Many people believe that the means to identify gold is a pretty easy task. There are also many people who get fooled on a regular basis and duped out of their hard-earned cash as well. Gold, like many metals, has a substance to it and weight and a distinct color. However, modern production capability is also quite capable of producing alloys that look very much like real gold but are in fact not. And this common availability makes it quite possible to fool experts if played well. That’s how some 80 tons of fake gold were passed through in China in 2019, shaking the confidence of the international gold market horribly.

For the average consumer, gold bars are not likely going to be the product to worry about. In fact, most consumers opt for jewellery first and then consumables such as bullion coins. However, there is plenty of room in these categories as well to cause problems, as many buyers are finding out in recent years with fraudulent sales online through eBay and similar. And with the spike in gold demand that just keeps on rising over the last few years, many criminals are taking advantage of the urge to buy gold as their opportunity to separate people from their money.

How to Identify Real Gold

There are a number of aspects of real gold that immediately separate the precious metal from other mineral types, particularly other metals. Understanding how these tests or criteria work and, more importantly, that they are not 100 percent foolproof, is critical to identify gold correctly. Many regular testers use a combination of methods versus relying on just one approach, thereby reducing their risk further, but even these can be duped by very professional fraud rackets that anticipate known testing methods.

1. Test With a Magnet

The first approach is probably the most basic and just about anyone can apply it. Gold is not magnetic. Unlike steel or iron, for example, if you put a magnet up to gold, it will not exhibit any kind of attraction or repulsion behavior, depending which end of the magnet is being used. Gold will simply just sit there until physically moved by force. However, there are other metals that are also not magnetic, and old magnets are entirely unreliable. Using a brand new magnet recently bought from a hardware store is a must versus something decades old having sat in a drawer unused.

2. Test With Teeth

A second method of testing includes one’s teeth. As silly as it sounds, for years people have been testing gold by biting down on it. The reason being, gold is a soft metal and will deform under enough pressure which the human jaw and teeth can provide. However, this is a bit of a destructive approach to the gold, as well as being not very hygienic. The last thing most people want with their jewellery, for example, is a bunch of teeth marks over time. And this method can be circumvented as well. Gold-plated lead, for example, is also a soft metal and will deform accordingly.

3. Test With Ceramic Surface

A third approach involves un-glazed ceramic surfaces. A glazed ceramic will have a glossy surface to it, similar to a lacquer on wood. Unglazed is dull, matte in color, and a bit gritty to the touch. When gold is rubbed across unglazed ceramic it leaves a bit of a yellow streak as small parts of the metal come off on the ceramic due to friction. Pyrite, otherwise known as fool’s gold and another fake form, will instead leave a black streak on a ceramic surface. Again, however, this is a destructive method that will definitely scratch the gold being tested.

4. Chemical Testing

There is also the use of chemical testing to identify gold. This approach is very common among professional testers who locate a nondescript part of the gold to test and then apply nitric acid to it. If real gold is present, there will not be a reaction. However, if the metal is not gold, then a reaction will usually occur and be noticeable. Often times the acid will change appearance as it reacts, typically turning green in colour for a base metal. Other colours like milky white or yellow gold can signal the presence of brass as well as silver. That said, one of the most well-used methods to circumvent acid-testing involves the use of the base metal, tungsten. It has a very weak magnetic reaction, and the metal can also pass the chemical acid test. The metal can be easily crafted to known weights that standard coins are issued in, which makes the entire tungsten combination particularly hard to spot and catch, even by professional buyers. At first, many tungsten and other metal attempts were very obvious to the trained eye. However, in recent years the refinement of fake coins has jumped tremendously, often with the aid of high technology, and multiple fakes are being circulated from countries that have no rules preventing replicas from being sold and traded.

5. Weight Testing

Weight can also provide a giveaway for a fake gold possibility. Gold has a specific metal weight regardless of how it is shaped. This is a good reason why anyone buying gold in standard form should have a mini-scale with them for visual checking. So, when one is looking at a gold sovereign coin that is supposed to be 1 troy ounce of gold it should weigh exactly 1 troy ounce, no more no less. On a regular scale a single troy ounce will weight 31.1 grams. Adjustments in weight can be made depending on the state purity of the gold involved. With a 22-karat gold coin the purity is 0.9167 and the remainder is other metal alloys, which increases the weight of the coin over the 31.1 grams level. Knowing the exact weight for these deviations helps as an immediate check when a suspect coin is weighed. Amazingly, despite this easy test that one can apply with a basic scale, people are still scammed regularly with fake gold products that weight differently than their apparent and obvious supposed weight.

6. Size Testing

Size of standard products can be a giveaway as well. Jewellery is hard to compare because it’s so frequently different from piece to piece. However, far more standard pieces like coins should be a standard size, always. Buyers when purchasing in person, learn early on to bring a small set of calipers with them to quickly and easily measure the dimensions of a suspect coin and compare them against known statistics issued by government mints themselves on their coinage. Many times products are being sold that when compared to the real version are clearly off in size and dimensions. These are comparable and easy to spot physically, but they can be hard to distinguish when looking only at an online photograph for judgment before buying. In both cases of weight and size, online buying negates many of the protections possible until one actually receives the product shipped and realizes the dupe which by then is probably too late.

7. Check the Paperwork

Paperwork can help tremendously as well, but it is not foolproof. Reputable gold product and gold sellers will always provide detailed paperwork on their items for sale, from jewelry to coins to gold bars and similar. This provides critical information about the seller, the product itself, as well as its sourcing on a manufacturing basis. All should be verifiable and easy to confirm through licensing before a purchase is made as well. However, it’s not perfect. As many in the import/export world know, paperwork and manifests have been faked regularly. The key factor is whether the business or seller is stable and established, i.e. a brick and mortar storefront address and operation for example, or if they are a fly-by-night operation that works out of a P.O. box or temporary suite. When a seller can’t show with their paperwork a well-established business history, that should be a potential red flag for a buyer right from the start.

What to Expect When Selling Gold

Anyone looking to sell gold to a gold buyer should expect their material and offerings to be tested. Most gold buyers, even temporary shops, will be using a variety of testing tools that they can apply quickly and in the moment. The most common types tend to be testing a small portion of the gold with nitric acid as well as comparing the piece with known measurements and dimensions when dealing with coins or similar.

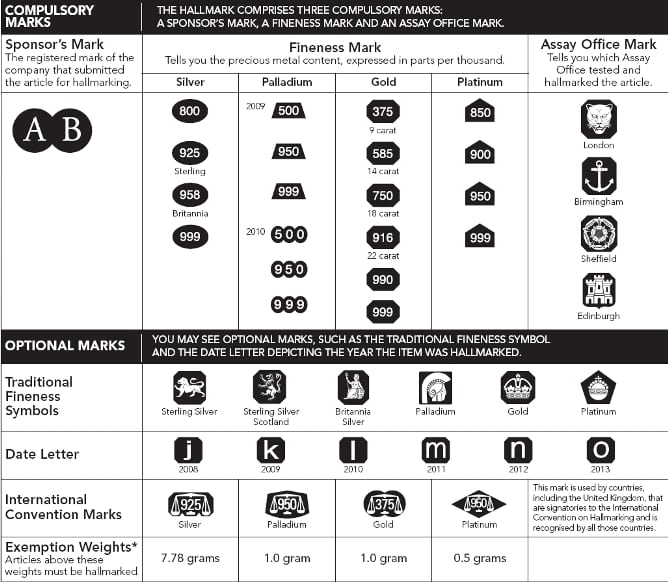

Jewellery can be harder, again because the shape and nature of it comes in so many different shapes. That said, these will also have additional features testers will look for in addition to the above criteria already discussed. One of the big categories involve manufacturer markings or hallmarks. Many jewelry manufacturers utilize clear hallmarks, badge stamps and markings that they have been approved to use. This feature provides a couple of unique pieces of information right away. They confirm the manufacture of the jewellery has come from a bona fide, licensed maker that confirms the purity of the product. Second, the stamp will also confirm whether the various import taxes have been paid on the product if imported and applicable. And third, it provides a history trail for the item where it can be traced to a production line and output batch. While marks can be faked, they frequently get missed by fraud parties not in the know about what the industry expects when a piece supposedly comes from a known brand name.

