer with a strong reputation in New Zealand, a proven track record in taking care of customers, and a secure channel for the transfer of gold as well as payment. Gold Smart covers all the bases in this regard and gives some of the best prices for second-hand gold. Give us a call or email to get started online, and you’ll be asking yourself why you didn’t try gold selling online with Gold Smart sooner.

Welcome to the new Gold Smart website!

Welcome to the new Gold Smart website!

The team have been working hard over the past three months to create an improved and updated website. You’ll recognise the familiar branding and colours with a modern update that creates a fresh, clean, rich and professional image.

As gold buyers we have included more in-depth information for people considering selling gold and silver. This includes our new Knowledge Base called “Money Matters”. Other areas that have been improved include the What We Buy section that provides examples of what your gold may be worth and the types of gold jewellery, gold bullion, gold coins, silver and diamonds that Gold Smart will purchase.

For customers that wish to sell gold it’s important to read what others say about the process of getting cash for gold so our Testimionals section has been upgraded to include further customer reviews and praise for our service.

Unique to Gold Smart is our Value Guarantee that outlines our commitment to providing the best rates for gold and silver. We endeavour to beat any price, deliver excellent service, provide full and complete communication, the fastest turnaround time, no pressure, and absolutely no hidden costs!

The FAQ’s have been updated to included more detailed information about why to sell gold to Gold Smart, the process, how we determine gold value, and many other useful and helpful answers to questions.

Please enjoy our new website and we look forward to your comments, suggestions, feedback or otherwise!

Silver prices have been doing extremely well lately and outpacing gold in terms of it’s rise. This is making it an excellent time to sell silver in New Zealand with spot silver hitting a new 31-year peak! How long will this rally continue is anyone’s guess with many commentators saying that “silver is overbought” and due for a correction.

Silver prices have been doing extremely well lately and outpacing gold in terms of it’s rise. This is making it an excellent time to sell silver in New Zealand with spot silver hitting a new 31-year peak! How long will this rally continue is anyone’s guess with many commentators saying that “silver is overbought” and due for a correction.

Gold Smart will purchase any silver bullion, silver coins, silverware (sterling) and silver jewellery that you want to sell. Examples of silver to sell include 1oz Silver Bullion (including silver Kiwi Ferns, Silver Kookaburras, Australian Silver Koalas, Canadian Silver Maples, Mexican Silver Libertad, Chinese Silver Panda, American Silver Eagles, Austrian Silver Philharmonics), 99.99% 1kg Silver Bars (PAMP Suisse, J&M, AGR, NZ Pure Silver, ABC, Perth Mint Silver), old silver coins that have no numismatic or collectors value (including Morgan Dollars, Liberty Head “Barber” half-dollars, some quarters, dimes and nickels, Crowns, Half Crowns, Florins, Shillings, Six Pences, Three Pences).

Silver prices have reached record-levels making now a great time to sell silver for cash to Gold Smart in New Zealand.

We are Gold AND Silver buyers!

The beauty of having a financial windfall like found money in your pants pocket, a lottery win, a gift for your birthday, or similar is that there are literally no obligations on it. With your paycheck, you already have bills due by the time you’re paid, you have to pay rent or a mortgage, food, and groceries need to be bought, utility bills are pending, and similar. The money is committed and gone before it has a chance to warm up in your bank account. However, with a windfall, the money is all yours, free and clear.

When you sell unwanted gold and similar precious metal items, the financial leap forward that comes with selling that second-hand jewellery or gold coins or similar works just like a windfall. You literally make old gold and precious metal items sitting around at home unwanted become useful and valuable again in your life. This is why gold has been handed down for centuries in different cultures; it provides a personal safety net. And given where the market is in the last year or so, the timing couldn’t be better. While petrol prices at the pump may be going through the floor, gold prices continue to move in the opposite direction, climbing higher each month. Some of this behaviour has been due to recent instability in markets and fear of economic recession in different countries. However, another big influence continues to be the understanding that gold remains a solid hedge when government currencies start to show weakness as well. And it is important to note that these go in spurts with fallbacks to solidify a level as some people take profits in speculation, and then they climb again.

