Just like with any other precious metal, there is a difference between quality versions of silver. There can be low-grade junk silver as well as high quality, fine purity silver. Understanding the difference helps avoid precious metal investing mistakes that can be common. For example, just because someone gets their hands on a silver American dime or quarter doesn’t mean they can then measure it against the spot market value of silver. Unlike the Sterling silver that the spot market is based on, the silver used in many American coins is definitively junk silver, mixed with other metals. If one is lucky, the coins are about 80 percent industrial silver. Ergo the easy confusion people can get into when trying to find silver coins for value protection.

Sterling Silver Notations and Hallmarks

Sterling silver represents a high-grade quality level of silver often used in jewellery, fine dining tableware, and government mint coin and bullion bar issues. Coded with the word “Sterling,” or the code “925”, these pieces or bullion forms are made with a silver content that is over 92 percent pure. A bit of other metal is mixed in for strength and durability, usually in the form of copper, nickel or zinc. Otherwise, the 100 percent pure silver version would be highly fragile, easy to bend and dent, as well as break. Because this quality level provides a combined benefit of high gloss, metal-free of contaminants and worth, 925 silver is regularly used for jewellery production. The strength also allows for easy workmanship because the mixture can handle reheating and folding. Pure silver does not do so well in the annealing process, often becoming fragile at the molecular level.

However, another factor that folks have to consider with silver is that no matter how high the quality, it will dull with age and no polishing. This is simply part of the oxidation effect that starts to impact the minor amount of other metals mixed into Sterling silver. Lower quality silver sees it to an even greater degree with higher amounts of other metals involved.

How to Identify Junk Silver

Note, junk silver will sell, but just not for as much in recycling prices. Where did junk silver come from? Generally, generally governments were still using precious metals in the form of silver for coin and value representation in their currency. This practice dates back centuries. However, unlike the earlier years, by the time coin currency reached the 20th century, the production was highly contaminated with cheaper metals becoming a greater and greater portion of the mixture. There simply wasn’t enough silver going around to meet demand without being costly. And cheaper metals visually mixed in just fine with silver for the general appearance. So, nickel and zinc started becoming a go-to metal additive, and eventually, silver was phased out of currency coins altogether. Many governments stopped using precious metals in coins by the 1950s and 1960s.

Extremely Fine Silver

In high-quality jewellery, the silver content is beyond that of Sterling and reaches an almost 100 percent quality level. Know in the industry as 999 or three-nines, fine jewellery silver has an amazing lustre but it is also very fragile and can break easily. The purity level makes it almost impossible to work with this silver more than once, and most jewellery forms are poured and finalized in casting as a result. No surprise, this kind of silver is only used in mint-issued bullion for collecting purposes and necklaces, bracelets or earrings that don’t require stress or durability to wear. These pieces can be easily scratched as well. On the other hand, high-purity silver doesn’t dull or corrode and maintains its gloss and shine for years upon years without change.

Given the nature of fine silver and its reputation, this kind of precious metal in jewellery form tends to be marked up heavily by the jewellery industry, often far more than the metal is actually worth even on the spot market. Anyone buying fine silver for the purposes of investment or expecting a big return from silver jewellery is going to be in for a rude surprise, realizing too late that the money spent was pure profit overhead and had nothing to do with the actual value of the metal sold, even in crafted form.

Gold Smart Is Interested in a Wide Array of Silver Choices and Inventory

Being one of New Zealand’s premier buyers of silver and gold bullion products, Gold Smart is interested in even the most obscure demands for bullion silver purchasing. Gold Smart provides access for Kiwi personal sellers to one of the most outstanding channels for selling silver bullion. Additionally, we also take in a heavy inventory of American and Canadian silver bullion coins as well as a robust inventory of larger bullion bars as well.

Granted, there are other avenues for selling silver in New Zealand, but we can probably argue that Gold Smart is one of the safest and most reliable in the market. Unlike the risk one takes with selling silver online through auction sites and private parties, we can guarantee the quality of our services every time. You won’t be dealing with any nonsense regarding unknown buyers that promise one thing and losing your silver instead. Remember, there is an incredible amount of fraud online, and hundreds of parties are working auction sites looking for folks to separate from their silver with fake electronic payments and no real purchases at all. Once your silver goes online and out of the country, it’s practically impossible to recover.

Gold Smart also provides Kiwi sellers with a very reliable and dependable online selling system. Products are picked up from your door via secure courier without any question on delivery or safety while in transit. Our customers are so happy with the digital Gold Smart selling experience, some comment on how they mentally kick themselves for not having used Gold Smart sooner. While we don’t wish that frustration on anyone, it is very understandable given how dedicated we are to our customers’ experience when selling gold or silver.

When it comes to brand name jewellery and any type of piece containing gold or silver, Gold Smart is not picky. To be blunt, we do not give one iota if your jewellery is made by a popular or coveted brand. We are primarily looking for pieces with significant metal content. Gold Smart is on the prowl for jewellery that contains meaningful metal weight in grams and pieces of high purity as measured by carats. We are interested in all of your metal pieces but for gemstones (diamonds).

Background on the Jewellery Appraisal Process

If you are looking to get some quick cash for your jewellery, you might feel a little bit intimidated by the jewellery appraisal process. Don’t feel uneasy as there is absolutely nothing to fear. It is perfectly acceptable to be unsure about the value of your jewellery collection. Be aware of the fact that brand names do not always carry their own weight during the appraisal process and you likely won’t be disappointed by the outcome of the appraisal. Let’s take a look at the many different factors that affect jewellery value.

Piece Quality

The main distinction between jewellery makers of yesteryear and those in business today is the fact that modern jewellery tends to have much more diversity in terms of manufactured stones. The biggest names in today’s jewellery business produce a low-cost line of pieces that the typical consumer can afford. As long as the piece is a part of a low-cost budget line, the odds of a brand name playing a meaningful part in determining its value are quite low.

Certificates

Plenty of jewellers provide certificates of authenticity for pieces purchased within their stores. Unfortunately, a growing number of online merchants are making a quick buck by replicating these certificates and selling them on the web. Some are even going as far as forging jewellery and selling them as if they are legitimate pieces. This is why customers should hesitate to put their faith in the authenticity of second-hand pieces and second-hand certificates. In general, those who buy and sell jewellery do not put much stock in these certificates. Even if the certificate is real, it simply serves to verify that the piece was purchased at a particular store. The certificate does not actually add value to jewellery that is not in demand.

Antiques

Certain brand names will have a measurable impact on a piece’s value but only if it is an antique. Select brand names have a historical value in accordance with the time period that they were in demand. Yet the majority of jewellery owners do not own these types of pieces. As a result, the presence of a brand name is rarely a contributing factor to the piece’s true value. The truth is that a large portion of the most popular brand names are still in business today and generating new pieces as time progresses. The bottom line is that few people own jewellery that is of true historical significance. This statement applies to the vast majority of pieces that have been passed down from great grandparents and beyond.