Recognizable jewellery paperwork is always a good thing to provide a professional buyer. It provides an additional layer of proof of real gold along with the testing that will be applied objectively. The combination of proof of sale paperwork plus test results often helps reinforce the veracity of a gold to a good comfort level versus selling blind gold with no history of transaction behind it at all. That said, many folks often throw away their paperwork over time, or they receive gold through estates and the paperwork has been lost before they came into possession of the jewellery. In these cases, buyers can only rely on physical testing and visible features versus anecdotal statements.

Buying Gold Safely

The most prudent and safest way to buy gold involves purchasing jewelry and coins or bars from licensed sellers that have a clear established history and presence as a business. For years this has been the case with licensed jewelry dealers as well as licensed gold selling business as well. However, with the recent spike in gold value, the online selling world has exploded. While extremely convenient, spanning distances and connecting people from all over, people really only have what is presented on a website as their information about the seller. And that ambiguity has created a lot of room for fraud that didn’t exists so much with in-person transactions and established dealers. Ergo, business history and licensing verification through independent means has become that much more important.

For example, many buyers look for a connection with the London Bullion Market (LBMA) when buying gold from dealers. LBMA sellers include certified dealers, mint sellers and gold refining operations that have been fully vetted and verified. It is one of the closest ways one can get to a guaranteed gold-buying source. New Zealand gold sellers offer a similar certification check through the LBMA as well since the organization spans 30 different countries and well over 150 different members.

Government mints and licensed mint dealers online are also extremely safe for bullion purchasing. Not only are the products measured and stamped with their quantity and purity for anyone to see, these sources are extremely controlled and regulated on what they issue, how it is sold and how transactions are documented. The products are sold and shipped directly from the mint through their own websites and selling channels, not unknown third parties.

Consumer buyers should always expect that the price markup for gold being sold over the counter will have a markup between 1.5 and 10 percent above the known spot price per ounce. Where items are smaller than one ounce, such as 1/4 or 1/10 ounce coins, the markup could be a bit higher but not by much. This is a typical profit range for a seller to recovery costs of operation. When a coin is well over this mark and in the neighborhood of a 50 percent markup, it’s a oftentimes a red flag of a problem being hidden or an overweight value that doesn’t match the actual gold being sold. These kinds of prices will appear mostly online and during times when high demand seems to be creating a buying frenzy. It’s also frequently seen through less reputable sellers such as pawn shops and payday loan businesses doing a side sale in gold items as well. Alternatively, anything below spot value of gold is either a fake, hoping to catch someone in a dupe that is clearly not gold but again buying frenzies tend to hide, or there are other fees in the transaction that will get charged to make up the difference. Buying clubs, collector programs, TV selling shows, and temporary gold sale programs working out of hotels use this angle a lot.

A similar problem can occur with graded coins. These are coins that are sealed in plastic see-through cases with an official label of an independent grader asserting the coin’s condition status, source, year, and collectability grade. Slabbed coins are most often seen in collector circles where buyers pursue gold coins not just for the gold but also the rarity of a particular year and issue. These coins can sell for far more than just the gold value involved when real and authentic, especially if very old. Unfortunately, slabbed coins also create a false sense of security with the casing and labeling, which can be easily faked by a smart fraud player. Some are done so well they are even sold at coin shows and temporary sale events where in-person experts have been duped. They will often be sold at competitive pricing, even below what the normal price would be to sell quick, convincing buyers they landed on a great deal. Being fake, the entire sale is a huge profit for the counterfeiter and a total loss for the buyer.

What to Expect from Law Enforcement

If you or someone you know as a buyer has been fooled, it might seem a waste of time to report the matter to police. In many instances it’s true that your particular case at the moment won’t be solved right away and maybe not for a few years. However, you should still file a crime report with all the details, photos, evidence and data anyways. Cases of online theft and fraud are not solved and convicted on one case alone. Police departments often compile case data and evidence over multiple instances. When there is a finally a break and the party is identified, the volume of cases they have been involved in can quickly shift a minor theft to a full blown felony status with multiple years in prison if convicted in entirety. Most of the online scams that have been broken with arrests involving online platforms like eBay, for example, have been cases were police worked together and combined their case data for an overwhelming evidence and case against the perpetrator. So, your report does matter, just don’t expect much to come of it for your particular recovery most times.

As for law enforcement blocking fakes and counterfeit gold from reaching bona fide markets, it’s been hit or miss. Products that have been moving through bulk channels like traditional shipping do get caught, and large counterfeit shipments are confiscated before they cause harm. However, the Internet has made it quite possible to move thousands of fake gold items individually, with buyers paying the cost, all over the world, and that it is near impossible to stop; it would require the postal services and courier companies to open each and every package and inspect the goods inside, which is not going to happen.

Some countries have enacted harsh laws against any attempt to knowingly create fakes, but this is not uniform, as was mentioned earlier. For example, the U.K. has laws on the books barring any fabrication of precious metal products without set hallmarks being literally stamped on the item. That includes jewelry and coins. However, the same rule doesn’t exist in the U.S., only on gold products that are imported into the U.K. And the law has no bearing on online sales, surprisingly.

On the jewellery side of things, fake gold is rampant, and the problem is well-known to law enforcement. The U.K. alone sees well over 150,000 fake gold items circulating annually. However, a key feature is the fact most of it is sold online versus in-person. So, that fact right there gives a buyer a clear and easy way to avoid such problems and related risks to identify gold– buy your gold jewellery in person.

Focus on Reducing Risk

There is no perfect way to avoid all potential fake gold fraud ever. After all, even the most diligent and experienced buyers and gold traders have been embarrassingly fooled by very elaborate gold swindles, even in recent years. That said, by using a combination of the above testing or criteria tools as well as working through licensed dealers like GoldSmart, you can dramatically reduce your risk to mistakenly buying fake gold. And that’s really the primary goal. The harder it is to make you a victim, the more likely a fraud or con is going to go after someone easier because there are simply that many fish in the sea to take advantage of otherwise.

We Want Your Alluvial Gold

Gold Smart is proud to announce that we are now purchasing Alluvial Gold! If you are a weekend-gold-fossicker or a more serious commercial mining operation looking for the best rates to refine and assay your gold material – then Gold Smart is ready to help you!

Advanced Gold Refining Services

If you have alluvial/placer gold that’s taken blood sweat and tears to find then you’re going to want the best metals analysis and refining processes. The Gold Smart gold refining service is fast and we use the latest technology to ensure accuracy and speed. We will also purchase all alluvial gold that gets refined at excellent per gram rates.

Refining alluvial gold has never been easier! We don’t however purchase Alluvial Gold Dust from Ghana – so if you’re thinking about asking, please DON’T. Only gold that’s already in New Zealand will be considered by the team at Gold Smart.

Call Us for More Details

Please contact Gold Smart for more details about our Gold Refining Services: 0800-465-376

Our Awesome Customers: Golden Women

It’s no secret that a lot of customers that come to Gold Smart are ladies (smart businesswomen, caring mothers, loving wives, loyal girlfriends, precious grandmas) … so in the spirit of things this post is all about celebrating and honoring our customers, and appreciating the achievements of women around the world!

