Gold jewellery has always been valuable, but that doesn’t mean that it will automatically command prices higher than the gold-content value, or anything close to what you might pay buying gold jewellery retail. The fact is, gold jewellery is frequently marked up well above what the precious metal is actually worth at the time, and it would take a significant amount of appreciation to match or cover the retail premiums. Very old items of jewellery that are collectible or rare, may achieve values above gold spot prices, however value of gold jewellery typically is based on gold content alone when selling in the second-hand jewellery market.

Why Sell Gold Jewellery

Selling personal gold that is unwanted, second-hand, broken or just not fashionable anymore has always been a smart move. What good is that asset if it’s just sitting in the back of a cabinet drawer collecting dust? Not much. Instead, by liquidating it for the value of the precious metal involved, the cash obtained can be used for all sorts of needs and wants right now or for the future. That can include helping with a house down payment, school tuition or books, a car repair, a medical need, a new home entertainment system, a trip, a new hobby or similar. Selling old gold just makes a lot of sense, and you get to decide for how much, as well as how that payment will be used to make your own life better afterwards.

How to Sell Gold Jewellery

There are a few options to consider when selling gold jewellery, including ‘gold parties’, selling privately or to a professional business. Most people today think of a ‘pawn shop’ with garish advertisements or selling their jewellery online on auction sites like Trademe, but these are not the only avenues for selling gold. There are also private sales to other individuals, pawn shops, gold parties which provide a temporary but easy means to sell personal gold once in a while, and trade channels as well where gold is traded for some other property that is useful or needed. However, just because there are a lot of ways to sell personal and unwanted gold, that doesn’t mean they are the best avenue or will produce the best sale price for the personal seller. A lot of challenges and snafus can occur with many of these options, especially if one is not paying attention to their surroundings or whom they are dealing with.

3 Tips on Selling Gold Jewellery for a Good Price

Tip #1 – Watch the Market Before Selling

Understanding the value of gold on the spot market has a big impact on when to sell second-hand gold jewellery. The precious metal that makes up jewellery for sale goes up and down in value based on the spot market. The actual price a personal seller is offered will be a percentage of the market spot value depending on a number of factors including the quality/purity of the gold involved, the metal type, the total weight of the gold, business overheads, and associated refining costs.

However, even with all of these factors involved, when the gold market goes up, so does the value of all gold, whether new or second-hand. However, when gold drops in value, so does everything related to it. Ideally, a personal buyer wants to sell at a time when the market is rising or at a much higher price point than when the jewellery was bought originally.

For example, someone who bought gold jewellery in the 1970s or 1980s would be in a very good position right now in the 2020s to sell those items as gold has appreciated significantly since those decades. On the other hand, someone who just received a ring or necklace from a good sale a few years ago would probably take a loss if they had been the original buyer from a jewellery store as the very high mark-ups paid when buying gold jewellery retail.

Gold will always sell dictated by supply and demand. One has to pay attention to what is happening with the market (gold spot prices and currency exchange rates) and do some homework if planning to unload a sizable amount of gold jewellery for sale and expecting a notable return. While gold will likely always be considered a great asset in which to store value and wealth, that doesn’t mean buyers automatically have to pay out to personal sellers at top market prices. If there is too much gold floating around in the market, the prices become depressed, and personal sellers will find it very hard to come close to their expectations for sales.

Tip #2 – Don’t Take the First Price Offered

Personal sellers who have had some experience know the first price offered will be the lowest possible for second-hand jewellery. Folks should always hold out for a better price, even if it means having to shop around a bit. Remember, gold buyers have lots of folks coming to them on a regular basis selling gold, so one individual sale is not going to be the end of the world if it falls through. However, when gold is in high demand, buyers might offer a lower price at first, but if the sale represents a sizable holding, they can be quick to make a second offer when told politely, “no.” Personal sellers should always try to do a bit of professional haggling to get the best price possible for their gold jewellery.

Smart personal sellers will have done their homework and will have been given multiple offers for their gold. That might take a bit of footwork and multiple meetings, but the difference can be worth it when one buyer decides to beat out the others to have access to the gold available. In these situations, bigger lots with higher quality gold will tend to be more attractive than smaller amounts and lower quality, i.e. lower gold content.

Remember, gold jewellery with hallmarks and high carat value is worth a lot more than miscellaneous gold with no marketing whatsoever. Hallmark gold brings with it a known standard of gold quality and manufacturing as the hallmark represents a specific company and producer certified for their gold quality. Known and stamped carat value also makes it clear when gold is a higher purity than mixed gold versions that might be stronger but are cheaper in gold content. Don’t let your high quality gold with clear marking get lumped into the pricing of lower quality lots to sell jewellery successfully. That would be giving away a definitive sale price value for free.

Tip #3 – Not all Gold Jewellery is the Same

If you need to know where to sell gold jewellery that involves mixed items such as gold coins set in pendants or rings, you may want to take a look at those coins or sets first. Occasionally gold coins may be worth more as collectibles than the pure precious metal value for the second-hand gold in a sale. Collectibles, gold bullion coins, specific sets or pieces made by a particular crafter all trigger collectible value that sometimes can be worth a more through the right dealer and channel. Again, pay attention to what you have for sale and do homework on it before selling. You may be surprised that its value is worth more than just selling it for gold alone.

Gold Smart is Always Available for Safe Gold Selling

If wondering where can I sell my gold jewellery safely, Gold Smart has always been a secure and dependable gold-buying channel for second-hand and unwanted gold pieces. As long as the jewellery is made of gold and doesn’t have precious stones inlayed or mixed, the jewellery is very likely a good candidate for sale to Gold Smart’s buying teams. With a safe, private approach, Gold Smart provides the professionalism of a licensed business, a strong New Zealand reputation for customer service, and competitive pricing tied to current spot market valuations. Most customers who have experienced Gold Smart have been so pleased, they’ve become regular gold sellers again and again. Try the difference and avoid the games. Gold Smart is ready for you and your gold jewellery when you are.

Gold has never stopped attracting people. Through thick and thin, urban and rural living, people go looking for the precious metal every chance they get. For 99 percent of folks, gold investing however can be done online or through in-person purchasing. However, there is the one percent out there who just wants to do things the hard way, even if it means getting their feet wet or their fingertips dirty. Gold panning, for example, has become extremely popular among Kiwis just wanting to pick up a few pieces of raw gold for themselves the old-fashioned way. It’s simple to do, takes only a few tools, and patience. And, most interestingly, natural gold-finding doesn’t require the Internet or stock market exchanges to put into effect.

Finding Gold Is Something Anyone Can Do With Persistence

There are multiple ways people can find gold naturally. And the best thing about gold-hunting in nature is that your investment in terms of equipment is one time, and your ongoing cost is time and energy. The latter two are simply your choice of how much you want to put into the effort or not, but many who really want to go after a gold find the hunt entertaining, adventurous, and fulfilling.