What does the above mean for consumers? Specifically, if folks have broken or unwanted jewellery and gold items sitting around at home unused, now may very well be a good time to convert those items into usable, functional cash for your household.

It’s Easy to Get Burned Selling Blindly

The above said, there are lots of pitfalls in selling personal gold. With fraud rampant online through auction sites as well as in-person selling, there continue to be stories after stories of well-meaning folks finding themselves in the wrong place at the wrong time trying to sell personal gold and being scammed or worse. Online auction selling, for example, has had some of the worst cases, with folks selling their gold and putting it in the mail only to find themselves robbed of both the jewellery and the money they thought they were paid electronically. One of the most rampant forms of this problem is the chargeback scam where a buyer pays by credit card and, once the personal seller has sent the gold, the buyer reverses the credit card payment electronically telling their payment processor the transaction was not theirs. This is bad enough when it happens between domestic parties, but across international lines, it is almost impossible for a victim to get their money or gold back once it has been sent in the post. And a number of in-person gold buying options aren’t the safest options either.

Given all the challenges, many will find themselves challenged in finding a reputable and safe gold-selling option in New Zealand without some serious research. On the other hand, there is a viable alternative.

Where to Sell? Easy, Gold Smart is a Perfect Choice

Gold Smart can help you reach financial goals, whether online or in-person at our venue address right in the heart of the Auckland financial district. Our professional gold buyers and teams operate without issue, provide fair and accurate prices for consumers, and stay up to date with gold markets daily. All of that means a seamless, smooth sales process for consumers.

One of the biggest issues people have with considering selling personal gold is knowing where to do so safely. That includes both immediate security as well as avoiding the risk of being scammed or misled by a fast-talking culprit. No surprise, these two issues have prevented many from realizing the benefit of recycling and selling unwanted gold again and again. We solve the double problem by providing a safe, seamless resource for selling personal gold without issues or concerns. Here’s how:

- Competitive Pricing – Because our buying teams work daily with the gold and silver market, we price items based on their most current value. That gives consumer gold sellers the best return on their items in terms of pricing versus other venues and buyers that might be delayed by more than a week or who use other methods for pricing evaluation not directly tied to the gold or silver market.

- Confidentiality – We keep each and every transaction secure, private, and confidential. There is never a risk of anyone aside from whom you let know have any idea or awareness about what you sold, for how much or when. Your gold is your property and your business to manage. We keep it that way. Our records only pertain to verifying your identity and the transaction itself as part of our own licensing requirements under government regulation. And we will never include any of our customers or their account information in any of our marketing unless you give us express permission to do so.

- Efficient Response – Gold Smart also puts a premium on customer time. We push for a fast turnaround and don’t allow for needless delays. You get an answer and pricing fast, every time, every transaction.

- Expertly Trained – Our Gold Smart teams and professional gold buyers are trained and retrained regularly. That provides a level of professionalism usually not found in other venues. In fact, probably over half of the other gold buyers and their staff have no formal training whatsoever in the gold market, professional appraisal, and gold buying.

- You Make the Decisions – We don’t pressure customers to sell their gold, ever. Your gold-selling choices are yours alone. We fully understand some folks may change their minds at the last minute because many times items have emotional ties to them. We won’t pressure you in any situation, no matter how much gold is involved.

- No Traps or Fees – Nothing sours a financial transaction than a hidden fee brought out at the last second. We don’t play games with our customers or hide the ball. You know upfront what our service costs every time, all the time.