The International Women’s Day is marked on the 8th of March every year and in different regions, the focus of celebrations ranges from a general celebration of respect, appreciation, and love towards women to a celebration for woman’s economic, political and social achievements.

These days it’s become an opportunity for men to express their love for women in a way similar to Mother’s Day or Valentines Day – however, the original meaning was strongly related to political and human rights with a focus on the political and social awareness of the struggles of women worldwide.

On the occasion of 2010 International Women’s Day, the International Committee of the Red Cross focused attention on the hardship displaced women endure. They state “the displacement of populations is one of the gravest consequences of today’s armed conflicts. It affects women in a host of ways.”

According to the Red Cross “Women displaced by armed conflict – often living alone with their children – are frequently exposed to sexual violence, discrimination, and intimidation. Many face poverty and social exclusion as well. International humanitarian law, therefore, includes specific provisions protecting women, for example when they are pregnant or as mothers of young children.”

This is shocking to know, yet we are reassured to know this day is taking on a new global dimension for women in developed and developing countries alike. The day has become a rallying point to build support for women’s rights and participation in the political and economic areas.

Here are some ideas that the team at Gold Smart think are a great way of celebrating women:

- Think about the women, living and dead, who have helped shape your life. Do something they (or at least a few of them) would have liked

- Consider cooking their favorite food, planting their favorite flowers in your garden or sending a check to their favorite charity

- Tell your children about the women you admire most. Talk about both the ones you’ve known personally and those you’ve only read about in books

- Tour an art museum near you and pay special attention to the work of female artists

- Have a party and invite all the women you never get to spend enough time with.

- Shower the women in your life with wonderful gifts (if you’re a man)

- Accept graciously when the men in your life shower you with gifts (if you’re a woman)

Famous Women of History

- Mother Theresa

- Cleopatra

- Joan of Arc

- Queen Victoria

- Indira Gandhi

- Marie Antoinette

- Marie Curie

- Eleanor Roosevelt

- Mary Magdalene

- Harriet Tubman

Famous Women of New Zealand

- Jacinda Ardern

- Jean Batten

- Katherine Mansfield

- Malvina Major

- Kiri Te Kanawa

- Kate Sheppard

- Yvette Williams

- Annelise Coberger

Most of those familiar with Auckland’s lovely CBD area are aware the residents of this fairly wealthy part of New Zealand have a considerable amount of gold and precious metals. If you live in or near the CBD area and own gold, consider selling to Gold Smart. We are proud to offer the best prices in all of New Zealand. Our CBD gold buyers are able to provide such compensation partially because we refuse to invest in lavish storefronts or other expensive features for our brick-and-mortar precious metals facility. We would rather have the money go to those looking to sell gold in the CBD.

Why You Should Consider Selling Gold in the CBD

Think back to the last time you looked at your gold. Whether it is gold bullion, gold jewellery, scrap gold, or any other type of gold, there is a good chance you have not looked at it or used it in years. Some CBD gold owners have not examined their gold in decades for good reason. Gold jewellery and other gold pieces are certainly beautiful yet they eventually lose their chic qualities.

Furthermore, emotional attachment to gold fades away as time passes. There is no reason to leave your gold in a drawer, safe, jewellery box, or any other storage space when you can turn it into cash. Our gold buyers in CBD are ready to pay cash for your gold, regardless of its aesthetics. If your gold item is worn, faded, chipped or flawed in any other way, do not assume it is worthless. Gold items have value regardless of their exterior appearance.

Gold Smart is Auckland’s Fairest and Friendliest Precious Metals Dealer

Reach out to the Gold Smart team and you will find we are cordial from the get-go. Our precious metals experts take great pride in our no-pressure approach to selling gold in the CBD. Contact us to have your gold item(s) appraised and you will feel perfectly comfortable from the beginning of the process all the way to the end. You can take as much time as you desire to review our offer. Even if you do not accept the offer, you will walk away from your interaction with our team feeling respected and valued.

Our sterling reputation throughout New Zealand is attributable to the fact that our family-owned business treats customers as if they are human beings rather than marks to exploit for profit. Unlike most other precious metals merchants, Gold Smart strives to be a true member of the Auckland community. Meet with our licensed gold buyers in Auckland and you will feel truly welcomed.

Get the Most Cash for Your Gold

Gold certainly has utility yet the average gold owner is understandably incapable of transforming gold into something useful. CBD gold owners are better served with a bundle of cash rather than gold that rests idly in the basement or attic. Think of all the things you could do by converting your gold into cash.

Sell gold in the CBD and you will be able to take a mini-holiday, buy your significant other or kids something nice, put the proceeds in the stock market or simply deposit the money in the bank. A nice wad of cash provides much more utility than old, dusty gold.

Sell Your Gold Today

If you are even slightly interested in turning your gold into cash, reach out to Gold Smart. Our CBD gold buyers will evaluate your gold and provide the best offer by a considerable margin. In fact, we are even willing to match the offers of other gold merchants should their quote exceed ours. Call us at 0800 465 376 to schedule an appointment for the appraisal of your gold piece(s). You can also reach us through our online contact form to get the ball rolling on your free gold appraisal.

Copyright Infringement by Ezycash

Ezycash Loans and Gold Buyers, Panmure, Auckland – www.ezygoldbuyers.co.nz have been found illegally copying content from our website. “Ezycash Gold Buyers” based at 30B Jellicoe Road, Panmure, Auckland East, have taken text from our website, changed our company name to theirs, and called the information their own.

See the below image for an example taken from their website showing copyright infringement by “Ezycash” of our website text and articles:

It’s disappointing when gold buying competitors decide to copy our original content and it has been mentioned before on our blog, yet this is the most blatant infringement of copyright we’ve yet seen from another New Zealand gold buying company.

Copyright infringement is a serious issue and one we consider dishonest, illegal and unethical. We have written to “EzyCash” to make them aware of our ownership of this content, and the appropriate responses expected.

This is the same company that offers to lend money at 360% interest per annum (so are we surprised?) – see their “Lending Terms & Conditions” for more details.

It’s quite hard to find any clear information about who “Ezycash Gold Buyers” are. Even with a search of the Companies Register and their website, there is a lack of clarity as to the legal ownership of this business – very strange.

See here for an example of the various “EzyCash” entities that have been registered in New Zealand (New Zealand Companies Office). If you have any information about the ownership of www.ezygoldbuyers.co.nz website, we’d be keen to hear from you as we have a case to take further action against these mysterious individuals.

Do Your Research Before Selling Your Gold

As Gold Smart customers will be aware, “Pawn Shops” are known know for being places that most people don’t like to go and there’s a very negative public perception about the type of business that lends money at predatory rates. You need to listen to your “gut” and if you feel uncomfortable then there’s probably a very good reason to avoid places that make you feel that way.

Be smart, ask around, check out our testimonials from customers that have already done the research for you and found Gold Smart to be the best choice.

“EzyCash” decided that it was easier to copy our original content and ideas than to create their own. Would you want do business with people like that? If someone is comfortable acting in this manner, what else are they capable of?

We have suggested all illegally taken content be removed immediately and will keep you informed as to “Ezycash’s” response to our notice to cease and desist from infringing on our copyright.

It’s our strong advice that gold sellers do homework on who are the legitimate, honest, and reputable traders that exist in New Zealand.

With this year’s gold value up over 26.5 percent by September 2020, the precious metal continues to seem like a safe haven to place value with public markets teetering on the edge of bubble collapses from being overheated by speculation. So many are wondering, is gold topped out again, or should gold buyers Auckland interests continue to consider adding to their positions and purchasing going into 2021?