Gold panning, obviously, is the easiest way to get started. The equipment requirements are straightforward as well. One just needs a few large, flat metal or plastic pans as well as some waders for being in the water for an extended period of time. A good backpack, walking stick, map, GPS tracker, and food and water make up a day’s walk in and out. And, finally, make sure you have a good pair of hiking boots. It makes all the difference. Sneakers won’t hold up and often lead to twisted ankles. Once you have a good location target figured out in terms of a creek or river likely to have panning potential, then it’s time to pick a day and hoof your way into the location. Make sure you have told people where you are going ahead of time and bring a partner versus going alone. Safety should always on the top of your mind, even when having fun panning for gold.

The second easiest option is metal detecting. This option costs a bit more. There are bargain-basement units available for very affordable prices, but in practice, they are a waste of money. The ability for these units to pick up well is poor. Expect that you’re going to spend a few hundred dollars (NZD) on some quality equipment. You should also spend some time practicing and training to understanding how to read the monitors correctly for the best finding results. Once you have your equipment dialed in, then it’s time to target your likely locations. When it comes to gold, you’re unlikely to find major gold veins with a metal detector; they are simply buried too deep. Instead, your focus should be beaches, river banks, parks, and campsites. Why? People lose things, and these places are prime for finding lost gold jewellery, coins, and similar as well as money and other items as well. Remember, one lost finger ring of 14 or 18 carat gold can be a couple of ounces of gold, well worth the trouble.

The third approach towards finding natural gold is mining and geo-spelunking. In short, you’re hobby mining. This isn’t something to engage in on the fly. Looking for bits and deposits of gold takes a lot of understanding of the land you’re moving through, and you can be putting yourself in some tight situations. It should definitely be a group effort and only practiced by those with experience and skill in adventure mining. Additionally, you have to keep in mind whose land you’re on when you go mining. Not every private landowner will be thrilled about the idea of someone poking around on their acreage to make a profit. And public lands often have plenty of rules that may restrict any mining or digging up resources as well. So, make sure to do your research first before going to a location. You don’t want your first mining foray to end the day at the local constable station cooling your heels waiting for a barrister.

Processing Your Raw Ore Gold Findings

The normal approach for handling raw gold would be to smelt it and turn the raw ore into refined gold. Fortunately, those who go hunting for gold in the wild don’t need to worry about trying to figure out what to do with their findings. At Gold Smart, we can easily process raw gold ore, along with any other kind of second-hand gold that one might have sitting at home that isn’t useful anymore. Because Gold Smart functions as both a buyer as well as a consolidator, we’re able to take large lots of gold as well as small and put them all together for refining into new gold bullion bars. These in turn get resold to the industry for new use. And the personal sellers get ready to cash at gold’s latest recycle prices in exchange.

Investing in Gold Without Field Hunting is Easy Too

Of course, one doesn’t have to go out in the wild to find gold. It’s quite possible to invest in gold in a far more urban manner; you simply go to a store and buy it or pursue it through various investment tools.

The most traditional manner is to buy gold in bullion form. That said, one should expect to pay a sizable price for the precious metal in its purest form, the ideal investment target of 24 carats. Gold’s feverish run has made a lot of people a lot of money, and though the rally has taken a breather in the last few months, there’s no shortage of flag-waving supporters who claim gold is on a march to US$2,000 and beyond. That sentiment, while experts might disagree will occur in 2021, still continues to keep gold at a very high price of $1,850 an ounce currently at the beginning of the year. The most common form one will then find it intends to be sovereign coins as they provide the easiest investment with government-issued weights and face values, making their quality and content easily discernible.

Alternatively, the next most common form tends to be jewellery. Gold in this form comes in a variety of quality types, better known as carats. 24 carats tend to be the most expensive and purest form, but gold can also be bought in lower qualities as far down to 10 carats. All of them are investments as well as adornments, but with the historical rising trend of gold over the years, each category could effectively be investment income down the road a decade from now. Jewellery has long been a means for investing in gold and culturally it was a well-practiced method for families to transfer value from one generation to the next. Today is no different.

For physical gold purchasing and investing, the best place to go a gold dealer that specializes in gold items for investment purposes, as well as has a strong reputation for trust, quality, and reliability. Gold Smart meets all of those requirements and regularly carries a wide assortment of gold bullion, whether in the form of gold bullion bars or gold sovereign coins from different countries and governments. Some of the best choices include the classic South African Krugerrand as Canadian Maple Leafs and American Eagles. All three are well known for utilizing close to 24 carat gold.

Finally, there is the digital world. With a click of a button, people can invest in gold through multiple channels. However, the choices all tend to be common in the form of stocks. Exchange-traded funds allow people to invest in gold by buying stock shares in a fund that buys gold. Company stocks allow similar investment in gold through companies that make money mining the precious metal and their business success doing so. However, none of these choices actually have an ownership in gold like a physical purchase.

Removing the Risk, Enjoying the Gain

Again, Gold Smart can provide you solid channel into a gold investment by purchasing gold that’s real, solid, and worth every dollar paid for it. We stock the highest quality gold investment choices, and we can provide options for safe storage of gold as well. With a long-standing history in New Zealand for supporting gold investors of all types, we have helped people consolidate their retirement savings, start new investments, save for the future, and create viable hedge assets that aren’t caught up in the latest business directions. In short, we have provided people an easy, reliable way to make gold a viable part of their financial lives without the risk that people face online or trying to buy gold through harder to evaluate forms. Gold Smart is your best New Zealand choice for gold investing, and when you try investing with us, you might wonder why you hadn’t done so sooner.

Gold has been around as a precious metal for centuries. The earliest gold fought over was well before the ancient Egyptians represented it in writing. Yet the same question that sits in the back of people’s minds today, exactly what makes gold so precious, was the same fundamental issue in ancient history as well. Gold per se doesn’t produce anything or transition into anything useful. It’s not a raw material that can be turned into a consumable. It doesn’t generate more growth on its own. Until high technology arrived, gold wasn’t even useful for tools because it was too soft of a metal to work with. However, gold as a holder of value and riches persisted anyways.