At Gold Smart, we regularly buy gold and silver in New Zealand for refining and recycling. Because our service has been established for years and held in the highest respect in the country’s gold recycling industry, we are easily able to help you exchange your unwanted, damaged or outdated gold jewellery for cash as gold prices continue to rise. We started Gold Smart because we recognized the need to provide regular customers like you a fair and transparent process for selling your unwanted gold jewellery versus what people had to deal with otherwise. As a result and over the past decade, thousands of customers throughout New Zealand have placed their trust and confidence in Gold Smart.

Gold Smart has always been a standing New Zealand source for consumers and individuals to liquidate unwanted gold, silver, and similar precious metals. Instead of having items collecting dust in drawers and doing nothing for years, folks can turn those personal assets into a useful and functional form of cash. Maybe you want to take a vacation, get some dental work done, pay for some classes and training you always wanted, or get a new TV entertainment system for the home. All of these things can be possible with freed up cash from selling personal gold, especially now as gold prices remain high.

We Provide Gold Education As Well

Not sure how gold recycling even works? That’s okay. Gold Smart also provides an extensive library of information and material on our website designed specifically to educate personal sellers on the different aspects of gold, from bullion coins to jewellery to gold bars to the gold market behavior and more. We even cover the history and details behind gold watches like Rolex timepieces. The best part of this resources is that it is entirely free. All you have to do is simply turn on a computer, connect it to the Internet and go to our website. At the destination you will find article after article on gold buying and selling education, as well as articles specific to you as a gold seller. We cover all aspects of the process, from how gold pieces are evaluated to what to watch out for if you decide to use other channels for selling personal gold.

Given all the above, when people actually work with Gold Smart for the first time, then end up so surprised at how smooth everything went, they often wonder why they didn’t think of using Gold Smart sooner. This regularly turns first-time customers into regular and repeat clients for us at Gold Smart, and it reinforces all the work we do to help protect customers and make gold-selling easy, practical, and profitable. Try it yourself with our buyers and you’ll see personally what the Gold Smart difference really means.

With gold prices hitting record-highs it seems there are people encouraging the public to spend money on jewellery valuations. Having up-to-date records of all your gold and silver jewellery items is very important and understanding how insurance companies work will save you headaches and trouble if the unthinkable happens – your jewellery goes missing!

With gold prices hitting record-highs it seems there are people encouraging the public to spend money on jewellery valuations. Having up-to-date records of all your gold and silver jewellery items is very important and understanding how insurance companies work will save you headaches and trouble if the unthinkable happens – your jewellery goes missing!

What’s the value of my Jewellery

First let’s look at the difference between ‘retail value’ and and what we call ‘real value’. As consumers we know (or should be aware) that purchasing any item new from a jewellery shop will contain a large ‘retail’ premium. This is true across almost any item you look at from large screen plasma TVs, new cars, clothes, computers, cellphones and so on. Commonly this is what’s called depreciation – basically the decline in value of ‘assets’. From an economic point of view when we enter into a contract of sale we are effectively accepting that the item will depreciate from the moment payment is made. The amount of loss in value depends on the item and how much over it’s ‘true value’ you bought it for.

What’s depreciation and does it relate to jewellery

Depreciation can also be caused by factors such as wear and tear, outdated technology and consumer demand however for the sake of this article let’s put that aside for the moment and focus on how this relates to buying and selling gold jewellery. There’s various definitions of what can be classed as an asset and the view we subscribe to is that it’s something that puts money INTO your pocket and improves your financial balance sheet. Such as stocks yielding interest payments, real estate that’s generating positive cash flow, long term investments, etc.

What’s an Asset

Assets are tangible or intangible items that produce value and have positive economic value. Paying “retail” for something is never a smart idea and yet we are often driven by emotion and desire (which can have a negative effect on our personal wealth and well being).

Retail Premiums on Gold Jewellery

Let’s now look at the various price components that make up the cost of new jewellery to help understand where this difference arises from… imagine the effort required to mine only 1 troy ounce of fine gold – it can take over 1 ton in rock to yield this much gold, that’s a ratio of 1:32,150! Not particularly efficient or environmentally-friendly.