There’s a lot of instability that argues for continuing to utilize a safe haven that gold provides. Volatility is only going to increase going into the fall of 2020, and economies typically slow down in the winter and start suffering losses or retraction. The traditional offset has been the holiday consumerism push, but this is year is anything but normal. Add in the fact that major governments are again considering more stimulus spending to boost their economies, COVID-19 continues to keep raging, and many who have realized pay cuts or lost their jobs are still struggling to make ends meet in different countries, and gold continues to keep looking strong.

The struggle that gold is having right now in breaking the current ceiling barrier has to do with profit-taking. Anyone who had a position in 2019 continues to realize a sizable gain of anywhere from 19 to 30 percent profit, and many have been selling, deflating the price of gold every time it makes a run in 2020 for the ceiling. Add to that the fact that equity markets, particularly in tech have been having extreme gains themselves, people have been torn between protecting their money and putting it back into the public market. That waffling pulls gold back. However, the fundamentals for an overall rise are in place and continuing to gain pressure systemically. Unemployment, loss of consumer revenue, rising debt levels, and unstable government leadership all lean towards more purchasing of gold over the next year with a very tight supply available and growing tighter.

The Ides of March

Gold buyers Auckland markets are not immune to losing value, and any investor who paid attention to what happened earlier in 2020 saw a good example of this. Like everything else, the initial shock of an economic panic sent gold hurtling down in value dramatically in the middle of March only to recover itself some 10 days later. This kind of dip was driven more by emotion and general financial anxiety than anything logical or rationale. Nonetheless, gold’s value was cut by almost 15 percent in that same short window, proving the precious metal could be caught up in global mob rushes like any other investment tool.

The above said, gold buyers Auckland activity joined with the rest of the world and treated the dip as a buying opportunity. Not only did gold restore itself in price value, it has been on a steady climb since March 2020, with an inflow in the tens of billions of dollars. That set the stage for a push to break the historical ceiling of gold, which finally happened in August 2020, and where we are today. Gold has pulled back a bit from its drive to the clouds, but based on the historical pattern the retraction is simply winding up for another push to go higher over the next few years.

Supply is Tight

After the summer started experts and market watchers paid close attention to the supply side of gold. The mining output has not changed much over the last few years, generally producing the same level from one year to the next. In fact, as Spring 2020 set in and social distancing became a big issue, some of the operations actually slowed down and output started to drop a bit.

At the same time available gold supply in all forms was being grabbed by individual and institution players from every direction. As government stimulus spending further weakened battered currencies by flooding markets with more cash, gold really started to stand out as a solid, disconnected asset to have that was not swayed easily by government monetary policy. That in turn drove more demand on a limited market.

Granted, a good number of folks in the last few months have seen the current window as a great opportunity to unload the gold they have kept on hand for years. Sellers have been richly rewards in all formats, from bullion gold to scrap gold jewellery being liquidated at continuously rising prices. That said, even though this push has moved new units of recycled gold back onto the market, it has been nowhere near enough to balance out the current demand. As a result, everyone from government mints to auction sellers on private sale sites like eBay have been swamped with offers and backlog orders.

Projections for gold levels and supply to return back to normal level anytime soon are completely off the grid. Mining is not going to suddenly boost and dump a huge amount of new supply on the market. Government central banks themselves are holding onto reserves to maintain needed stability if something goes haywire with the bubbles they are seeing in the public markets, and private buyers outnumber private sellers 10 to 1 at least. In short, the supply shortage of available gold for investing is going to continue to be pinched and will likely hurt even further to the beginning of 2021.

The Refinery Side of Things

Government-directed shutdown ran rampant across the production industry for gold in the earlier part of 2020. Many of the big gold refineries in Europe were simply shuttered, and that loss of inventory replacement has now been hitting the end retailers hard, stripping them of the baseline they were able to expect every month. In addition, what is available has become harder to move as the logistics side of the picture has also been hammered with increased restrictions and shutdowns of major transport channels for the same public health reasons.

The transport lockdown has become a major headache in multiple industries, and gold is caught up in that fiasco due to the nature of its weight as well the need for specialized courier treatment. Where inventory is geographically displaced from buying markets, it sits in vaults and safes or gets distributed in small amounts via package couriers, far too small in activity to meet the demand or relocate what is available efficiently. As a result, the logistics failure resulting from COVID-19 has also contributed heavily to the price push in gold from a basic supply versus demand perspective.

Gold scrap refineries can’t get their hands on enough material either. Regularly advertising to private individuals to liquidate their various jewellery and sold gold items, many are finding the need to be creative in marketing outreach and educating entire new markets on how to liquidate private gold. As soon as the scrap stock is received and smelted it’s practically shipping out the door to new buyers for additional holdings and bullion purchases.

Major bullion suppliers and refiners were not completely caught off guard. 2019 had already built up quite a demand for gold and many already had programs and efforts underway to push for more gold supply to meet demand. The problem that occurred was that the current demand in January 2020 never went away. It was simply added to five-fold but some experts’ estimates. That compounding effect caused prices to rocket on what was sellable and available to buy. And, of course, markup on a buying spree went hand-in-hand as well.

Institutional barriers also exist that no one was prepared to address. For example, Great Britain has a notable stock of gold bars in the 400 oz size on hand. Unfortunately, these don’t match the trading size of 100 oz and they are geographically in locations very far away from a sizable amount of the international market demand. So, in practice while the gold exists, some $420 billion USD worth or 8,263 tonnes, it’s unavailable from a practical level. The special 400 oz bars would have to be broken down and refined into 100 oz bars under controlled circumstances and then redistributed to get to market. That entire process in itself takes months under good conditions. Under current conditions the problem is even finding a working refinery to do the job.

Anticipating When to Buy Gold

The common temptation is to try to time the market, try to get into gold when it dips in price to hopefully make a “stellar” gain. In reality, most experts are arguing no such “good time” exists. Gold is on a standard, long-term trajectory upward and investors simply need to build in a position as they can for a buy-and-hold perspective. Yes, there is no argument that the entry point right now seems expensive relevant to where gold has been the last 10 years, but all indications are pointing that today’s price level may be bargain in a year from now if the current systemic factors continue in the gold market.

At a minimum, investment advisors regularly recommend building up to a portfolio position of 5 percent of one’s overall investment portfolio. However, with current instability, many have been pushing that recommendation higher, from a range of 5 to 15 percent of a personal portfolio. Even a few percentage points can restructure a portfolio considerably because of gold’s strength during uncertain times and its safe haven hedge against the direction of inflation and equity bearings.

Folks will, considering the above, find there are multiple ways into gold with upsides and downsides to each. When all is put into comparison objectively, however, bullion stands out to be stronger place to be in for a variety of reasons. Here’s why:

Physical investment – bought in the form of coins or gold bars, this is the most traditional way to buy and own gold in the most secure fashion. It doesn’t require a brokerage, and with government-issued bullion one knows exactly what is in hand based on weight and value. However, bullion always requires solid storage and security, which adds to its holding costs. Once an investor has a sizable position, lots of bullion becomes a bit of a challenge without a sizable vault or a storage services involved. Insurance adds a cost as well. Home fires are probably the number one way personal gold is destroyed if kept secure in the house.

Buying electronic holdings – purchased in the form of exchange-traded funds, ETFs, gold positions can be bought and sold similar to stocks. Doing so is so easy now, one can purchase a gold position in a matter of seconds through a basic online public market brokerage. However, what is bought is a paper commitment, not the gold itself. If the managing company of the ETF runs into problems, the position is worthless. The gold it was supposed to represent is not outright owned, only shares in a managing pool backed by that gold. That kind of risk for a large position may be untenable for many.