The Geological Origins of Gold

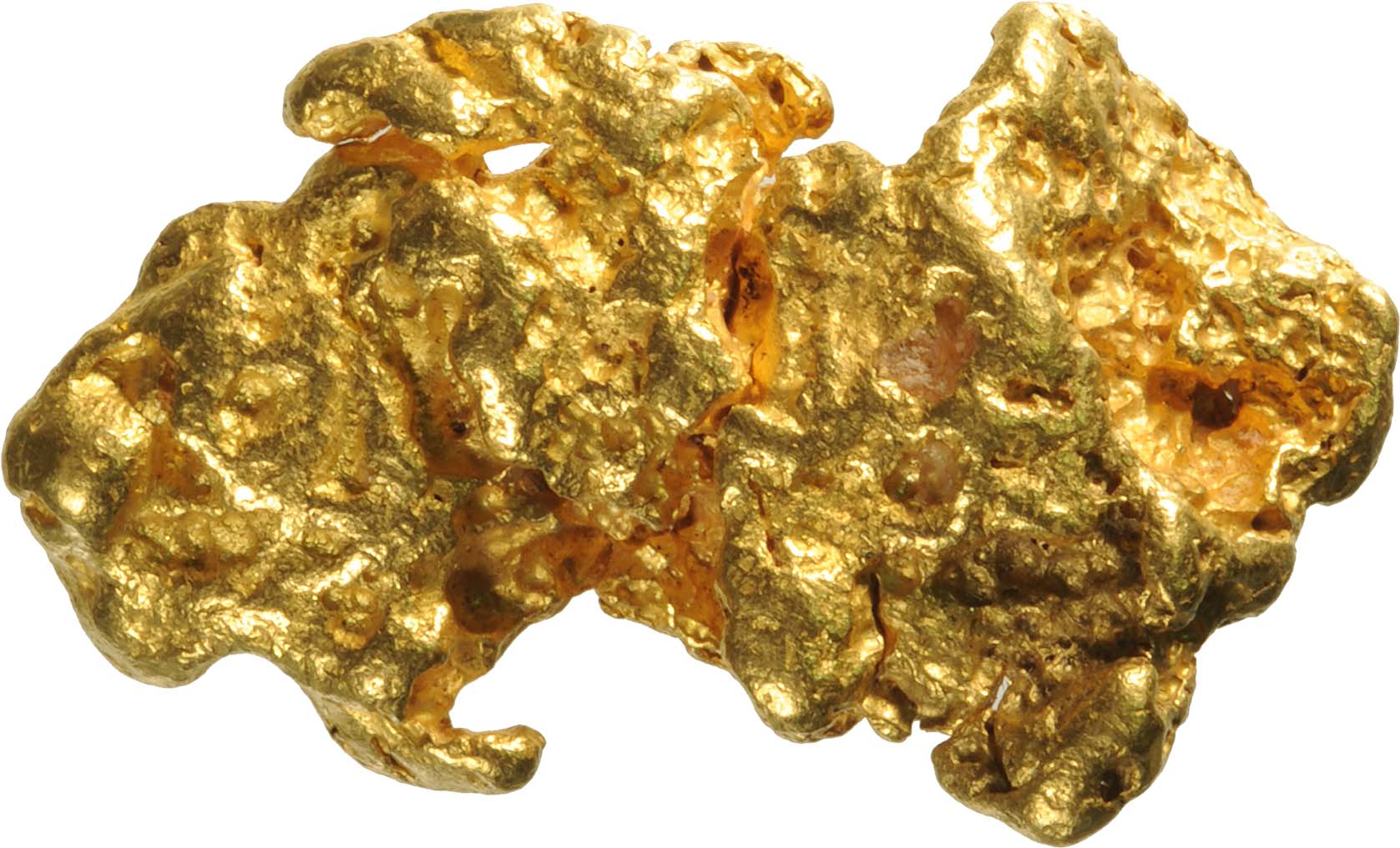

Gold as we know it today is a refined metal output that comes from a gold nugget or lode, the naturally formed version of gold. Gold nuggets are often found within rock, quartz in particular, in melted and slagged form. Much of this is due to the fact gold melts at very low temperatures and liquifies easily while other types of rock still stay hard. No surprise, gold then pools and reforms within crevices and cracks of other rock. As rocks are eroded, broken up, and separated, gold appears in the form of gold veins. Gold also falls apart with smaller rocks when washed apart by rain and the elements, ending up with smaller pieces in rivers and creeks as watersheds catch water from mountains and higher points.

Gold nuggets come in all shapes and sizes. Some show up as parts of strings, others as lumps or almost round balls, and many smaller pieces as flakes or chips. Some will still be attached to the quartz they bonded with or similar rock material and others float loosely in dirt. Regardless of hypotheses, study after study has found that the high majority of gold available was originally formed well underground in high heat and expelled upward through geological forces.

In their raw form, gold nuggets tend to be on the higher side of purity. Usually ranging anywhere from 20 to 22 carats of pure gold, gold nuggets will actually vary in quality by their location. For example, nuggets from Australia tend to be very high quality, even reaching as pure as 23 carats. Gold pieces from Alaska, on the other hand, are on the poor end of the spectrum, some being well into the lower quality of 20 carats. The largest gold nugget in recorded history was posted in 1869. Two fellows digging in Australia unearthed a 2,284 troy ounce unit weighing in at 71 kg. Nothing else has come close since although there have been a number of sizable finds and one of the more recent stones found in 1980.

The Ancient History of Gold

Gold was considered worth coveting as far back as at least 40,000 B.C. How is this known? Archaeology has literally found the proof. Gold flakes have been part of the artifact inventory recovered in ancient sites clearly located and placed within the Paleolithic area, including evidence of worked material, i.e. handled by humans. In just about every case gold was not treated as trash or common stone but instead protected and valued. This particular behavior has been worldwide versus being only localized to a few regions. Somehow, some way, people decided to apply a worth to gold beyond just being a shiny stone or rock they found while foraging.

The ancient Egyptians get the prize for being the most prolific with gold in terms of working it into amazing products, jewellery, symbols and even entire caskets for the dead. King Tutankhamun’s has probably become the most famous of all Egyptians with gold, particularly due to his iconic death mask, but gold was well-used by the Egyptians as far back as 3,000 B.C. The Egyptians went a step further, however, and associated set weight standards to gold pieces, developing an asset exchange value that redefined trade and economics in their time. For example, one piece of Egyptian gold of set size was worth 2.5 parts of silver set units. By doing this, Egyptians created economic predictability, which in turn allowed their trade markets to grow as everyone began to understand what their products were worth versus other products and services sharing a universal measurement (at least in the Egyptian world). Interestingly, however, the Egyptians were unlikely to have used gold directly as money in daily transactions. Barley and agricultural food products were worth far more in daily living.

Gold was used so heavily by the Egyptians, they both generated trade to accumulate more of it as well as mining it and pulled new reserves from the earth. This is known due to surviving gold maps showing the locations of gold mines in the ancient world as the Egyptians knew it. Instead, a different culture known as the Lydians and located in what is now modern Turkey was the first to apply gold as a daily currency.

The Beginning of Western Civilization

By the time the Greeks arrived on the scene, gold was already used for adornments of religious idols and temples, jewellery, awards, vases and cups and much more, all associated with richness and high value. Gold to the Greeks was akin to the immortal deities and what was the highest form of glory in the Greek world. They treated the yellow metal both as currency as well as a material with which to make some of the finest adornments. When the City of Troy was rediscovered in the 1800s, much of the work centered around the amazing gold jewellery, items and artifacts that were being dug up and unearthed in the site being from the same time period as the Greeks. Unfortunately, that also probably resulted in a lot of archeological damage, but the gold was considered the prize of the dig for Heinrich Schliemann, one of the fathers of modern archaeology.