Cut, Clarity and Size

A piece’s value is primarily determined by the weight and size of the materials relied upon for its creation. Even if a highly-coveted brand name has been engraved on a piece, the producer’s namesake won’t play a major role in determining its value. The jewellery appraisal process keys in on the piece’s diamond cut, clarity and size as well as the legitimacy of their source. Gold Smart does not purchase gemstones yet we are interested in pieces that contain precious metals. If your piece has the precious metal we are looking for and their true physical weight is significant, it will spike the appraisal value.

Conclusion

It is best to think of jewellery brand names as a status symbol that people gravitate toward in order to impress their social circle or feel better about their purchase. The bottom line is that it is quite rare for a brand name to add significant value to a piece of jewellery. This is primarily due to the fact that the vast majority of contemporary jewellery makers sell pieces in a wide range of prices so that the average consumer can afford a low-level piece. What matters most to gold buyers like Gold Smart in the context of jewellery value is a piece’s metal. Contact us today if you are interested in selling your jewellery or selling gold for cash.

When it comes to selling gold in New Zealand, most people are unsure as to where they should start. The best place to sell gold is not always a brick-and-mortar store. Rather, online outlets like Gold Smart tend to have excellent prices thanks to their courier pack system that services customers across New Zealand. You’ll be sent a pre-paid courier pack that you can load up with your gold and send in for payment. Our Mail-Away Service is operational in Wellington as well as anywhere else in New Zealand. Alternatively, if you are in Auckland, you can meet us in person.

Follow These Tips to Get the Most Cash for Your Gold

Bringing your gold to a gold party or any old neighborhood jewellery store won’t guarantee that you will receive a fair dollar for your stash. Even though many will offer cash on the spot, it is not worth parting ways with your gold unless you are sure that you are getting an accurate quote. Begin by studying gold’s price and measurement so you have the basics of gold buying/selling down pat.

Mind the Scales

Gold’s weight is the main driver of its value. However, some jewellers use unique measurement standards like grams, troy ounce, and pennyweight. U.S. scales show that an ounce is equal to 28 grams. Just be sure that the dealer you do business with pays you according to the proper unit.

Karats Count

Pure gold is so soft that it can’t be used in a practical manner by itself. It must be combined with other metals to generate something that is long-lasting. This is why the gold we wear is 14k or 18k. Each piece of jewellery has a stamp that shows its alloy, whether it is 10k, 14k, 22k gold, or .999 silver. Karats indicate the gold content. The higher the karat, the more gold is present. Each pile of gold is weighed by the karat and the ensuing payout is based on the market value of the karat amount.

Segregate Karats

Be sure to have jewellery with similar karat values be weighed in groups. This way, you won’t be paid for your lowest karat value. Trustworthy gold dealers will test your gold and pay you according to the individual weights of each gold pile.

Gold Parties Don’t Always Bring the Best Price

Don’t get your hopes up thinking that a gold party will bring a big profit. Gold parties tend to yield around three-quarters of gold’s real value in terms of item per karat weight.

Gauge the Value

Be sure to know the value of your gold before selling. Do not be afraid to check with a secondary source just for a second opinion.

Identify What You Have for Sale

Make sure you know exactly what you have for sale. If it is something with a brand name that you paid extra for, the value might not be carried forth and reflected in your final sale price. This is due to the fact that gold buying companies typically pay by the karat weight instead of visual appeal, brand name, or sentimental value. The piece might even be worth more when melted down. So do your homework and give some consideration to having an independent appraiser check out your item(s) and provide advice beforehand.

Take a Look at More Than one Offer

It doesn’t hurt to get an appraisal or offer from other gold buying companies. The educated consumer stands a better chance at maximizing his profit than customers who perform little to no research. Quote estimates can be obtained for free. If you believe that a certain piece’s artistic style or workmanship makes it worth much more than its value in weight, have it appraised.

Get an Understanding of the Buyer

If you look close enough, you’ll see all sorts of ads for appraisers or precious metal dealers who want your gold. Do not do business with the “pop-up” style buyers who will only be around for a short period of time. They might not even be licensed. So do some homework on your end before entering into a business relationship. Check out candidates’ licensing and standing with the Better Business Bureau (BBB) before proceeding.

Plenty of economic and investment prognosticators believe gold’s value will either stagnate or decrease in the near future and possibly even across posterity. Yet there are also some analysts who believe gold will continue to climb in value throughout the remainder of 2016 and beyond. Perhaps the truth lies somewhere in between these opinion extremes. Let’s take a look at why selling gold to gold buyers Auckland in the next weeks and months might prove to be a savvy decision.

The Recent Rise of Gold

The value of gold recently reached a two-year high thanks to the Brexit fallout. Investors panicked after the Brexit news broke and poured a massive amount of cash into gold. The logic behind this cash migration to gold goes like this: Gold is widely thought of as a safe-haven throughout investor circles. It is highly unlikely that the value of gold will suffer a dramatic drop in the short or long-term so investors tend to dump their cash into this precious metal when economic or political uncertainty occurs.

The fact that the United States government bond yields recently reached an all-time low has also fuelled the renewed interest in gold. The precious metal’s recent boost can even be partially attributed to comments made by the President of the New York Federal Reserve, William Dudley. He indicated the central bank might exercise prolonged patience when it comes to considering an interest rate hike. These comments were made in light of growing economic volatility and low inflation in the United States.

An Expert’s Opinion

If you put any faith in Credit Suisse’s investment aficionados, selling your gold to gold buyers Auckland right now is a prudent decision. One of the firm’s revered investment strategists, Jack Siu, went public with his thoughts about the value of gold last week. He stated that his fellow investment gurus at Credit Suisse have a neutral outlook for gold. Their three-month price target of $1,300 an ounce is less than the current value of gold.

Siu also commented that Credit Suisse’s investment gurus have a price target of a mere $1,150 per ounce over the next calendar year. Siu pointed to the weakness of the primary market and the precious metal’s dependency on investor interest as reasons why the precious metal might decrease in value in the short-term as well as the long-term.

A Selling Opportunity?

The fact that the value of gold rose so rapidly has tempted many investors to sell their gold in hopes that profit-taking will send the precious metal’s value right back down to its pre-Brexit levels. Others are tempted to sell as fears over Brexit subside and the EU develops a plan to proceed without the contributions of Great Britain. Yet the truth is that no one is exactly sure how much risk Brexit truly poses to the global economy.