Gold company stocks – there is no gold involved at all with this choice. An investor is only buying the performance of a company that mines or refines gold for the market. The prospect for these companies looks potentially good, but many right now in 2020 are struggling just to get operating again due to staffing restrictions or shutdowns. So, if they can’t produce, their company stock is not likely to gain any profit anytime soon.

What to Expect Now

With gold in a temporary drawback from its highpoint at the beginning of August 2020, once again the precious metal provides its typical entry point for more positions to be added. Supply is not going to rise fast anytime soon, and the public markets just need a Halloween scare to spook everyone back into gold again, shooting the value up once again. The U.S. is already talking about implementing another fall stimulus spend right before its national election, and Europe will probably follow suit to balance the overall international market. Equity stocks typically fall in the winter, creating more pressure for value protection, only adding to the demand for gold by 2021.

Based on all the factors above, My Gold can help gold buyers of all types begin to create or add to a gold position if you believe that’s the next step for your investment portfolio. With a solid system in place for supply, inventory, and market price analysis, our team can put you on a solid footing for gold bullion investing as well as protection of your assets as you build your holdings. The demand for gold isn’t going away anytime soon. And with how integrated markets are today, everyone needs a safe haven for a safety net these days.

Understanding and knowing the value and composition of one’s jewellery is fundamental to being able to utilize the asset when it comes time to liquidate these pieces for future opportunities, changes, or new jewellery choices. Too often people buy jewellery items or more commonly receive them as gifts, but there is poor-recordkeeping for what is actually received as a particular necklace, ring or bracelet. There is no question that jewellery can be valuable and it has culturally been a shared form of family treasure-keeping for centuries. In the Middle East, for example, women to this day stock up and keep fine jewellery as both decorative pieces as well as a personal financial stability resource if it is ever needed in an emergency. This tradition has gone on for hundreds of years, and it’s all the more reason why a jewellery owner today should have a good idea what kind of pieces are in one’s own collection.

Gold in fine jewellery can be identified in a number of ways, and the easiest methods are those that are already provided by manufacturers. Gold jewellery makers of established authority regularly use a variety of tools to identify their product and craftwork, better known as stamps and hallmarks. The identification symbols are well-recognized in the industry and immediately work as a verification of the gold content used in a particular piece. This is extremely helpful. In the same way the government-issued bullion coins make it easy for people of all backgrounds to identify quickly the worth and value of a given sovereign coin, stamps and hallmarks make it far easier to evaluate gold jewellery.

Hallmarks and Manufacturer Stamping

Gold quality stamps and hallmarks have been used for centuries to affirmatively identify the type of gold used in the given jewellery as well as who tested or confirmed the quality of gold involved as well. Eventually, these markings where then modified to identify a given goldsmith involved in the manufacturing as a branding stamp. Why have these marking continued into modern times with all the paperwork available and ability to digitally record data by the millions of records with computers? The reason is simple. How easily can the average person tell one gold jewellery item from another? Some think that the colour of the gold makes a difference that can be used as a metric but, in reality, most people just examining gold by eyesight alone cannot tell the difference between a 14 karat gold ring and a 24 karat gold ring-shaped the same. And that reason by itself has been more than enough to maintain the hallmark and stamp system that has existed for so many years.

The Early History of Hallmarking

The use of gold hallmarks is definitely not new. In fact, the very first usage of gold jewellery hallmarks dates back to the 1200s. Hallmarking was invented to both identify the purity of the gold involved in a jewellery item as well as to identify who rated the piece and whether they could be trusted as a tester. Both were invaluable in a time when gold was regularly used for premium jewellery, coins and value protection. During the period of Edward I in England and Louis IX in France craft guilds were the dominant skilled-manufacturing force in Europe, and they were not without their local politics. To insure that what was produced by the guilds was indeed the advertised quality, state government assayers came into being as an objective regulator of sorts over guild products made with precious metals. Soon becoming successful, early craftmarking became a required prerequisite for any gold merchants who were going to sell a gold product in the regulated community.

A century later, Edward III was recorded awarding the Worshipful Company of Goldsmiths a royal charter for their work and skill as well as brand protection, a form of early monopoly of the jewellery market. It was from this royal charter and the Goldsmiths’ existence in Goldsmiths’ Hall that the term “hallmark” originated.

Fast forward to modern times, and gold items sold in the United Kingdom are regularly hallmarked, the only exception being products that individually weigh under 1 gram. The U.K.’s model has not been universal, however. Different countries have different hallmarking systems, and so the stamps on the jewellery involved vary depending where there were created geographically.

The U.K. products are stamped from one of four assay locations. London is the most famous but the three others are in Birmingham, Edinburgh and Sheffield. Across the pond, however, the U.S. system is far looser and allows documentation separate from the jewellery itself, i.e. paperwork. Where a U.S. jewellery piece is marked, it must have both the quality mark and trademark stamp next to each other. China and India have no required system, and hallmark stamping in both countries is entirely a voluntary act. No surprise, the variation leads to a lot of doubt and extra testing on products from these countries. In Italy, on the other hand, gold jewellery markings include a stamp for the given manufacturer’s name as well as a grade of quality. Common gold names include Arezzo and Valenza, for example. Amazingly, hallmark stamping in Switzerland is entirely voluntary unless the gold is in the form of a metal watch case. The above said, Europe came together in 1972 and tried to standardize hallmarking via a convention agreement better known today as the Vienna System. It has been renamed the Common Control Mark or CCM, but the standards were originally spelled out by the Vienna Convention on the Control of the Fineness and the Hallmarking of Precious Metal Objects.

A Common Standard in Gold Jewellery Manufacturing

It is rare today to find gold jewellery sold in major markets without some kind of stamp, etching or hallmark for indication of quality and make. While these markings might be very hard for the average person to see or make out, experts know exactly what to look for right away. That said, there is still a lot of a variation in the stamps used, which still creates confusion in typing of a piece, even for a jewellery buyer. Fortunately, the large majority of items fall in line with the standards most manufacturers follow.

The first big stamp to look for is the purity grade. This one matters the most to a gold buyer Auckland expert. While it can be different forms, the stamp indicates the type of gold used in the jewellery, ranging from 10 karat to 24 karat gold. The marking will either be an obscure 3-digit numeric set, such as 585, or it could be an obvious tell such as 14k for 14 karat. The 3-digit reference ties in with a common standards chart where number sets dictate the percentage of gold involved. 999, for example, is the purist amount, essentially 24 karat gold with a 99.9999% purity. On the other hand, 750 is indicative of a 75% purity level, better known to most as 18 karat gold. The 3-digit stamp sequence generally gets identified as follows:

- 999.9 or 999 – 24 karat gold

- 995

- 990 – 23 karats

- 916, 917 – 22 karat gold

- 833 – 20 karats

- 750 – 18 karats

- 625 – 15 karat gold

- 585, 583, 575 – 14 karats

- 417 – 10 karat gold (typically the lowest one will find in U.S. markets)

- 375 – 9 karats

- 333 – 8 karat gold (typically the lowest one will find in German markets)

Many times jewellery made with precious metals like gold will also have additional markings to help specify the content. This is common where the jewellery item is made with a combination of metals versus a high content value of just gold. For instance, “GF” will be used for gold filled and “GP” will signify gold-plated manufacturing. An immediate rejection from a jewellery buyer Auckland expert may be due to spotting these symbols right away. There may also be the addition of a single-digit number on rings to help identify quickly the ring size instead of having to measure on a ring-stick.