Now imagine that unrefined gold doré bullion has to travel some distance perhaps overseas like the Martha Minein New Zealand to the Perth Mint in Australia. That product must be processed and refined taking out all the impurities and separating the gold, silver and precious metals. This process has several steps and uses very toxic and strong chemicals to complete. Next the refined product needs to be turned into materials suitable for the jewellery manufacturing process – this could be in the form of alloy, gold/silver granules, fabricated metal products, castings, plate sheet, solder paste, wire and so on.

Manufacturing overheads

Next the jewellery manufacturing process will take place, which could be done in China, Thailand, Indonesia, or other countries where the human labour costs are low (or in Western nations where costs are higher). Depending on the item being made the finished product will have a variable amount of time required to finish the jewellery. Normally done in bulk, mass-produced runs to reduce the costs such as seasonal designs or product ranges used by high-street jewellers.

The jewellery would then be shipped to a warehouse for distribution to various retail locations across the country and the World. Next items are sent to individual stores for presentation and sale. Of course retail costs can be very high as can well-trained jewellery sales men and women including retail overheads, full time sales staff salaries, commissions and so on.

Gold Prices

If you think about gold prices as the raw-ingredients used in the supply and manufacturing of jewellery and the above mentioned steps as what’s considered “value-add” then it’s not hard to imagine how much above the “gold value” jewellery can be. It’s no uncommon for this to be in excess of 300% above the metal value. Yes, gold and silver could be considered an asset, however that’s given when you bought the gold it was at fair market valuation – i.e. very close to the actual gold spot price. If you’ve bought many years ago you may be lucky in that the gold price has moved up so much that you now have items worth more than you paid for them! This is not guaranteed however – best to make money when you purchase not hope for some potential increase in value.

Jewellery valuations

If you consider for a moment the recent world-wide property bubble that was built on high leverage, easy debt and speculation, then one must be open to considering that banks, promoters of real-estate investment and valuers were partly responsible. Remember the rating agencies that provided AAA+ ratings for all those toxic mortgage-backed-securities? The public believed rating agencies opinions and yet overlooked the shocking fact that rating agencies were paid by the very companies the products were created by – now that’s a serious conflict of interest.

Ethically and in most cases by law, valuers are required to remain objective and impartial providing a genuine service to customers. Yet we’ve heard that if you own real estate it’s quite possible to encourage the property valuers to provide either a higher or lower value depending on your intentions. Now imagine that the same valuer or Real Estate agent was the one looking to purchase your property… hardly objective is it?

The illusion of higher value

In our opinion we must look carefully at who benefits from not just selling jewellery but maintaining the belief that something has more value than it really does. Quite simply something is worth what another person will pay for it. If you have to insure an item to retail or replacement value who benefits? The company providing insurance (the higher the value the larger the premiums), the valuer that needs to provide a new report each year and of course the retail jewellery shop that provides you replacement jewellery at retail prices.

Yes, gold and silver is considered an asset that maintains it’s value (given normal market fluctuations). Jewellery however does not meet our definition of a true asset because of the high retail premiums you pay when purchasing from a shop (especially true when items are brand-new). Be very careful of companies that value jewellery and also purchase it!

For customers looking for a reputable jewellery valuation for insurance replacement purposes, we recommend Gemlab, as they are independent and impartial valuers. www.gemlab.co.nz

For fast cash for your unwanted gold and silver (and excellent rates), please talk with the friendly and professional team at Gold Smart today. goldsmart.co.nz

As gold traders it’s been an interesting time with choppy gold prices in the past few days… Overnight there was significant liquidation of precious metals (-$US30) with traders selling anything of value in an attempt to raise some cash. Sometimes investors have little choice but to sell well preforming assets to cover margin calls and losses elsewhere.

The massive slide in the Nikkei (Tokyo Stock Exchange) has started to ease off with some thinking that the markets have been ‘oversold’ due to the severe asset sell-off around the World. Fear and confusion are great reasons to take profits while you can and sell gold before things get worse.