If the dominos continue to fall and more countries like France eventually decide to exit the EU (Frexit, anyone?), it is likely that even more money will be invested in gold. However, additional EU exits are unlikely in the short-term. Furthermore, the Bank of England has taken action to ensure the country’s banks will continue to lend money in the post-Brexit era. It is clear that the Brits are doing everything they can to minimize economic volatility and general uncertainty. If everything settles down as anticipated, the value of gold might flatten out or even decrease.

The fact that the DOW reached an all-time high last week is a testament to investor certainty in the United States economy, the global economy, and the stability of the international political scene. Though the Turkish military appears to have launched a coup in an attempt to take over the country’s government, it is unlikely that this development will drastically boost investor uncertainty. When it comes to the value of gold, uncertainty is of the utmost importance. As long as the economic and political climates remain steady, it is possible that the value of gold will either level off or gradually decrease.

Now is the Best Time to Sell Gold

If the value of gold stagnates from here on forth, those who decide to sell their gold this winter will have played the market to perfection. It is certainly possible that today is the most opportune time to unload your gold collection. Imagine a scenario in which fat-cat gold investors take their profits off the table in the aftermath of the precious metal’s recent upswing and those who own gold bullion, jewellery, and other pieces also decide to sell.

If such a hypothetical scenario unfolds in the ensuing days, weeks, or months, you will have missed out on a fantastic opportunity to collect a tidy profit on your gold investment. This just might be the best time in the past couple of years and possibly the next couple of years to sell those old gold items you’ve been storing in your drawers, lockboxes, and safety deposit boxes.

Nowadays, it seems like you can’t go anywhere without someone soliciting you for your old jewellery. Whether you are at a shopping complex, on the world wide web, opening the mail or reading the newspaper, advertisements for old jewellery are seemingly ubiquitous. If you take the initiative to perform an Internet search for “selling old jewellery” or “buying old jewellery”, it would generate pages upon pages of relevant results. Plenty of new buyers have entered the old jewellery market in an attempt to capitalize on the spike in demand for gold. Furthermore, the typical New Zealander is willing to explore every possible money-making opportunity due to the fact that the economy is still sputtering. As a result, it has become a bit of a challenge to pinpoint a trustworthy old jewellery buyer.

An Overcrowded Market to say the Least

There are few barriers to entry when it comes to gold buying. All one has to do is comply with the Ministry of Justice’s standards, apply for a Second Hand Dealer’s certificate, create a website and launch promotional efforts. The problem with this modern day gold rush is that the surplus of prospective buyers creates a risky environment. When you do business with an organization that has a presence on the world wide web rather than a traditional brick and mortar store, you really do not know who is truly behind the scenes. Nor do you know whether the price offered is fair. If a snag were to arise, you would likely struggle in an attempt to obtain a timely resolution.

How You Should go About Selling Your Old Jewellery: Know Your Gold’s Value

Obtaining top dollar for your old gold jewellery has become a bit of a challenge for the reasons outlined above. However, sellers do have some power. It is critically important to know the true value of your jewellery collection as well as the value of each individual piece. Every potential seller should remain abreast of the current value of gold. You can visit www.mygold.co.nz on the world wide web for real-time updates of the price of gold. Or, check in with an esteemed buyer for an accurate price. The bottom line is that those who fail to understand the actual value of their old jewellery will likely end up selling it for much less than it is actually worth.

Carats are of Critical Importance

The average person has no idea about carats or the fact that pure gold is much too soft to serve any practical use. This is precisely why it is combined with several different metals in an effort to boost its aesthetic as well as its colour. Everyone who is interested in selling old jewellery should know that carats represent gold purity. As an example, 18 carats is twice the gold content/gram for gram value as 9 carats. Those interested in your old jewellery will only be willing to shell out money for the items’ gold component. The other metals have little-to-no value. Furthermore, you should not let jewellery that has different carat values be weighed at the same time. Separate each item so that they can be weighed in an individual manner. Beware of the fact that certain buyers will offer the lowest carat value out of your old jewellery collection, in the hope that you will not raise objections.

Understand What You Are Attempting to Sell

As a gold seller, you are paid for the value of your items’ gold. This is referred to as the jewellery’s “melted down value”. There are certain items that might hold more worth when sold in their current state. This is particularly true of some types of designer jewellery.

Consider the Buyer’s Merit

As noted above, the gold jewellery market has been somewhat flooded by buyers. Do your research on each prospective buyer before you make a deal? Consider their history, customer reviews and the number of years in business.

Don’t Set Your Hopes too High

The amount of money you are paid for your old jewellery is partially determined by the individual buyer’s overhead costs. Those who do not sell directly to a refiner should understand that they might not receive as much money as originally anticipated. Do not lose sight of the fact that you will be paying for the convenience of the transaction in the form of a reduced sales price. Consider each of these factors before making the decision to sell to a particular gold jewellery buyer.

Don’t Forget Your ID

Every gold buyer is legally required to view a seller’s identification. This identification must be verified before a sale can be completed. Furthermore, a copy of the seller’s identification must be made in case the old jewellery has some sort of previously unnoticed flaw or turns out to be a fake. Sellers are also required to sign sales documents, admitting that the possessions are genuinely their own as opposed to being stolen.

A Test Might Be Performed

Certain gold jewellery buyers will conduct an acid or scratch test of the jewellery before making an offer. This practice is commonplace. If you prefer that such a test not be conducted, shop around for a dealer who is willing to provide a quote without such a verification procedure.

Study the “Birdseed”

The “birdseed” is the sales agreement’s fine print. The devil really is in the details when it comes to selling your old jewellery. Take a close look at all of the terms and conditions, especially if you are using a mail away service. Always take digital photos of your old gold jewellery before sending it to the buyer. Be sure to keep all of the paperwork and make copies for posterity’s sake.

If you own gold coins, you should know that those little beauties can fetch quite the sum of money nowadays. Gold has gone up in value as time has progressed. Anyone who is thinking of selling gold coins should recognize the possibility that gold might be at or near its high for a while. This just might be the perfect time to sell gold coins. Let’s take a look at the background of gold coins, the types of coins, and how to proceed if you decide to sell gold coins.

Gold Coin Basics

If a coin is either completely or mostly made of gold, it can be called a “gold coin”. In the past, some gold coins were used as circulation coins. Nowadays, gold coins are primarily made as either bullion coins for investors or as commemorative coins for collectors. Though today’s gold coins are considered to be legal tender, they are not actually used in place of actual currency as the metal value almost always greatly outweighs the nominal value.

The world’s central banks stockpile gold reserves in the form of gold coins as well as gold bars. These gold reserves are stored within the overarching category referred to as “forex reserves”. Gold is desired for an array of reasons. Aside from its striking beauty, it serves a number of practical purposes. It can be transported with ease, it has a considerable value to weight ratio and it can be subdivided without eliminating its metal value. It is also worth noting that gold is extremely difficult to counterfeit due to its abnormally high density. Add in the fact that gold is quite un-reactive, preventing it from corroding or tarnishing and it is easy to see why this precious metal is so strongly coveted by people around the world.