The Actual Hallmarking Creation Process

In the old days the markings put into a jewellery item were applied with a steel punch. In most cases the jewellery metal was softer, making this application a fairly easy if sensitive process to get the punch applied without damaging the item itself. Today, however, metal punching is extremely rare. Instead, laser etching is used, providing a far more accurate mark and avoiding the risk of impact damage to the jewellery involved.

The modern U.K. hallmark will be made up of four types of marks. These are now, by standard, required, except for the date of manufacturer which ended in 1998. The four marks include:

- Other countries vary in how they follow this

- The manufacturer’s mark

- The standard of fineness, otherwise known as purity

- The assay office involved that evaluated the item

- The date of testing and marking process or deviation from it

For consumer buyers, it’s important to both understand how marks are used in their home country as well as how they apply to the jewellery they may come to own or are considering purchasing. These marks can be extremely helpful in protecting a consumer’s investment in the purchase as well as avoiding otherwise lower quality items that don’t match the price being asked for from a seller. Can the marks be duplicated and faked? It’s possible, but anyone selling a fraudulent jewellery item with fake marks and getting caught could end up facing serious prison time for doing so. One item alone can easily put a defendant in the target scope of a major grand theft felony charge given the pricing of fine jewellery these days, making a conviction turn into multiple years of incarceration.

The Quality Content of Gold as a Standard

The manufacturing source is not the only criteria one should pay attention to when evaluating a jewellery collection. Yes, while 24 carats is the ideal standard to obtain, is 22 carats such a bad thing? How about 20 carats? Why are rings usually 12 and 14 carats and not higher? The quality of the gold content can have an even greater impact on the value of a collection than just who happens to be the crafter of the jewellery.

Carat Basics

When referring to gold by carat, it provides the most universally understood reference of gold purity in a jewellery piece. People could be far more technical by stating a given necklace has 90% gold and 10% other metal for mix and alloy strength. But that wouldn’t likely go over very well, and most folks would wonder what the other metal is and how could they verify its just 10 percent in the first place? The fact is, gold jewellery and other products made from gold need a bit of other metal in the mix to give them strength. Gold is an extremely soft metal and, on its own, would not last long as a jewellery piece. That said, carats provide an easier, more intuitive understanding that is easy to use whether one is a consumer or part of the gold industry.

24 carat is the finest, purest form of gold possible. This has practically no substantial metal in its mix and typically comes in .999 or .9999 purity. If one wants literally raw gold that has no other metals in it, then 24 carat is the standard to go by. However, while 24 carats is extremely valuable for its gold content, the form has very little utility because of its softness. Strong mixes allow gold to be used in forms that can take more wear and tear. Rings for example generally need to be strong as people use their hands on a regular basis and soft gold would essentially bend and eventually crack or break off over time. On the other hand, if one just wants gold for investment purposes, 24 carat gold is about as good as it gets for the finest version of the precious metal with the highest spot value and return.

Symbols of Carat Quality

On jewellery pieces the most frequently used symbology tends to be a stamp or engraving of numbers and the letter “K” or “ct” for carat as a unit of measurement. The numbers will range from 8 to 24 for standard, universal carat reference. However, the numbers can also include three digit codes instead. In these cases, it doesn’t mean the gold is 333 carats. Instead, it is a simplified version of saying a gold piece has 33.3 percent pure gold in it. Most would otherwise recognize this meaning as 8 carats of gold, a very low quality gold content piece, usually found in a ring versus a bracelet or earring.

Different carat values tend to be more or less common in different parts of the world. British Commonwealth countries have made wide use of the 9 carat standard for lower cost jewellery. This is identified as 9K or 9ct or 375. Interestingly, it would very rare to find a 9 carat jewellery piece in countries like the U.S. however, which instead favors 8, 10 and 12 carat for lower quality gold jewellery. The even numbers have long been used in marketing, so the 9 carat version is practically unheard of there. Worldwide, on the other hand, the 10 carat jewellery piece is well-recognized and can be found with stamps of 10K, 10ct and 416, again representing 41.6 percent fine gold content. This is the ideal balance between metal strength and gold luster that sells well in all types of markets.

14 carat jewellery uses the same stamp pattern of 14K, 14ct or 585 for 58.5 percent pure gold content. This value range has a bit of confusion in it because of the Russian market. In Russia, a 14 carat jewellery item actually include 58.4 percent fine gold content, not 58.5 percent. While being a slight difference, internationally Russian gold is getting mixed up with the rest of the world and, as a result produces variation in 14 carat jewellery, depending on the source. And U.S. markets now sell a 14 carat gold criteria that is 58.3 percent pure, just to confound things further.

There is also a 15 carat version, which is very uncommon and appears with 15K, 15ct, or 625 on the quality marking. It’s rarity has a lot do with the fact that the mixture was effectively ended back in the 1940s. As a result, while pieces do exist, they appear as estates are liquidated or jewellery is passed down to later generations from earlier holders.

From the 15 carat level gold then makes a jump to 18 carats. Again, similar symbology is used to show 18K, 18ct or 750. It equal 75 percent gold purity. 18 carats took over the 15 carat level decades after and generally became the same representation in terms of labeling.

22 carats has the same symbology above for its level and gets a three digit code of 916 for being 91.6 percent pure fine gold.

Finally, the 24 carat level represents the zenith of gold purity with an effective 100 percent fine gold content. When used in jewellery it is for pieces that generally don’t require or get exposed to stress and pressure and will essentially supported. It typically has a 24K or 1000 code stamped on the piece to mark it’s quality level. Most jewellery manufacturers tend to avoid 24 carat gold for their products because it is so easy to bend and break, but there is a market for fine gold pieces simply for the sake of wearing the most valuable gold possible.

Gold Weight as a Measure and Standard

While official bullion pieces have a set weight can be easily validated on a weigh scale, jewellery tends to be far more challenging. The problem comes in the fact that jewellery pieces have different shapes and sizes and weight values. That means an owner needs to know the total weight of the jewellery piece, assuming all of its parts are the same quality, and the carat of gold. Between the total weight of just the gold and the carat, then one could mathematically arrive at an estimate of value. However, who in practical terms is going to sit there and tap away on a calculator for every piece of jewellery they have for a guestimate? Not many.

Second, gold is weighed and valued by the “troy” ounce, not the standard weight measurement. So, the standard weigh scale measurement then has to be converted. For example, one troy ounce is the same generally as 480 grams. From here then a jewellery owner could calculate a close raw gold value of a jewellery piece, assuming it has no other metals or stones included aside from just the gold alloy itself. Many jewellery dealers will use the troy ounce/gram conversion method for weight and tracking jewellery pieces in their inventory, particularly for accounting and business tax inventory reporting.

Getting Help With Evaluating Personal Jewellery

If you find the all the above to be fairly complicated and challenging, don’t worry. Many share the same sentiment. Gold validation and measurement takes a lot of training and work. But that doesn’t mean you need to spend a few years at the computer distance-learning a new college degree in metallurgy. Instead, Kiwis can take advantage of a home-grown New Zealand expertise right at their fingertips with Gold Smart. Our service has been well established and responsive for years with customers and full transparency. Thousands of customers have worked with us in pricing their jewellery made from precious metals of all types including gold, silver and palladium. Not only can our experts apply years of training and expertise to your collection, we have all the right tools for an accurate evaluation as well.

Gold Smart has regularly bought unwanted and scrap gold from private sellers for years. As a result, we are able to review all types of gold jewellery with hundreds of marks, hallmarks and background symbology for identification. And, we have the capability to test and evaluate unmarked gold as well, a common problem for many that appears more often than people think, usually with estates and family inherited pieces manufactured decades earlier.