The other concern for gold prices is the scale of investment holdings in Japan because they own large amounts of gold (765.2 Tons/3% of total World reserves), this supply could come onto the markets in the coming weeks as physical holdings are liquidated to generate cash.

Precious metals are often seen as safe-haven assets, however jewellery because of it’s gold purity content (normally less than 98.5%), it’s unique form (non-uniform) and the retail premium (300%+) over the gold value would not be considered an asset in the common sense meaning.

A weakening New Zealand dollar is helping to cushion the effects of the price movements (so we can be grateful for that!).

If you’re thinking about selling – talk with the Gold Smart team today! 0800-465-37

The best feedback we can get at Gold Smart gold buyers comes from customers that sell gold to us. Often these customers are smart and have shopped around a few dealers to get prices for their unwanted items. Two recent sellers had this to say…

From Murray in Auckland – “Thanks so much to Goldsmart who I called recently to facilitate a quote for the sale of my no longer in use wedding ring. They were fantastic and informative and upon me mentioning I would like to shop around suggested I gather quotes and call them with the weight and carat of the ring to see how the prices compared. The next morning I visited a franchise in a popular shopping mall and got the ring weighed and valued and was underwhelmed with what was offered. I was also underwhelmed with the aggressive nature of the attendant trying to persuade me to sell it on the spot. I returned home (with my ring) and called Goldsmart who immediately offered me a price that was 68% more than I had been offered earlier in the day. I was invited to stop by Goldsmart and was met by Anita and her colleague who then wrote me a cash cheque. The Goldsmart team are very professional and I was satisfied that I hadn’t just given my ring away, after all, even though I no longer had use for it, there is still emotional attachment and it would have severely devalued that (if that makes sense) to have let it go so cheaply. I would recommend anyone go to Goldsmart to sell their gold, they conduct their business with integrity and respect, which was such a contrast to the franchise I had originally dealt with, who seemed to be blatantly profiteering from peoples misfortune.”

From Robin – “Just a quick note to say I shopped around for months before deciding to sell my gold to you. I was first taken with your website which seemed to promise a more professional and respectful approach in comparison to many others I’d tried which implied the seller was desperate to acquire cash as the sole motive for selling – which of course isn’t true. I got quotes from three places on the same day and earlier and all were well below your quote which you fully honoured when I called to sell. Many thanks for a professional, friendly and efficient transaction.”

Save yourself the time, sell your gold to Gold Smart!

We are humbled to receive such warm reviews from our customers – it’s rewarding to provide the best services and incredible rates to Kiwis around New Zealand.

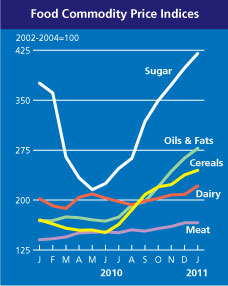

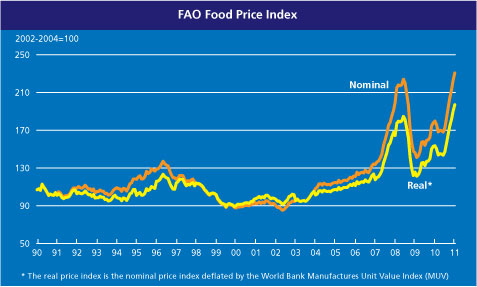

Deadly riots because of high food prices have been raising a lot of media attention lately. From Haiti to Egypt, dramatic increases in world food prices are causing political and economic instability. This has been resulting in social unrest particularly for poor and developing nations.

Deadly riots because of high food prices have been raising a lot of media attention lately. From Haiti to Egypt, dramatic increases in world food prices are causing political and economic instability. This has been resulting in social unrest particularly for poor and developing nations.