The Romans also put a currency value on gold and treated the gold metal as their highest form of exchangeable barter in markets and in riches. In fact, gold was a standard means of paying soldiers for the Roman generals, which meant the top officers needed constant financing as well as loot to keep their armies happy and marching. Gold coins with Julius Caesar’s profile as well as marking his death have been found and continue to be highly prized to this day as collector items. The Romans also took gold a step further during their reign; they made gold the means by which to claim tribute from conquered areas among other goods. Not only did this give the Romans a generic form of loot that was liquid and easily transferrable, it meshed with their current economy automatically, increasing Roman strength and value exponentially. Unfortunately, this also meant a good amount of indigenous art and crafts were destroyed in the process to turn into Roman loot.

The Columbian Exchange

The Discovery of the New World by Columbus in 1492 brought a tremendous amount of change to what is now known as Central America. However, one particular aspect that the New World gave back, at first to the Spaniards and then to many others who reached the same shores was a tremendous amount of gold. Not only did many of the indigenous people of the Americas favor gold, they were very good at working with it. Once the Spaniards actually realized what they had on their hands with their first conquests of the Aztecs as well as in South America with the Incas, the gloves were taken off. Natives were enslaved and used as miners, gold was confiscated in every form possible, and entire civilizations disappeared as a result both from disease brought over from Europe as well as from subjugation. An amazing amount of gold was pumped out of the Americas back to Spain, even with tremendous loss of life as well as ships on the high seas. Some of those wrecks became famous in the 1980s when discovered again, and Spanish gold coins are still found on the beaches of Florida to this day. Gold flooded into Spain for years and funded an empire that was known for its largesse as well as riches. Even with entire fleets lost at sea during storms or attacks, Spain’s intake of gold was tremendous and impacted the country for years to come.

Colonial America

By the time the American colonies threw off the yoke to the British Crown and began to establish their first solid government monetary policy 15 years later, gold was already well-established as a country’s hard value worth in Europe. Exploration and colonization had made central countries in Europe incredibly wealthy, but war was also robbing them of those riches as well. Britain, Spain, Portugal, and Italy spent much of their wealth in epic wars ranging from 1750 to 1850, which consumed much of the capital of these states. In the meantime, the newly created United States had decided to shift to a gold standard in 1792.

Under what became famous as the Mint and Coinage Act, the U.S. tied its new currency to gold, and actual gold and silver coins were exchanged as currency in the country. Gold at this point stood at a value 1,500% more valuable than the same amount as silver, i.e. 1:15 ratio. This stabilized the market for gold versus silver, and the government was bound to exchange at the same rate regardless of other economic factors. However, some 70 years later during the U.S. Civil War, the Union government found that the law was too restrictive on its ability to raise funds for war efforts. It simply didn’t have enough precious metal to pay its bills. So, during 1862, the Union government switched to a paper currency, declared that as face value, and disconnected its legal money from a direct gold value. By 1873, silver was also nullified under the Coinage Act of 1873, wiping out the true silver dollar completely. Through to 1900, however, the U.S. still backed its currency in general with a gold dollar that was moved around for the country’s reserves.

The U.S. is notable during the same period because from the 1840s forward, a massive gold rush was occurring in the West. California made and broke the fates of thousands as people from all over migrated to the Pacific state simply to dig in the hills and find their treasure in raw gold. Most spent their diggings for supplies, food, and lodging as well as drink, and the real moneymakers of gold became the tradesmen and businesses that boomed to support the miners. Gold continued to be found in the West with the Klondike territory in the northwest as well as British Columbia, and miners moved ever northward into Alaska looking for the yellow metal in the earth.

Australia also hit the gold map during the same time period with a gold rush in the Outback. Areas of Western Australia that would have otherwise been barren became populated with miners, families, trades, and businesses, and most of the towns in the expansive Outback find their roots during this time period.

Global Wars and Bretton Woods

While World War I had a dramatic effect on reshaping Europe as well as colonies around the world, it was World War II that had the most influence on gold. During the beginning of World War II Nazi German forces made sovereign gold a critical target as the expanded quickly and conquered nearby European countries. The German war planners knew from their World War I experience that they were going to need hard currency to exchange for supplies and materials to keep the war effort going. This was the Achilles Heel that ultimately caused the German surrender in World War I. As a result, as countries were conquered, the Nazis raced towards the locations of the central banks to secure gold bar deposits and similar. Many of the low countries in Central Europe fell quickly as well as Eastern Europe. However, the Danish, French, and Norwegians made valiant attempts to save their gold, getting much of it moved to England. Spain tried the same but their gold was surreptitiously diverted to Moscow by the Russians who pretended to help. All of the Spanish sovereign gold disappeared as a result and funded the Russian war effort. What was moved to England ultimately ended up being moved to the U.S. and New York to keep the remaining sovereign gold safe from the Nazi encroachment. As a result, the U.S. for the first time became the economic leader of the world. This in turn set the stage for gold and related economic changes after World War II.

Post-war, the most significant economic shifts internationally were made under the Bretton Woods Agreements. These were a series of meetings defining new financial rules for the primary world power-brokers, but a key factor was tying gold to a U.S. dollar valuation. Again, with all the world’s leftover gold reserves and the one remaining economy that was incredibly strong after the War, the U.S. created the new monetary policy paradigm for the rest who were busy trying to rebuild their infrastructure.

The Bretton-Woods paradigm lasted until 1971 when the Vietnam War and President Nixon moved the U.S. off gold completely to redesign the U.S. economy from bankruptcy. From that point forward, no particular country was ever based on a gold standard again, and gold became very much a non-governmental investment asset, even though the countries and their central banks still hold gold today for financial reserves. This change likely made gold even more valuable and contributed to its modern times value spike because the precious metal has been allowed to operate as a free market asset disconnected from government policies and public markets. In a sense, gold became the perfect safe harbor for portfolio diversification. That has been evidenced more so in the 2000s than at any other time in history.

Closing Words

We hope this short history summary adds some context to why a portion of gold is recommended for anyone’s portfolio, either as bullion or jewellery. Despite what happens in the world, the precious metal has proven to be invaluable in times of need. Gold Smart provides New Zealanders an easy safe access to gold as well as a practical channel by which to liquidate it when ready. If you want to buy gold or sell it, give us a call or email, and we can help you value your gold, understand what you hold and what your options are without pressure or any requirement or commitment. We have been serving Kiwis for years with the New Zealand gold market, and our inventory of gold asset options is robust. If gold is on your mind, contact Gold Smart to consider your next move.