Gold Coins of New Zealand: The New Zealand Gold Kiwi

The 1 ounce New Zealand gold kiwi coin is produced by the New Zealand Mint. Made with .9999 pure gold and limited to a mintage of under 4,000 coins, this stunning creation is a part of the Mint’s National Treasure gold coin series. The coin was originally made to honour the country’s famous kiwi bird. Designed by artist Rick Lewis, the coin’s other side features an outline of New Zealand and the word, “Aotearoa”, the Maori word for the nation.

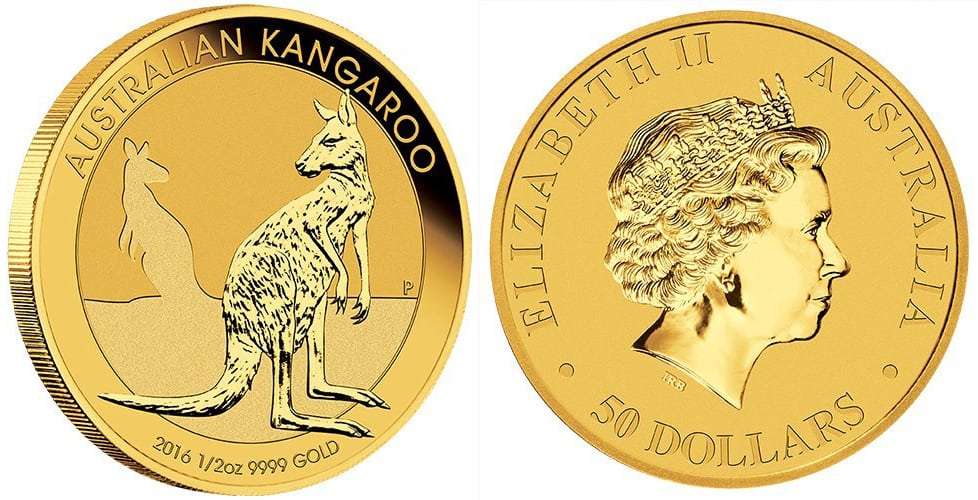

Gold Kangaroo

Gold Kangaroo coins are available in five sizes: 1/20 oz, 1/10 oz, 1/4 oz, 1/2 oz, and 1 oz. Though these are the most common sizes, Gold Kangaroo coins are sometimes released in larger sizes such as 32.15 oz, 10 oz, and 2 oz. These coins were originally created by the Gold Corporation back in 1987. The company was fully owned by the Western Australian government at the time. Originally issued as legal tender, this coin is beloved by coin collectors around the world for good reason. One side features a large kangaroo looking backward. The opposite side shows Queen Elizabeth II. The coin originally displayed an Australian gold nugget. By 1989 it had switched over to the more easily recognized kangaroo. Made with .9999 fine gold, the Gold Kangaroo coin is undoubtedly a thing of beauty. The coin can even be described as “dynamic” as it is one of the few gold bullion coins to alternate its reverse design on an annual basis.

Gold Krugerrand

The Gold Krugerrand was originally printed in South Africa back in 1967. Intended to help the country market its gold, this coin quickly became quite popular around the world. It has a clear cut design that portrays two famous South African figures: the Springbok antelope and Paul Kruger, the first and only president of South Africa. The words, “South Africa” are also displayed in English and Afrikaans. The reverse side of the coin features the aforementioned Springbok antelope. This animal was selected for the coin as it is South Africa’s national animal. Other details printed on the coin include the year of the minting and the gold weight.

The Gold Selling Process

If you own gold coins of any sort, this is an excellent time to sell. You might be timing the market just right by selling this week or this month. Don’t sell your gold coins without doing a little bit of preparatory work ahead of time. Consider getting a coin appraisal in which a professional attempts to determine the true value of your coin(s). Figure out exactly how many karats your coins have, determine their weight and consider consulting with a coin aficionado to assess their condition. Don’t hesitate to get a second appraisal if the first seems undervalued. Once you have gotten a gauge of what your coins are worth, you might find that it is a bit difficult to get a traditional coin dealer to give you a respectable offer. Gold Smart takes all the uneasiness out of the process by offering a competitive quote in little time.

Gold Smart Wants Your Gold

Take some time to think about how nice it would be to cash out your gold coins for a tidy profit. Or, maybe you simply want to liquidate in order to use the cash for other purposes. Our gold coin buyers Auckland business is here to take your gold coins off of your hands. Reach out to us today for a free quote and more information.

Gold is a precious metal that has always been valuable. It will likely continue to hold its value, if not gain in value, far into the future. Gold has served a number of important purposes throughout history, ranging from being used in jewellery to medical devices and even spacecraft.

The Push to Pinpoint all Sources of Gold

Human beings are going to great lengths to conserve every last bit of gold within our grasp. Apple recovered around $40 million worth of gold as a part of its corporate-wide recycling program conducted last year. The company’s recycling program is a component of Apple’s recent push for environmentally sustainable operating practices. The total amount of gold saved through this initiative alone was a whopping 2,204 pounds. This equates to right around the previously mentioned $40 million value. The gold has been plucked from the company’s used smartphones, each of which contains about 30 milligrams worth of gold. The gold is actually positioned inside of the phones’ internal circuit boards. Apple’s example of gold conservation efforts and the push for re-use/recycling will likely inspire numerous other electronics companies to create recycling programs of their own.

Gold Background

The people of the ancient world mined gold as it was quite stunning and could be used to make a number of other useful objects / devices. Gold was used as a decoration for royalty and as a personal decoration. Gold objects have been found dating back over 5,000 years, especially around Egypt and other portions of the Middle East. Egyptian pharaohs relied on mines along the Upper Nile by the Red Sea for their gold.

Contemporary Gold

Today, gold is used in a number of items but it is also used to back currency as well. It is a medium of exchange for a good number of monetary transactions. Much of the United States’ gold is stored in a famed Fort Knox Bullion Depository vault. Its current value is quite high though the public is not privy to the details.

Gold prices have gone up this year. Gold owners saw their investment increase by over 20 percent and we aren’t even half way through the year. This is an excellent time to sell, considering the high price. Gold Smart buys just about every type of gold from sellers across New Zealand. If you have gold bullion, gold jewellery, gold trinkets or gold of any other variety, we invite you to contact us for a free quote. Our prices are the best in all of New Zealand.