“Price spikes have been influenced by rising oil prices (costs of fertilizers, transportation, etc), falling food stockpiles, expanding middle-class populations of Asia, subsidies in developed nations (e.g. Corn subsidies in the US), market speculation, climate change and world population.”

In the latest edition of its Food Outlook report, the United Nations Food and Agriculture Organization (FAO) warned the international community to prepare for harder times ahead unless production of major food crops increases significantly in 2011.

In the latest edition of its Food Outlook report, the United Nations Food and Agriculture Organization (FAO) warned the international community to prepare for harder times ahead unless production of major food crops increases significantly in 2011.

Sugar climbed for a third year in a row in 2010, and corn jumped the most in four years in Chicago. Food prices may rise more unless the world grain crop increases “significantly” in 2011, the FAO said Nov. 17. At least 13 people died last year in Mozambique in protests against plans to lift bread prices.

“There is still, unfortunately, the potential for grain prices to strengthen on the back of a lot of uncertainty,” Abdolreza Abbassian, senior economist at the FAO, said by phone from Rome today. “If anything goes wrong with the South American crop, there is plenty of room for them to increase.”

Global food production will have to rise 70 percent by 2050 as the world population expands to 9.1 billion people from about 6.8 billion people in 2010, the FAO has said.

In response to the 2008 crisis, countries from India and Egypt to Vietnam and Indonesia banned exports of rice, a staple for half the world. Skyrocketing food prices sparked protests and riots in almost three dozen poor nations including Haiti, Somalia, Burkina Faso and Cameroon.

So what can you do to protect yourself and your family?

First off, plant a garden – New Zealand has by most standards plenty of arable land suitable for growing tomatoes, carrots, radishes, brussel sprouts, herbs, potatoes, etc. Planting a garden can be an inexpensive and fun activity for the whole family. If you’ve never grown a vegetable garden before, there’s plenty of books from the library or websites that will help you know how to grow nutritious food.

First off, plant a garden – New Zealand has by most standards plenty of arable land suitable for growing tomatoes, carrots, radishes, brussel sprouts, herbs, potatoes, etc. Planting a garden can be an inexpensive and fun activity for the whole family. If you’ve never grown a vegetable garden before, there’s plenty of books from the library or websites that will help you know how to grow nutritious food.

Secondly, consider how you will store your freshly grown food – such as a food dehydrator, zip lock bags, freezing, etc. This will ensure the long-life of your supplies. This could be considered your “Food Bank” a place where you store canned goods, dried foods and other essentials that may become much more expensive in the near future. Consider storing salt, peanut butter, cooking oils, sugar, coffee and powered milk.

Thirdly, you could consider selling your unwanted gold jewellery to help fund your emergency food supplies for yourself and your family!

This Valentine’s Day are you celebrating your love for someone or looking for someone new to love? When it comes to love how do you know it’s real and true? At Gold Smart we are grateful for everyday that’s shared with those we love and cherish the memories created.

This Valentine’s Day are you celebrating your love for someone or looking for someone new to love? When it comes to love how do you know it’s real and true? At Gold Smart we are grateful for everyday that’s shared with those we love and cherish the memories created.

Sometimes we can be in relationships that are not healthy and yet find it difficult to move on and break free. If he gave you diamonds and gold, how do you know it’s real? How heart-breaking would it be to find out his gifts were not all he said they were. Yet this is something we see at Gold Smart – boyfriends, husbands, lovers giving presents that are lower carat or simply fake. These are the ones you have probably already left and may not be too surprised to find out all that glitters may not be gold.

How do you know when true love abounds? Well, that’s something you’ll need to discover for yourself – however the team at Gold Smart are experts in determining the authenticity and value of your gold and diamond jewellery.

To-morrow is Saint Valentine’s day,

All in the morning betime,

And I a maid at your window,

To be your Valentine.

Then up he rose, and donn’d his clothes,

And dupp’d the chamber-door;

Let in the maid, that out a maid

Never departed more.—William Shakespeare, Hamlet, Act IV, Scene 5