Gold Prices

The price of gold and silver has risen in recent days. This means that if you bought gold bars in the past, you may be able to sell them at a higher value – making a good profit. Of course, the price of precious metals could rise further, however, we can not guarantee what will happen with prices tomorrow, next month, or even next year. Instead of trying to guess the right time to sell your bullion, why not take advantage of high prices right now?

In determining the value to sell gold bullion, it’s helpful to know the weight, purity, and where it was refined. Regardless of its condition or place of origin, and as long as it’s genuine gold or silver we will purchase it from you. Offering excellent rates and fast payment service.

We want all our customers to have a pleasant experience when dealing with us. We will purchase any kind of gold and silver as well as selling platinum and palladium bullion.

Best Time to Sell Gold

At a time when gold and silver continue to increase their importance, selling your precious metals can become an extremely smart choice. If you are looking for a buyer, you have just found us!

Our team of experts is ready to support you during the selling process, answering your questions, and working with clarity so you feel comfortable and informed throughout the process. We invite you to contact us directly to learn more about our services and then encourage you to decide for yourself.

Take advantage of the high price of gold and silver and sell bullion to Gold Smart today.

Thank You, Dear Customers!

This post is dedicated to all our fantastic customers and friends who have sold their gold and/or silver items to us. We greatly appreciate your business as well as the many testimonials we have received. This truly means a lot to us.

Years ago, we recognised a need for people to be able to swap their unworn jewellery for money that they could put to good use elsewhere. The options were limited, selling online and having strange people turn up at your door, or dealing with pawn shops and loan sharks…

We thought: why not create a professional, safe, and friendly alternative with low overheads that enables us to pay top rates for gold and silver…a business where the customer wins, and they are pleased to tell their friends?

The Birth of Gold Smart

…Gold Smart was born.

Today, years later we are constantly looking for ways to provide an even better service, and improving our customer’s experience when selling gold.

Call us today and join the thousands of people who have sold their gold and/or silver (and palladium or platinum) to Gold Smart, and were happy that they did.

Those who buy and sell jewellery often hear the descriptors of “antique” and “vintage” used in place of one another as if they mean the same thing. There are substantive differences between these two types of jewellery. Both types often have considerably value yet there are nuances between the two varieties that we highlight below.

Vintage Jewellery

Vintage jewellery lacks a highly specific definition of antique jewellery. In general, jewellery experts and gold buyers New Zealand consider vintage jewellery to be a piece that is at least two decades old. This is precisely why so many pieces of jewellery are considered vintage as well as antique.

Timepieces from eras and periods of time when certain figureheads and cultures strongly had a strong society-wide influence qualify as vintage jewellery. These eras are as follows:

- Vintage retro (sometimes referred to as Post-War) period: 1945 to 1960

- Art Deco period: 1915 to 1935

- Art Nouveau period: 1895 to 1915

- Edwardian period: 1901 to 1910

- Victorian period: 1837 to 1901

- Georgian period: 1714 to 1837

Antique Jewellery

The primary way to distinguish antique jewellery from vintage jewellery is that antique jewellery is at least a century old. These pieces are further segmented into the time periods outlined above.

Estate Jewellery

Oftentimes, industry veterans use the term “estate jewellery” to refer to pieces that were previously owned and from any of the previously mentioned eras. However, some jewellery aficionados are adamant that estate jewellery is limited to pieces made in the last three decades. In general, jewellery labelled as “estate” is a second-hand piece.

Why Age Is So Important

Part of the reason why antique and vintage pieces are so coveted is that they make use of metals and objects of considerable beauty and rarity. Yet many of those looking to sell jewellery question what, exactly, makes their piece so rare or special. For many pieces, the mere fact that it is old and still intact is a major component of its high value. Plenty of older pieces of jewellery were crafted with goldsmithing techniques that jewellers and collectors favour over today’s methods.

It is also important to note that as we progress through time, a growing number of older pieces of jewellery are lost. As a result, older pieces are much more likely to be rare and consequently, more valuable. Another factor is whether certain rare materials were used in the creation of the piece. Examples of such rare materials include lucite, bakelite, ceramic, and wood.

Gold Smart is the Best Place to Sell Any Type of Gold

Gold Smart is interested in your gold, whether it is in the form of coins, bullion, jewellery, or scrap gold. We are willing to pay cash for your gold, silver, platinum, and palladium. Our precious metal appraisals are typically equal to or higher than other gold buyers throughout New Zealand as well as across the globe.

Contact one of our friendly customer service representatives today to learn more about our cash offers for precious metals.

The British Guinea represents both a collectible coin as well as gold bullion asset, which makes it potentially twice as valuable, depending on the coin year, grade, condition and ownership. Gold Guineas represent an optional pursuit of precious metal investment which have the added flavor of numismatic appeal as well. So, rather than just focusing on a base gold investment alone, one can make their financial holding a bit of a hobby as well. That said, the rest of the finance world is well aware of the value of gold Guineas, and they are priced accordingly in various markets. However, occasionally one pops up in common private transactions, the most common of which tend to be estate sales and inheritances. And that’s when things get really interesting.

Historical Background

The British Guinea came about starting in 1663. The coin and distinct form were issued by British government mints for almost 151 years ending in 1814 (ironically right after the War of 1812 which probably sapped a good amount of the British sovereign gold to pay for its recent military activities across the pond). Each coin was measured and minted to include one fourth or a quarter of an ounce of pure gold. The name, however, had nothing to do with the British Isles. Instead, it was an identification of where much of the sovereign gold was being sourced from in West Africa.

Another unique historical aspect of the Guinea comes in the fact that it was the first gold coin the British government issued that was entirely manufactured or struck by mechanical means. The original price was suppose to stay at one English pound sterling, but that didn’t hold for very long. Differences in values between gold and silver quickly caused variations, bouncing from a low of 20 shillings to as much as 50 percent higher at 30 shillings over the long life of the Guinea series.

The beginning of the downfall for the gold Guinea came in the British government’s shift to a gold standard backing paper money. By this point, the Guinea had already become a bit of a collector coin versus a regularly circulated currency. Ironically, its name was still being used in the accounting arena as well as in professional circles such as medicine and law and horse-racing.

Various Forms of the British Guinea

When it comes to buying gold Guineas or selling them to liquidate and receive a return on an investment, it’s important to understand that the gold value plus the time and collectability of the coin will all influence its final value for sale.

The Charles II Series

The first series of Guinea coins produce an obvious and distinct character with the profile of King Charles II on them. These coins ran from 1631 to 1700, with one side presenting an image of a wreathed Charles II, and the other side showing four shields representing the three countries of the United Kingdom as well as France.