Gold Uses

Gold is widely used in jewellery and decorations. Yet it also serves a purpose in an array of other items like electronics, airplanes / spacecraft, dentistry, medical devices etc. Gold is considered to be a “noble” metal, meaning it will not oxidize when exposed to conditions that cause other metals to do so. It has a gorgeous metallic lustre and actually reflects heat, making it ideal for spacecraft that travel at incredibly fast rates of speed. Furthermore, gold conducts electricity, it will never tarnish, it is surprisingly easy to work with, it can be manipulated into wire, hammered into sheets and melted. You really can’t overstate just how special gold really is. All in all, just under 80 percent of gold used each year is applied to jewellery. The other 20 percent is used in products like global positioning systems, cell phones, personal digital devices, calculators, TVs, glassmaking, surgical instruments etc.

Gold Smart Wants Your Gold

If you own gold of any type, reach out to us today. We are looking to buy gold from New Zealanders of all backgrounds. From Auckland to Christchurch, Hamilton, Tauranga and beyond, our team is on the hunt for gold sellers. We are willing to buy anywhere from Kiwis. If you want to sell gold, contact our gold buyers Auckland today for the best gold price.

Silver is not a new precious metal asset by any means. In fact, it’s presence goes so far back in history, silver along with gold are two of the oldest assets known in recorded history. And in addition, archaeologists have continued to find proof of silver’s use well before mankind had a really good idea how to smelt and make tools from metals as well. Today, silver is far from the ancient jewellery or tools it was used for in history. It plays a critical role as an electronics component as well as an industrial metal used in other production. Silver also still holds a cherished place in fine silverware for dining, accessories for a home or office, and fine jewellery as well. And, while it is on the lower end of the value spectrum, silver also enjoys bullion status with national governments who use the metal to regularly mint coins for collections and investment. So, despite how long silver has been around, it still continues to be in demand, and the metal in all forms continues to be usable as an asset that can be sold later for real cash value.

Silver’s History

By already 3000 B.C. humans were actively mining and pulling silver out of the ground. It wasn’t particularly useful in terms of coins or currency at that time, but the metal was being used for jewellery and items of artwork and crafting. Some 2,500 years later, the first coins actually appeared. This allowed silver to be used as currency which, while already being seen as lesser value than gold, made it easier to give value to partial amounts of gold in exchanges and trade. No surprise, silver became quite useful in international business, being used to liquidate goods in multiple markets and still being able to retain value when one returned home after selling everything. Some 300 years later, the Romans expanded silver even further. The metal was adopted as the Roman official currency material for all of its primary coins. By the time Jesus was born, silver was as common as the U.S. Dollar is today or the Euro for international currency. And Jesus referenced in the Scriptures being sold out by Judas for thirty pieces of silver.

Halfway around the world in the East, China began to use silver as well for the currency. The exact date is not clear but it did happen somewhere between 200 B.C. and 200 A.D. This continued well into the 16th century when Spain and Portugal reached China and began to open up trade across the Pacific with the Chinese. By this point the Chinese were desperate for silver, having exhausted their domestic supply. Suddenly, the Portuguese are able to buy anything and everything China has with new, unlimited silver, and the gloves were off. Many believe in hindsight this was the undoing of ancient China but silver had such a dramatic effect, Portuguese knew they hit the jackpot at the other side of the big ocean.

While the British had were well-ensconced with their gold guineas, the Americans fresh from a revolution decided in 1794 that silver would make for a fine national currency. And the first U.S. silver dollar was minted and sold. This set off a coin trend that would last well into the next centuries until 1964 when the last circulated U.S. coin was made with silver in its content.

Being taking out of circulating currency didn’t stop or weaken silver demand, however. The minor precious metal continued to be used for commemorative coins and medals as well as awards, there continued to be a strong market for silverware for fine dining, and the industrial market was growing as both Europe and the U.S. were booming after World War II. In fact, in 1980 silver reached its highest value on record at $50 a troy ounce, and it continued to bump around in the mid $30s through the 2000s. Interestingly, despite the pandemic and economic turmoil of 2020, silver has been relatively affordable still in the range of upper $20 per ounce. And many are projecting a rise soon back to higher levels because of that affordability.

Industrial Demand for Silver

As technology has increased, so has the demand for silver in bulk for industrial use. Some of the latest technology is utilizing silver for connections and motherboard applications as well as reliably handling circuitry demand with thermal conditions. Additionally, silver has regularly been used in the medical field for preventing infections, dealing with burn injuries, addressing skin conditions, helping with radiology and implants as wells as prostheses, and it has been used for decades in fillings until recent years. In an extreme environment water becomes essential, and silver ions have become extremely useful in purifying water as well as removing harmful bacteria that could cause digestion problems in people. This has proven itself in space missions where water has to stay in storage and can otherwise build up bacteria when not being replenished regularly.

Purity

Considering your silver for sale means first understanding what you actually have. In most cases for a household, silver is often owned in one of three forms: jewellery, coins or silverware and accessories. It’s important to keep in mind the nature of the metal in these forms. Silver is quite soft compared to most other common metals, and it can be worn out fairly easily. To solve this problem, silver is regularly combined with other metal alloys that make it stronger for daily use. These metal alloys like copper enhance silver’s longevity, rigidity and “wearability”. However, the average person would not be able to tell an alloy from a pure silver right away just by sight.

The first sign of purity or alloy comes with jewellery. Fine jewellery tends to be marked with a number that indicates its purity present. High-quality silver pieces often have such a number marker or marker’s mark. As an example, sterling silver pieces are usually marked with “925”. This is not to say that unmarked silver has no value; silver without a mark and silver that does not qualify as sterling can still have considerable value. However, when marked, silver purity is indicated with percentages. The highest silver purity is 99.9 percent. Other purity levels range from 80 percent to 92.5 percent and 95.8 percent.

Government coins, on the other hand, range from an extreme of almost 100 percent silver to junk silver. Mint bullion coins are typically 99.9 percent pure silver. These are sold for collection and show and have no circulatory value at all. Yet, as we mentioned before, countries mixed in silver with other metals for years, creating partial silver coins that went into circulation quite a bit. These too have fallen into collections but are dubbed “junk silver.” Many of them have 90 or even only 80 percent silver, and because they were used in circulation they are beat up most times. These coins will still get value but they will not be sold for a full silver price because they are not pure.

Other items like silverware or silver table pieces may not be marked at all as above. Instead, owners may have the documentation for the sets or pieces, or the manufacturer’s mark will be on the item which is recognizable to silver buyers. In these cases, silver items that have documentation or brand marks will likely sell very well as they are a known commodity and will easily pass evaluation and testing.

Finally, there is all other scrap silver, which is essentially silver items that may or may not have full purity, but their content and make are simply unknown. This can range from rings handed down to necklace chains to silver metal fixtures, like handles for example. These will all need to be tested, but to the extent, they are silver in substance, they can sell for value.