Give us a phone call, email or letter and we will help you get started in understanding the true value of your gold jewellery. We focus on items and pieces that are solid precious metal, not gold-plated or with stones embedded. That said, we can help you through an number of different channels, whether in person or through secure courier. And there is no pressure to sell your jewellery. We would rather educate and help than achieve a simple transaction. At Gold Smart, we find it’s better business all around to help folks understand their jewellery and gold than to try to score a single purchase or sale. We think that’s good for you as a consumer, and it’s a strategy that has proven itself for us over the years as a business. So stop wondering what you have in the jewellery box and find out for sure. You’re likely to be surprised at what you don’t know you have.

Table conversations can be interesting social events that can last for hours, and once the ice is broken people will often inject all kinds of stories on a given topic from presumably personal experience. This is how most people have learned socially for centuries. However, it is also a very easy way for folks to also end up with the wrong information too. When it comes to selling personal gold, the Internet has not made things any easier. With any kind of a search engine check people will easily find lots of content and material that ends up being just empty marketing to either sell goods or buy goods without a lot of guidance. And that can create a lot of mistakes too.

The fact is, gold buyers look for very specific tell-tale signs when they purchase personal gold from private individuals, and people should definitely be aware before walking into a buyer’s office or store what to expect. Doing so not only prevents confusion, it also helps avoid embarrassment and frustration as well; gold is one of the few assets that is often personal and emotionally attached as well. So, professional buyers will regularly look for objective qualities and aspects to point to for their price evaluation. This avoids ambiguous pricing methodologies that people get leery of quickly, and it provides a fair price for individuals that is objective and market-based.

The Basic Qualities

Gold is gold is gold, right? Well, not quite. Professional buyers will definitely be first interested in any objects that a pure yellow gold (normal form), white gold or rose gold. The concentration of the gold (i.e. karat value) does not suddenly take items off the table; it only differentiates between how much will be paid for an item make high purity versus lower content. Gold jewellery and items that are physically broken or damaged are not really that big of an issue, even with mismatched pairs or matches missing, as long as the item is gold and not gold-plated or mixed with stones and inlays.

Once the material is confirmed as gold and not some other kind of mix and that the offerings are pure without stones or other effects added and embedded in the metal casting, then it’s time to get to the content quality.

Differentiating the Gold Content Buyers Look For

Professional buyers will then take gold items and look for distinct manufacturing marks that denote that type of gold used to make the item. With bullion forms and government sovereign coins that part is easy; the quality of the gold is typically stamped into the bullion in a visible form. With jewellery things get a bit more difficult. In high-quality items the original manufacturer will have placed some kind of a small maker’s stamp in the item to identify its gold quality. This will be visible on inspection as a number and then the letter K. So, for example, if a ring is stamped “12K” on the inside of the finger band, the manufacturer identified the content as 12 karat gold. That immediately tells the buyer the ring, if verified true, has a content value of 58.3 percent pure gold. A necklace stamped 10K similarly would signify a value of 41.7 percent pure gold. The buyer can then estimate the value of the item versus the spot market. Once the item is then verified or tested for gold to ensure it’s not a fake, the buyer will measure the weight and being calculating the price offer to the seller which includes the buyer’s difference from the spot market so that he or she can retain a profit on resold gold.

Most jewellery designed for regular and frequent use is going to have a lower number than the “pure” version of gold known to be 24 karats. The reason is simple; gold is a soft metal on its own. If jewellery was only made of 24K gold, things would break and bend very easily with daily or regular use, and folks would find wearing jewellery impractical. So other metals are added to the mix to make the overall gold stronger. However, that also reduces the gold content in the jewellery, making it worthless as resold or scrap gold later on. This is why a buyer could have two identical necklaces where one is 12 karats and the other 24 karats and with dramatically different buying offers for the gold involved.

Several different testing methods can be used to verify one is dealing with authentic gold and not some kind of fake or gold-plated item. Professional buyers vary in their methods but three of the common approaches include:

The acid test – using a very thin sample of the item’s gold, which does cause a minor amount of damage, the buyer applies an acid which then reacts and identifies the gold content level.

The magnet test – A non-destructive method, a strong magnet is waved near the gold item. If it had other metals in it, the item would react and move with the magnet. Gold is not magnetic so there should be no reaction.

The loupe test – This is more of an examination versus a test. The buyer uses a portable magnifying lens to find any maker’s marks identifying what kind of gold was used in the making of the item.

The Kind of Material Gold Buyers Avoid

As with any market-based exchange, there are going to be plenty of categories and materials people might think are eligible and will be rejected by a professional gold buyer. Some of the more common ones definitely have gold in them but it is not in a form that is usable or viable for a scrap gold refining operation to work with.

Gold-plated material is the first area that buyers see the most of getting mixed up with real gold. It looks like gold and has the same color, but it is not pure content. Gold-plating is an electrical and chemical adhesion of a thin layer of gold to a base metal. The amount of gold actually involved is so thin and minor, it would be cost-prohibitive to try and remove it for recovery. Since gold-refining involves melting gold down so that it can be bulked and re-sold or reused as a stock bars by industrial buyers, gold-plated items simply are unusable. Gold foils or gold wrappings also do not produce what a professional buyer is looking for. Again, this is another form of wrapping a thin layer of real gold onto non-gold material. A number of maker’ marks are usually added to quickly identify costume jewellery or similar materials, and any of this symbols pretty much shuts down an item from being considered: KT GP, KT GF, KT GEP, RGP.

In some cases, the gold involved, usually, a coin, is worth far more as a collectible than as bullion. A professional gold buyer who is ethical would identify this factor and, if they also do business in collectibles, may make a commensurate offer from that perspective. This is not always the case, but many buyers maintain a licensed business that has been in operation for many years. They are not interested in developing a reputation of “cheating” someone out of a big find that the personal seller may not be fully aware of. This is oftentimes how collectibles are “found” when a professional is brought in for an evaluation.

The Type of Gold Buyer Auckland Service Who May Not Know Their Job

Private sellers may feel that all gold-buying operations are the same, and it is an arms-length transaction simply selling anything gold from party to the next. This is repeatedly proven to not be true. Pawn shops, for example, have a high reputation for paying the least amount of value for what they buy because the venue type is almost always used as a means for fast cash. So, the regular pawn buyer expects their seller to be under strain and willing to take ready cash versus holding out for a better price point.

Check-cashing venues are in a similar boat. They are run primarily to provide short-term cash loans at higher than normal interest rates for profit maximization. Gold buying tends to be a side-activity and the buyer frequently has very little training or professionalism as a scrap gold evaluator. Again, the assumption here is that seller is desperate and needs money right away, so the safe position for the payday loan venue is to offer a low cash value quickly and make a profit on the purchase. No surprise, many can be cheated out of better scrap gold pricing found elsewhere with a bit more patience.

Hotel buyers are here-today, gone-tomorrow operations. They literally involve a buyer who sets up shop at a local hotel, a person’s home, or a meeting location and offers to buy anyone’s local gold on hand with “great” prices. They will usually blanket the local areas with flyers and slogans like, “Sell Gold Auckland Cash Fast” and “Unload Unwanted Gold for Quick Cash.” Reputable gold buyers Auckland venues do not market or communicate in this fashion. The hotel buyer modus operandi is similar to the above two categories – people will sell quickly when they see ready cash in hand. And, unlike the pawn shop, a seller cannot get something back if the sale ended up being a personal mistake.