The James II Series

By 1685, James II was now the primary title, and the Guinea coin had changed dramatically. Gone was the wreathed profile of Charles II and the four shields on the obverse side, only to be replaced with James II’s profile as well as an elephant and castle mark on some coins and others without it. These coins had a very short mint window, being replaced by 1688. It may have had something to do with the Glorious Revolution. James II did not lose his head as some rumors portrayed; instead, he died in exile after losing a battle to William of Orange.

The William & Mary Series

James the II was now out and the new monarchs, Prince William of Orange and his queen (James II’s daughter) Mary were now on the coin profile. The two appear side by side on one part of the coin, and the obverse side of the Guinea has a large shield emblem with four sections, each bearing the arms of England, Scotland, Ireland and France. This motif and coin series ran from 1689 to about 1694. Smallpox then took its toll on Mary, and William III was left to reign alone. Mary’s death triggered a modification to the gold Guinea that ran from 1695 to 1701 with only William’s face on the coins rather than both him and Mary.

The Queen Anne Series

Following William III’s reign, Queen Anne then took over and a respective gold coin was stamped and produced for her, running from 1702 until 1714. It was during this period and particularly in 1707 that the Guinea went through a major change noted on the coin’s design. With Great Britain actually formalized for the first time, consolidating Scotland and England, the British Guinea was modified accordingly. The four-country logos on the opposite side of the coin from the monarch’s profile changed and France was dropped. Instead, the shield emblem now represented England, and Scotland, and representations of Ireland and France became buried in minor symbology. These coins also included the highest content of gold produced yet in a Guinea, with a 0.9134 purity.

The George I Series

The coin reflecting King George I’s reign only lasted a short 13 years, running from 1714 to 1727. In this version the king’s profile once again takes up one side of the coin, and the obverse side of the Guinea has the country’s emblems on it. Interestingly, this run of gold Guineas included five different versions of the king’s profile or portrait during his tenure.

The George II Series

The next monarch to achieve coin reflection status triggered another significant change to the gold Guinea. King George II’s tenure ran for a lengthy 33 years, and his coins were available and minted for all but four years during that period. The purity level was generally about the same as earlier.

The George III Series

The next monarch being George III, his coin also retained the higher purity level of before, 0.9146, with the monarch’s portrait on one side and the shield emblem on the other reflecting the arms of England, Scotland, France and Ireland as well as newcomer, Hanover. It was during George III’s tenure that the spade-shaped shield emblem was introduced, triggering the nickname, the “spade guinea.” This phase was also a major destructor of the coinage past. It is estimated that at least 20 million gold Guinea coins worn down from earlier periods, mostly William and Anne’s reign, were slagged and remolded into new issue coins as part of the King George III series. It was by this time as well, near 1799 and 1800, that gold was in short supply. However, yet another half Guinea was issued in 1808, and by 1813 a slew of new gold coins had to be minted again. Why? Armies need to be paid when they march, and the Duke of Wellington was busy fighting a war against Napoleon with soldiers who were only going to march with coin in their pockets. Finally, 1816 arrived and the gold Guinea was finally put to rest, unceremoniously replaced by the British Pound and the new gold standard.

The 2013 Reissue

To commemorate the long history of the historical Guinea gold coin in all its phases, the British Royal Mint issued a new, 2013 two Pound coin recognizing 350 years since the creation of the first gold Guinea sovereign coin. This commemorative coin included a spade Guinea design on the emblem side, as well as famous quote from Stephen Kemble on the edge of the coin.

What to Expect for a Gold Guinea Today & How to Sell Gold Guinea Coins

The gold Guinea is not going to achieve or be on par with some of the major sovereign bullion coins today like the South African Krugerrand or the Canadian Maple Leaf, however, the gold British Guinea is no slouch either. It’s gold content includes a very specific value of 22 karat purity that embodies a hefty 8.3 grams of weight. Scoring at a perfect 25 percent of a Troy ounce today, a basic Guinea coin, without considering its collectability value, will easily be worth $683.88 NZ dollars ($472.5 USD). Those interested in selling should note that because gold British Guineas have a lot of variation, the size of the coin also comes in various price amounts as well. Half-Guineas, Third-Guineas and Quarter-Guineas were all minted with 22 karat gold, so the variation tends to be simply a fraction of a whole Guinea and its value versus a Troy ounce.

When selling a historical gold coin or a collection of old gold coins, British Guineas will need to be tested. While they are, technically, sovereign bullion coins, the last production finished some 204 years ago. They don’t have a current standard available anymore. That leaves a lot of room for potential fraud which, believe it or not, is on the rise in 2020. Some of the most amazing fakes involve intricate work to replicate older gold coins and in fact have turned out to be gold-plated bronze, copper or zinc fakes. Many are just hitting the market in recent years due to advances in technology that didn’t exist just 10 years ago. To insure that what is being sold is in fact an authentic gold coin, professional buyers will verify the year and series of the coin, its weight, its gold metal nature and chemical response. Private sellers should not be alarmed or offended by these procedures. There are a lot of fakes and attempts at fraud circulating in the private market online like eBay and similar, particularly with older coins like the Guinea and earlier. So, validating a purchase is standard procedure for any gold buyer dealership that knows its industry well.

Remember, the gold Guinea coin value offered is going to vary depending on whom a private seller is working with. A bullion gold buyer is going to focus on the gold content and weight of the coin and offer pricing consistent with the current spot price for gold as well as a discount for buying. They will not price in any numismatic value of the coin, regardless of which year or series the particular Guinea was part of. If one wants to achieve a sale for a coin that includes both its gold intrinsic value as well as coin collectability, then he or she should be working with a numismatic coin dealer instead. Their market will be far more aligned with the coin collectability side as well as the demand for such coins for historical and rarity value.

The above said, there has been a rise in the gold Guinea worth both for the gold content value alone as well as for the collectability of the gold coins UK rarities. Both aspects have seen significant demand price increases in the last few years, which bodes well for sellers of all types who are looking to liquidate the gold Guineas they have on hand.

Extra Baggage from the Government

Many wonder if selling a gold Guinea is a smart idea when it comes to personal taxes. After all, in the high number of cases, people end up with these historical gold coins through estate sales or inheritance as mentioned earlier. So, receiving such a coin and then selling it logically seems like a 100 percent profit absent any shipping costs involved. Does New Zealand tax the private sales of British Guinea coins? Known as capital gains tax or goods and sales tax in the accounting world, New Zealand generally only applies a goods and services tax (GST) on coin transactions where the seller regularly sells those goods and services. So, for the private seller selling a windfall from an inheritance, the GST levy would probably not apply. However, if the private seller is a collector who traffics, buys and sells coins on a regular basis, then the GST could apply. The best way to know is the read the details directly from the New Zealand government or to consult with a tax adviser on the same.