Getting an Honest Evaluation

Gold Smart will always be interested in buying your silver, gold and platinum. Our customer service is top-notch and our prices are fair, which is backed up by our years of business and reputation as well as hundreds of customers who have been with us for years. If you have silver, Gold Smart is looking to buy it, providing you a viable channel for selling you scrap silver that is no longer wanted. And, we purchase a wide array of silver bullion and jewellery, so bring all your pieces if considering a sale. We look at all silver makes or sizes from jewellery to coins to silverware.

During the evaluation process we look at every piece a customer brings in to confirm its quality and fineness. As mentioned above with purity, silver usually averages between 80 and 96 percent fineness. Any marks, documentation, branding and similar will help in this regard, but it’s not conclusive. As professionals, Gold Smart buyers will still confirm the metal content as, unfortunately, there are lots of fraudulent players with very capable means of producing fake metals. We will also weigh the piece to confirm its objective quantity and mass.

The good thing is, your silver can be old, scuffed, scraped or tarnished, and we will still buy it if confirmed as genuine silver metal. We are always interested in all silver pieces regardless of their condition. No surprise, damaged silver jewellery, coins and silver bullion will be considered for purchase at their melt value and the same would apply to other silver items in scrap condition not in sets etc. Where an item is a particular known fine brand, we will seek these out and price them accordingly as well. However, because Gold Smart is a professional metal buyer and not a numismatic dealer per se, we will not price coins for their collectability. Customers hoping for collection-level pricing should seek out numismatic dealers for coins instead.

The Types of Silver That Will Likely Be Bought

We are interested in almost anything that has solid silver in it. From undesired silver jewellery to bullion bars, coins, silver cutlery, silver wire, scrap silver and beyond, our Gold Smart team will make a competitive offer for just about every type of silver. We are also interested in sterling silver odds and ends like beads, bails, clasps, fittings, clips, links, pins, studs and tubes. As long as they don’t have stones embedded in them or are mixed with other metals, we will evaluate the silver for purchase. And, we regularly buy coins. Silver Buffalo Coins, Silver Eagle Coins, all World Mint silver coins, Silver Maple Coins and plenty of other government-issued coins will get a positive reception.

Examples of silver to sell also include 1oz Silver Bullion (including silver Kiwi Ferns, Silver Kookaburras, Australian Silver Koalas, Canadian Silver Maples, Mexican Silver Libertad, Chinese Silver Panda, Austrian Silver Philharmonics), 99.99% 1kg Silver Bars (PAMP Suisse, J&M, AGR, NZ Pure Silver, ABC, Perth Mint Silver), old silver coins that have no numismatic or collectors value (including Morgan Dollars, Liberty Head “Barber” half-dollars, some quarters, dimes and nickels, Crowns, Half Crowns, Florins, Shillings, Six Pences, Three Pences).

Remember, scrap silver can also be converted to a cash value as well with Gold Smart. Because we are situated as a primary consolidator, we are able to take in all types of silver for melting purposes and converting the pieces back into bulk silver for resale to the general market. Some buyers will be industrial while others will be looking for material to use for new consumer products. Because we source from all types of customers, including private individuals, on a regular basis, we are able to intake any and all types of silver versus just government-issued bullion. That means your odds and ends silverware, silver dishes, cabinet and drawer fixtures or knobs made of silver, and decorative cups or teaspoons all fall in the same category. For example, anything that is marked sterling silver is pretty much a known 92.5 silver content. That’s a very viable form of silver scrap or undesired piece, and worth far more than some of the lower quality pieces at 80 percent for the same weight.

Which Pricing Will Apply?

Folks sometimes mix up different price values for silver they want to sell because they have heard or had their silver evaluated in another format. It’s easy to assume the same value applies from one situation to the next, but it doesn’t. Three main value appraisals can occur with silver. These are known as cash value, insurance value and replacement value. They are not the same.

Cash value informs you as to how much cash you can get for your silver piece on the open precious metal market if you decide to sell it. However, many times you will not have a good idea on the true value of your silver piece until you bring it in for a professional review. If it turns out that your silver is worth a decent amount of money. There is an opportunity with Gold Smart to sell it for cash.

The insurance value, also known as the “agree on value”, is the amount of money that you and your selected property insurer can agree upon in the event that the silver piece is lost or stolen from your home or security defined in your policy. This is an agreed value with an insurance company only, and it has no bearing on how much a silver piece could actually sell for on the market.

There is also the replacement value. This is the market value the insurance company will pay if the piece is lost so that you can replace it with a new or similar item. Again, it has no financial binding on your silver if selling it to a metal buyer; it’s only an agreement between you and your insurance coverage.

At Gold Smart, we will always give you a fair price for your pieces, coins and bullion based on the latest silver market and our buyer’s margin. We don’t have hidden fees and we evaluate every piece with you so you know how the full value of your lot is arrived at. And, there is no pressure to sell anything. We would rather have you as a long-term customer than achieve a singular sale. To find out more, give us a call and set up an appointment. Our professional buyers will be happy to work with you on evaluating your items and arriving at a very accurate fair pricing for your sale.

Everyone loves gold. It’s brilliant, shiny, has a weight to it that people love and, frankly, it’s a darn good investment financially. On the other hand, if you need cash quickly selling your gold can be very fruitful as well. Selling your unwanted gold has never been easier, and the proliferation of websites and gold market tracking boards that can be used to track the cost of gold worldwide make it possible to track gold values literally at one’s fingertips via a smartphone. All of that informational power in turn makes it possible to confirm that one’s second-hand gold is being bought for a fair and reasonable price.

As it was centuries before, gold remains one of the most valuable commodities in the world today. It withstands the test of time in ways that many other metals do not. Not only is it beautiful to look at but the jewellery created from gold is worn by men, women, and children worldwide.

In different cultures, gold is given as gifts on special occasions such as weddings, birthdays, and anniversaries. It’s officially the gift for the “golden anniversary” of marriage at 50 years. And the fact that gold itself comes in a few different quality forms measured by carats makes it possible for many to have access to gold at different income levels. It’s most commonly sold in 10k, 14k, and 18k with related pricing for each level of carat closer to pure gold (24k). And gold can be obtained in white, gold, or even rose color variations.

The above demand in turn continues to make gold valuable when it comes time to let it go. No surprise, this is why the yellow metal was formed into jewellery for years, providing a wearable form of security for women during ages when their spouses could end up being killed the next day in military activities or by simple accidents in the wild. It was the financial safety net for many cultures long before government welfare was ever even thought of as a program for the poor and disabled.