Professionalism Makes a Difference

High-quality service gold buyers can be discriminating against on what they buy, but they also see their role as protecting the industry, the private seller, and their business as well. Years before the idea of selling unwanted gold was relegated to just channels where people were in financial situations needed cash quickly. However, because of what has happened with the gold markets worldwide in the last two decades, the scrap gold market has professionalized considerably in a regular, established industry with a set of standards and ethics. Not every buyer follows these examples, but all of the established venues and businesses voluntarily enforce rules on themselves to ensure customer protection as well as their own business success.

For private sellers working with professional buyers who look for specific gold qualities can be a great way to be educated on what qualifies as “good” scrap gold. Not only can a person learn first-hand what a professional buyer is looking for, it also teaches them things to look for when they are buying their own gold jewellery or gold bullion later on in a different situation. And the overall process increases the trustworthiness and financial safety for all involved as well.

Gold Smart has been in operation for years, helping private individuals and customers liquidate scrap and unwanted gold through reliable and safe channels. With a professional team regularly re-training to stay up with technology and changes in the gold market as well as manufacturing methods used for gold jewellery and similar, Gold Smart’s gold buyers are some of the most skilled in the New Zealand market and are often relied upon as subject matter experts in the trade. To find out more about Gold Smart’s gold buying program or to schedule your own appointment, call or email any time. Gold Smart can also make arrangements for large lot evaluations as well to ensure your comfort and a smooth transaction

Selling your personal gold in 2021 is a bit like going on a trip and being allowed to find your own personal treasure chest on an island. You go digging through your home, actually find a few items that really qualify as spare gold you can sell, and you look at the price of gold online and realize you have something worthwhile, a real prize. Then, just like the fellow who dug up the chest on the island, the reality hits you. Somehow, you have to figure out how to actually sell that gold without losing your shirt, your hand, or your wits. And there are a lot of pirates and good-for-nothings out there on the high seas of real life looking to separate you from your gold without paying for it.

Personal gold selling actually used to be pretty rare only a few decades ago. Most people just held onto what they had, or they were aware of a discrete service that was in fact a refiner who would buy unwanted gold for a price. It simply wasn’t socially acceptable to be selling one’s jewellery unless a person was in dire financial straits. And then, in those cases, the person had to trudge down to a local pawn shop as there were no respectable firms available to liquidate one’s gold. Granted, there were jewelers who would buy fine jewellery from estate sales, but these were uncommon at best.

Today, thanks to the skyrocketing spot price of gold on the investment market, one can sell gold just about anywhere, in any sizable town and in any country. The demand is so high, there isn’t enough gold going around, which makes buying back second-hand gold a brisk business. Unfortunately, that means there’s also a lot of shady characters looking to take advantage of that activity as well. This guide is intended to give you, the personal seller a clear idea of what to expect, what to avoid, and how to sell your personal gold jewellery safely and profitably. Most importantly, it’s also intended to help you stay safe doing so.

Who are the Gold Buyers

The best place to start involves understanding who the buyers for second-hand gold actually are. Business and firms that regularly work in the gold intake side of the market fall into these categories:

Refiners or consolidators

These businesses are the major players in the second-hand gold recycling side of the business. They bring together multiple lots from other players and often have the equipment and means to manage the smelting process that reduces all the gold items they receive into consolidated form to be recast into gold bars. These businesses then sell the consolidated gold back into the market to industrial buyers who either needed it for jewellery stock, industrial use, or investment bullion. While refiners and consolidators often provide the best pricing for gold, the average person will almost never deal with them as an individual lot is simply too small for what these players are buying. These look instead to other businesses to bring collections together that can be smelted into large amounts of bulk gold in one lot.

Professional gold buyers

This type of business is ideal for a personal seller. A professional gold buyer works as a halfway point between the wide, differing market of many sellers and the consolidators. Many times professional buyers may also be refiners as well. Because they have the wherewithal to handle larger buys but cater to consumers, these businesses will provide a very fair price for gold sold to them and then consolidate that into larger lots with their wide network of sourcing. They are not a fly-by-night operation; professional gold buyers tend to be the most established businesses in the gold recycling market.

Local Jewellery Dealers

Not established to buy gold in the first place, some might delve into the activity when it involves fine jewellery that is recognizable right away or has a documented worth, as well as bullion coins. However, many jewellers are simply going to resell their gold to a refiner or to other customers, and only make a thin profit margin in the process. They are not invested in an ongoing operation. So, when they do buy, jewellery dealers will often have a hefty markup to make it worth their time occasionally buying private gold from consumers.

Pawn Shops, Payday Loan Businesses, and Backstore Venues

These businesses do not focus on gold specifically. They are in business to leverage valuable items from consumers who need cash right away and are willing to sell their items and possessions far lower than what they are worth. All three types of businesses focus on that human behavior to buy gold at discount pricing and then resell it for far more, making a sizable profit doing so. They frequently operate in less-than-stellar neighborhoods and the process is fairly unfriendly right from the start.

Private Buyers, Temporary Visitors, and Gold Parties

Consumers will frequently run into private buyers of all types. These types portray themselves as professional buyers, but they don’t have a business license or address typically, and they almost always operate out of temporary locations. The most common tends to be a gold buyer in town with ready cash and meeting folks at a local hotel to buy any gold available or being the buyer at a gold party hosted by a known local (who gets a fee for hosting the party at their house). Again, the goal here is to take advantage of people’s desire for instant cash and buying their gold at discount prices. Since most people don’t really understand what they have, the buyer waves cash in a fun environment and people fall for it by the dozens every time. There’s no recourse the next day if someone thinks they made a mistake; the buyer has already left town.

Online Buyers

Thanks to the explosion of the Internet connecting people all over the world, selling gold online seems to make a lot of sense. After all, it’s like a giant garage sale but with far more customers showing up to buy things. The problem here is that many consumer sellers are not familiar with how scams can be pulled, making them easy targets for online buyers. The most common fraud is the chargeback method. In this scenario, a buyer pretends to buy a gold item and issues a credit card payment. Sellers go for it when they see the money show up in their online account, and they ship the gold. As soon as it arrives, however, the buyer then issues a chargeback telling his credit card company the payment was not his. The seller loses the money electronically before knowing it, and the buyer has both the gold and his money. Scammer 2 pts, seller 0. This scam is not the only one used, but it has been so successful, it has made selling online high risk on multiple platforms ranging from eBay to Craigslist to many others. Still, people sell gold online regardless every day.

Making Sure Your Gold is Ready to Sell

For the consumer seller, it’s important to understand right from the start one will not be paid the value of the spot market price for gold sold. First, the gold buyer involved needs to make a profit to stay in business. They are not speculators in the sense of buy and hold investing. They don’t buy to sit on the gold for months or years and then sell it when the price has risen further. As a business, they need to move that gold and resell it into the market at a profit to pay for their operations and growth. Because of this, anyone selling gold, even with the best pricing, will be doing so at a discount, period. The trick is to find the right gold buyer who gives the consumer the best price, even with the discounting included. The best price isn’t always the most either. What good is a price if the person is subjected to risk and their safety is threatened or if the transportation cost there and back ends up eating a big chunk of change? In practice, the best price is the one that can be reasonable obtained for the gold being sold without losing cost somewhere else.

Secondly, different second-hand gold will receive different pricing. The main factor has to do with the quality of the gold being sold. 24 carat gold is by all standards the highest quality gold to have and will fetch the highest price closest to the market spot price seen in the news. 10 and 12 carat gold, on the other hand, is the lowest purity due to mixing with other metals for strength and will fetch the lowest pricing possible. Everything else is a range between those two points. Most people don’t consistently buy and receive the same quality gold in everything they have. So, as a result, most personal lots will be a mix of gold, ranging from the lower quality to hopefully the higher end as well. That said, when a number of pieces are being sold, it’s a good idea to know ahead of time what one has and separate them when possible.