How to Sell a Gold Guinea Safe & Reliably

If you find yourself in the opportune situation of receiving gold Guineas you wish to liquidate, or you wish to pare down an existing collection, GoldSmart can help. Our professional buying team provides a no-pressure, safe environment where we can objectively value your coins and provide you a fair offer based on the current gold market for repurchase, including historical sovereign coins. Many worry that while they know they can sell a gold coin easily, the party they deal with may try to pull a fast one. GoldSmart has never opted for these kinds of unscrupulous business practices. We maintain a high quality professional approach always. Our buyers are fully trained and will never pressure any potential seller into a sale he or she is not comfortable with. In fact, we’d rather educate a person on what they have in terms of coinage, gold value and history and build a relationship for the future than resort to a higher pressure tactic. So, if you have gold Guineas you wish to sell comfortably give us a call or email, and we can arrange an appointment that works best for you.

If you live in or near Tauranga and you have gold you would like to sell, you are in the catbird’s seat. The value of gold has steadily increased in recent months due to worldwide economic uncertainty. Selling gold is an excellent way to make some extra money within the confines of the law. Let’s take a look at a few gold-selling tips that will help you get the best price for your stash.

You Might Have Gold in Places You Have not Considered

Gold is used in a variety of consumer goods and luxury items. If you own earrings, pendants, charms, or even broken chains, you probably have at least a small amount of scrap gold on your hands. Most of us grow tired of our old pieces of jewellery and end up passing them down to someone in the family or putting them up for sale.

Today’s gold prices make it awfully tempting to sell. Gold Smart is interested in all of your old pieces of jewellery and other items with gold. We will weigh them, test them, and provide a fair quote on-the-spot.

Gold Hunting can pay off Big-Time

If you have a passion for uncovering hidden items, gold hunting is right up your alley. Hop on the web’s gold hunting message boards and you will be able to get an idea as to whether one of the streams, creeks, or rivers in your town has gold running through its waters. If you find gold in your Tauranga neighbourhood or anywhere else, bring it to Gold Smart.

We are even willing to make an offer on the smallest gold nuggets you uncover. Give gold hunting a chance and you will find it to be a fun activity that generates real money and gets you outside for some exercise. Bear in mind that you might need a permit in order to dig for gold and other precious metals that are not on your property.

Gold Coins

Those who are in the coin collecting business know that gold coins are worth a pretty penny. If you own a gold coin or a multitude of gold coins, you should not hesitate to bring them in for on-site analysis and quote. Gold coin prices differ according to all sorts of factors like age, make, rarity, and condition. We are also interested in your silver and platinum coins as well.

It is Time to Bust out the Silver

Though most do not know it, plenty of household items are made with silver. If you find any item that is marked with “.999”, it is made with silver that can net you a tidy sum of cash. Anything from silverware to cups and baby spoons has the potential to generate good money. Bring all of your silver items into Gold Smart. We will weigh them, test them, and provide you with a no-cost quote that you will find to be quite competitive.

Consider the Value of Your Dental Gold

Though few are aware of it, those old gold fillings in our mouths have the potential to generate a quick influx of cash. If you are a dentist or have an abundance of gold fillings in your mouth, you are literally sitting on a gold mine. Selling your dental gold stash is a fantastic way to earn some extra money. Just make sure to have the dental gold removed from your teeth before trying to sell them.

Are you considering selling gold in New Zealand? Perhaps you know someone who has gold bars or gold coins and would like to turn these items into money in a day’s time. Anyone looking for a trusted merchant to sell gold coins or sell gold bars in Auckland has found the right place in Gold Smart. We are interested in gold coins and gold bars of every variety.

We Will Bid on Gold in Every Condition

Give us a chance to look at your gold and we will assess its value, provide a quote, and give you the chance to walk out with a wad of cash. You can consider our offer, come back in the future, or bring in another piece or a full collection for analysis. We are the flexible gold buyers Auckland team you have been looking for.

It does not matter if your gold is in terrible condition or excellent shape. We are interested in your gold coins and gold bars regardless of their condition. So, don’t worry about those scrapes, blemishes, scuffs, and other imperfections. There is a good chance we will make a bid on your gold and you will walk out with the money you need.

Turn Gold into Cash Without Delay

Our team is here to assess your gold, make an informed offer, and help you leave with the most money possible. This is the quickest and best way to turn old and unused gold into cold hard cash. So, bring your gold bars and gold coins on in for an evaluation and walk on out with your pockets full of money that you can use for new investments, a night out on the town, a vacation, or anything else you have your heart set on.

Examples of What We Buy

When it comes to gold bars and gold coins, we are interested in paying cash for just about every variety. Bring on in your South African Krugerrands, Perth Mint Gold Kangaroos, Chinese Gold Pandas, Gold Kiwi Bullion Coins, Mexican Peso Gold Bullion, and coins of all other varieties. As long as they are gold, we are interested in buying them. We want your cash bars, gold minted bars, and bars of all other gold varieties. Schedule an appointment, bring them to Gold Smart for a quote and you can walk out with pockets full of cash.

Have Gold to Sell? Contact Gold Smart Today

If you have gold coins, gold bars, or gold of any other variety and are considering selling, we are the Auckland buyers you have been looking for. Contact us to schedule an appointment so we can prepare for your arrival and gold assessment. Let us take a look at your gold coins, gold bars, and other varieties of gold.

We will provide a quote and you can be on your way with a nice wad of cash. Contact us today to learn more. You can call us by dialing 0800 465 376. You can also reach us by email at anita@goldsmart.co.nz or, use our website’s free Live Chat support feature to learn more.

If anyone in your family has passed away, you and your loved ones will be tasked with deciding whether to sell or keep the valuables from your relative’s estate. Gold jewellery and other gold items have considerable value even if they are decades or centuries old. There is no reason to keep these items around any longer when you can sell them for cash in as little as a day’s time. Selling estate jewellery is easier than most think. Gold Smart is here to turn that old, dusty gold jewellery into cash that will make your life easier for years to come.

Sell Estate Gold to Gold Smart as Opposed to an Auction House

Sell gold estate jewellery to Gold Smart and you won’t have to go to the trouble of attempting to sell these valuables at an auction. It is an awful hassle to sell gold jewellery and other estate gold items at auction houses. In many cases, customers are not allowed to sell gold items at auctions as reserves are typically the gold value to start with. Auction houses claim they can provide the highest prices for gold jewellery from estates, other gold items, and other pieces of value.

The truth of the matter is most of those who bid at auctions are not willing to pay a penny more than the gold value of the item in question. In some cases, gold jewellery from estates does not receive a single bid. This is the nightmare scenario Gold Smart will help you avoid.

Though auction houses certainly serve a purpose for some relatives of decedents, an auction transaction that proves mutually beneficial to the seller and buyer is becoming increasingly rare. If you have an extremely unique item, a highly valuable antique, or other rare pieces, it might make sense to bring it to the auction. However, those who understand the dynamics of the precious metals market, estate sales, and auctions are adamant the best option is to make a beeline to a trusted precious metals dealer such as Gold Smart.