And, just like those in ancient times, today folks may find selling their gold is timely, useful, and smart, especially that gold has been held for a long time. It’s no secret that gold value has gone through the roof compared to where it was 10 and even 15 years ago. The appreciation of the precious metal’s value has been tremendous, and it continues to be supported at high levels that aren’t likely to drop anytime soon. In fact, if economic instability shows up again as it did at the beginning of 2020, gold could easily skyrocket as people seek a safe harbor in finance to hold onto value and avoid market losses. As a result, anyone who right now is thinking about selling gold is still looking at a good opportunity. That said, whom that gold is sold to can make a big difference. There are lots of gold buyers in New Zealand, but that doesn’t mean they are the best choice for an honest and fair Kiwi price and deal.

Getting Started with Selling Personal Gold

Selling personal gold can be a very effective way to create additional financial capital for families. However, when considering selling gold in New Zealand you’ll need to be sure you are selling gold to a gold buying company that provides the best rates, full privacy and discretion, personal and friendly service, and knowledgeable staff. It’s not worth taking the risk to just go with the first buyer that comes along – your intuition is a great asset when considering which gold buying company to sell to.

It is incredible how a small amount of gold jewellery can add up to a significant amount of CASH. It may only be a few handfuls of gold jewellery that you are considering selling, yet that could be several hundred if not thousands of dollars when liquidated. Unfortunately, that incredible value doesn’t go unnoticed. An amazing number of less-than-stellar buyers have appeared over the years in New Zealand, looking to separate people from their gold at prices far less than what the precious metal is worth. As selling gold has become more normal for customers around New Zealand, many borderline buyers have realized that there is a goldmine of its own in easy consumer targets. And by waving some ready cash in hand, many of these buyers are having throngs of Kiwis marching to their doors for ready sales, often selling their personal gold at values that are 30 to 50 percent less than what people should be getting paid. These financial victims only realize how badly they’ve been fleeced once the buyer has their gold and is long gone or they’ve agreed to an unscrupulous business legally without any recourse for recovery.

Understanding how to sell starts first with understanding whom the buyers are. Gold buyers in New Zealand fall into four categories:

- Private buyers

- Pawn shops and corner store buyers

- Jewellery buyers

- Professional gold buyers

Private Buyers

Private buyers oftentimes are not even legal businesses per se. They operate with a wad of cash and show up with little notice, offering to buy any gold available. Because the settings tend to be in a pub, a hotel meeting room, someone’s home at a party or similar, the social pressure is one to commit and enjoy the buying. In fact, turning the buying into a party is one of the common tactics. People can’t handle transactional math very well after a few pints, even if they have a math degree. The buyers will play a lot of sleight of hand, argue the gold involved is a lower quality carat after visibly testing it with a handy tool, and then the seller feels obligated to accept the cash being waved in front of him or her. The next day the buyer is long gone, having left town that night and not even staying in his or her hotel room, and the sellers wake up with a hangover realizing they may have just made a big mistake.

Pawn Shops

Pawn shops and corner stores situate on purpose in neighborhood areas where things tend to be financially harder. They know these locations are where the market exists to get valuable property by providing quick cash loans against the personal goods provided as collateral, including gold jewellery and assets. The business makes its money regardless; either the borrower pays the loan back with hefty fees, or the pawn shop gets to keep the property, having “bought” it with a cheap loan for less than the worth of the property. Pawn shops also outright buy gold too at extremely low prices, again waving ready cash for what’s available. Most people visiting sell even when they know the item is worth more. Financial desperation has that effect. The only difference between the pawn shop and the corner store buyer is that the corner store doesn’t pawn any property; they just buy the gold outright but still at low prices. Because of the ready cash and easy liquidation of gold, pawn shops, and corners stores have frequently been a problem with property crime and fencing stolen goods.

Jewellery buyers

Jewellery buyers work out of regular jewellery dealership, but buying second-hand gold is not their primary business. These buyers handle gold buying as an offshoot of their main business, generally looking for prime jewellery pieces they can resell directly, such as jewellery made by Tiffany Co. or similar. Otherwise, the gold they take in simply gets resold to gold consolidator they know for a marginal markup. That means the jewellery dealer has no interest in really buying second-hand gold at a fair price as they aren’t set up to take in lots of it as a regular business. So, they frequently low-ball pricing offered or refuse to buy altogether.

Professional Gold Buyers

Professional gold buyers are the top end of the gold buying stratum. They are licensed businesses and regularly buy second-hand gold to maintain a steady supply of the precious metal. Some work as retail buyers only, then moving their lots onto consolidators who actually melt the gold into bullion form for industrial sale, and others handle both functions by being a retail gold buyer and consolidator in one operation. Both focus on bulk gold consumption, but professional gold buyers also offer personal sellers a way to sell gold at rates that are comparable to real market prices for recycled gold. Remember, even professional gold buyers are a business and need to make a profit to stay operational. So, their pricing will never be equal to the market price for gold. However, they are oftentimes far closer than any other gold buyer type in New Zealand.

What Buyers Look For

If you have a lot of different gold pieces lying around in the back of your jewellery collection, it might be time to sell that gold to get the return on your investment you desire. This is especially true if you have many pieces that you don’t wear anymore or they are broken. Selling gold is a terrific way to make a little extra money for the things you truly need. And professional gold buyers are always ready to evaluate your gold pieces for purchase.

The most likely gold to sell will be pieces and assets made entirely of gold. That includes government-issued bullion coins and bars, raw gold ore which sometimes is given as a give or attached to jewellery, sold gold jewellery such as rings, necklaces, and earrings, and broken gold pieces. As long as the metal is entirely made of gold, it will likely sell. However, items that are gold-plated should not be considered. These are not gold at all; they are just base metal pieces with a very thin film of gold electrostatically or chemically applied to the base metal. Most times, the inside is made of lead, aluminum, copper, or bronze. Additionally, jewellery with stones inlayed will not be viable either. Professional gold buyers aren’t set up to market the stones after separating them from the gold involved. These kinds of jewellery may be better sold to vintage jewellery dealers instead.

If you are planning on selling your gold in New Zealand, then you need to know about Gold Smart, a trusted, professional gold buyer that has been established for years in the industry. At Gold Smart personal gold sellers will find a professional team of friendly people who the seller’s best interests in mind. They are licensed gold buyers, naturally, and will offer excellent prices on gold using a process that will ensure a fair price for all unwanted gold, whether in bullion form, coins, scrap, ore, or finished jewellery. And, if it so happens that you have it, Gold Smart also buys silver and platinum as well.

So, if you live in the Auckland, Wellington, Christchurch, Tauranga, or Hamilton area Gold Smart is more than happy to service your gold selling needs. When you think about the 9 trillion dollars’ worth of gold hanging around all over the world, don’t you want to get your little gold slice of the pie evaluated? It’s not doing you any good sitting unused in your jewellery box. Bring it out into the light to get the money you deserve for all that precious gold. It’s best to go to an established gold buyer specialist like Gold Smart, who will give you the right price for each different carat of your gold jewellery. We aren’t in the business to pressure you to sell either, so don’t worry if you are unsure that you want to part with your jewellery. Showing you exactly what you’ll get for it will help you make the smart decision. Our service is discreet, professional, and has zero hidden costs or fees. Being upfront with the process is part of our value and service to you.