Gold Smart Simplifies Estate Jewellery Sales

Gold Smart takes an alternative approach to buying gold from estates. Do business with our precious metals experts and you won’t have to deal with the many challenges of selling at auctions. Gold Smart purchases gold according to its gold content. There is no need to research local auctions, obtain assistance in selling estate gold, and invest an abundance of time hoping someone makes a reasonable offer. We make gold selling quick and easy, so you can move on with life.

Fair Prices for Estate Gold

Gold Smart refuses to turn customers away simply because their estate gold is outdated, faded, marred or damaged in any other way. We are interested in buying any type of item you have as long as it contains gold. There is no shame in not knowing the full value of your gold items. You may have been inundated with an abundance of gold pieces following your relative’s passing. Perhaps you have not owned gold jewellery, coins, bullion, or other precious metals in the past.

Gold Smart’s precious metals aficionados are here to assess all of your gold pieces, determine their true value, and make a fair offer. We are New Zealand’s most reputable gold buyer for good reason: we let the customer make decisions without applying sales pressure. You will feel completely comfortable in our presence from the moment you contact us to schedule an appointment to the moment you walk out of our doors with a pocketful of money.

Gold Smart is Ready to buy Your Estate Gold Jewellery

Contact Gold Smart before attempting to sell the gold items from your relative’s estate. Give us a call at 0800 465 376 to schedule an appraisal of your gold jewellery and other gold pieces. Whether you have a couple of pieces from the estate in question or dozens, our team is here to perform an honest assessment and send you home with a wad of cash.

You can even reach out to us online by filling out our convenient contact form or clicking “Live chat now” in the upper right corner of our contact page.

The summer is here and that means it is time for some decluttering. If you are like most people, you have acquired an abundance of sundries, many of which you no longer use. Don’t feel bad about these extra items. Just about everyone holds onto possessions thinking they will obtain some utility out of them at some point down the line.

It is time to perform an intake and analysis of all these items now that the warm weather is here. Start out by whittling down your jewellery collection.

Declutter Your Gold Jewellery Collection

There is a good chance you have some old gold jewellery that you no longer use. Instead of keeping it in storage and allowing it to collect dust, consider selling it. Your old gold jewellery really is worth good money. Whether it is a gold earring, gold necklace, gold ring, or other pieces of gold jewellery, it represents cash. Even the smallest piece of gold jewellery will fetch some money. Though the piece might not be resold in its original form, it still has solid value thanks to its gold content.

How to Approach the Rest of the Decluttering Process

Decluttering your entire home will take some time. Start off with a small decluttering project like the gold jewellery one described above. Consider devoting an hour each night for a week so you can attack one room or section of your home at a time. As you declutter, separate items into four different piles. The first is a “sell” pile. The second is a “donate” pile. The third is a “keep” pile. The final pile is for items that should be trashed. If your items have any sort of value, do not put them in the “trash” pile. When in doubt, try to sell or donate your extra items to make some extra money or out someone in need.

The Power of Decluttering

Once you have decluttered your old gold jewellery and other items, you will feel an overwhelming sense of peace. You will have an abundance of open space, plenty of extra money, and the joy that comes from eliminating excesses. You will also feel a sense of relief to boot. It is awfully refreshing to get rid of those extra items that you no longer use.

Furthermore, selling your old gold jewellery will fatten your pockets with some much-needed cash that you can spend on new experiences, save for a rainy day, or invest. This really is a cleansing process that will get you on the right path for the summer.

Gold Smart Wants Your Old Gold Jewellery

Gold Smart is ready and willing to pay for your old gold jewellery. Analyse your gold jewellery collection, figure out which pieces you no longer desire and we will give you a quote on the double. The end result will be an influx of cash, more open space, and a calming peace of mind.

Contact Gold Smart today to learn more about how you can sell your gold jewellery, gold coins, bullion, silver, and platinum.

Timeless Beauty of Gold Watches

Men and women alike have always had a love affair with fine timepieces. When it comes to watches, there’s something about gold watches in general that really appeals to most people. The gold itself is very attractive, of course, and the weight of the fine gold watch on your wrist lets you know that not only can you tell time accurately but also that you have something that’s been crafted beautifully and can be handed down from one generation to the next.

Watch Out for Counterfeit Gold Watches

There is one problem with gold watches, however, especially some of the top-line gold watches like Rolex, in that there is a very large market for counterfeit gold watches. Not only does this make it difficult for buyers who are seeking to find a fine gold watch at a bargain price but can also be a problem for those who wish to sell their gold watch and use the money to pay down debt, start a small business or otherwise need quick cash.

Indeed, it can be a very nasty surprise to find out that the “valuable” gold watch they have is actually a forgery made from lesser metals or is gold-plated. The fact is however that the technology exists today to make counterfeit gold watches so well that it takes special equipment in order to confirm and/or refute their authenticity.

Check if Your Watch is Authentic Gold

What that means for you, the consumer who’s looking to sell your gold watch is that you need to first determine if your watch is (hopefully) an authentic gold watch.

One of the best authorities in the world on gold watches is the Swiss Customs Service. They advise that even if you pay a very high price for your gold watch it doesn’t guarantee that it’s authentic, and neither does any indication of “fineness” that you might find on your watch. They also cautioned that “hallmarks” can be easily forged these days and that many consumers have purchased a gold watch because of the hallmark, only to find that it’s a cheaper, gold plated copy. (They also go on to say that there are legitimately produced gold plated watches, but if you believe that yours is solid gold you are still being deceived.)

You can actually be the owner of an authentic solid gold watch even if it doesn’t have a hallmark. For example, in the United States, a jeweller must actually have what’s called a “makers mark” in order to also put a hallmark on any pieces that they design.

Even for the most experienced of jewellers it’s practically impossible to simply look at a gold watch and help deduce whether it’s solid gold or not. That’s why most jewellers have simple tools that they can use in order to make sure, including something called nitric acid which doesn’t react to gold but does react to other, cheaper base metals. Similar testing needs to also be performed in order to determine what “karat” that the gold your gold watch is made from happens to be. (The hallmark usually shows this as 10k, 14k, 18k, etc.)

We Buy Solid Gold Watches for Excellent Prices

Here at Gold Smart, we purchase only solid gold watches and we pay excellent prices for them. When you sell your watch to Gold Smart you can rest assured that we’ll tell you exactly what it is worth and give you an extremely fair and competitive price for your timepiece. In fact, we urge all of our customers to first go online and Google our name. What you’ll find is a high volume of excellent reviews from our customers showing that we indeed do take good care of them.

So if you need to cash fast and you’d like to sell your gold watch, no matter what brand it happens to me, give us a call, and let’s talk. We’ll give you straightforward, honest advice and, if you like what you hear, we’ll give you an excellent price for your gold watch.