Unique to Gold Smart is our Value Guarantee that outlines our commitment to providing the best rates for gold and silver. We endeavor to beat any price, deliver excellent service, provide full and complete communication, the fastest turnaround time, no pressure, and absolutely no hidden costs! There’s no reason to take risks with other seller types or to be low-balled just to liquidate your gold. Gold Smart makes the entire selling gold process easy, safe and profitable for you.

AUCKLAND, 26 August, 2015 – Recognised in New Zealand for their excellent customer service as gold buyers, Gold Smart (www.goldsmart.co.nz) is offering tips to those who want to sell their old gold jewellery for cash. Selling jewellery is a popular way to put extra money in your pocket, especially around the holidays. Gold Smart suggests locating a specialist in gold buying to get the most from the sale.

Some gold buyers claim they offer fair value for gold jewellery but severely undercut what they pay sellers. Whereas, gold buying specialists have in-depth knowledge of best practices and stay up to date on precious metals so they can give you the best price. Gold Smart, for example, specialises in buying gold jewellery as well as bullion and coins.

Gold buying specialists will never pressure a seller to make a sale. If jewellery has sentimental value, it can be difficult to part with, often reminding the seller of the time and place it was received or the person who gave it, a spouse or parent.

“Customers love that there’s no pressure when it comes to selling,” notes Gold Smart spokesperson, Anita. “They come in and enjoy a coffee, the view, and meeting our Siberian Husky, who loves a good pat.” She further continues, “We understand the emotional experience of letting go of both good and bad memories associated with jewellery. I’m proud to say we’ve helped many customers move on in a positive way.”

Since 2009, Gold Smart has helped thousands of Kiwis get the best prices for their old gold jewellery. Sellers feel safe selling gold in a secure and friendly atmosphere. “As a first time seller,” says customer Nani, “I did some shopping around first to determine the best value for my gold piece and found Gold Smart. They were very prompt with communication and the whole process was professional and hassle-free.”

Gold Smart offers customers four options to sell their gold jewellery, in the store, through courier pack, by VIP pick-up service, or allowing customers to send in their own parcel. They also understand New Zealand’s gold industry, with locations in St. Johns, Wellington, and Tauranga. Instead of hanging on to that old gold jewellery piece, consider putting the sale money to good use now.

For more information, visit http://www.goldsmart.co.nz

CONTACT

Anita Elliott

anita@goldsmart.co.nz

0800 465 376

A family of treasure hunters has found more than $1 million worth of gold artifacts off the coast of Florida.

Multiple media outlets reported that boat captain Eric Schmitt and his family made the find June 17 about 4.5 metres in the Atlantic Ocean off Fort Pierce.

Brent Brisben is the co-founder of 1715 Fleet – Queens Jewels LLC, the company that owns the rights to the wreckage where the family found the gold. Brisben says the artifacts date from a 1715 maritime tragedy in which 11 Spain-bound galleons were lost during a hurricane.

He says the items recovered include 51 gold coins and 12 metres of ornate gold chain. There’s also a rare coin called a Royal that was destined for the king of Spain.

Original Source: nzherald.co.nz

Gold as an elemental metal historically results from the earth’s inner machinations, created by an intense process of nuclear fusion, high energy, heat, and pressure. In short, it’s not any place a human could even go near from thousands of miles away. These are the dynamics for what it takes to create a soft metal; just imagine what it took to create harder metals like iron! That said, the world’s supply of gold did not just appear some 500 years ago as people started digging. It has been sitting in the earth’s crust for well over 4.5 billion years ago as atoms started bonding with each other to make specific elements. The results have produced the entire natural chemical table as we know it today, and that’s just what is on earth alone. We have no idea what else is possible in the universe.

As the earth continued to gyrate and expel its inner material through the new crust and volcanic or geological actions, gold moves from inside the planet towards the outside. And, after millions of years of erosion and weathering or exposure, gold eventually became accessible by the minuscule impressions humans made to the earth’s crust mining to find it or access the yellow metal. Otherwise, it also became available as the earth’s crust broke down, most notably with erosion. That weathering process continues to deposit small bits of gold, better known as nuggets, in watersheds and streams which ultimately becomes the gold people find panning in rivers.

The deepest presence of gold known is some 1.5 kilometres underground, deep in caves and drill holes that take huge equipment and effort to operate. Another major location tends to be open mines that open up the earth about 50 metres down, exposing gold that otherwise is probably unreachable to 99 percent of the population given the effort it takes to remove that much earth and expose it. However, even when found, gold is not a metal that one just picks up and throws into a melting bin to produce gold bars with. It has to be separated from the rocks it has bonded with, and that process takes further work and effort. As a result, at its peak, the world produces maybe 2,500 tonnes of new gold annually.

Gold as mined metal is not easy to find either. Despite the lore of just going to the nearest river and panning if it comes from the mountains, the reality is that gold is very hard to find. Modern-day gold-hunting doesn’t happen with a lot of walking or driving around. Instead, companies use geologists who scrutinize and examine thousands of images from satellite photography. When, with the trained geology eye, an expert spots signs of a potential gold presence, folks then have to go out to the location and survey it. They spend days walking the area, taking samples, looking for physical signs of gold presence or the materials that would signal high probability like quartz, and then they bring all the information back to analyze. Only with a good amount of processing and data-crunching do companies then pinpoint a location for test-digging to actually pursue the gold itself. Even then, many test-dig sites are failures, and everyone goes back to square one again to do it all over for the next site. All of this rarity and challenge adds to gold’s demand in modern life, of course, and increases the chance of fraud and fake gold as well.

Solar System Origins

If one wants to get astro-mechanical about gold, there’s plenty of material on that topic going around as well. Due to being a metal, gold was originally created inside stars, at least how the astronomical perspective theorizes the matter occurred. This process, better known technically as nuclear fusion, delt with gold in its primary elements in the form of hot gasses first; the yellow metal didn’t even exist yet in this phase. In the entire process of moving from lighter elements to heavier ones as stars churned and burned through their millions and millions of years of life, eventually, the bigger solar beasts started developing elements in the form of metals, iron being one of the most significant. These processes were not peaceful, consistent events; they blew apart violently and supernovas were quite common in one considered them in the context of billions of years being a moment. As supernovas occurred, the explosion of stars propelled atoms of newly created elements far and wide, and that expulsion seeded the known universe with its first atoms of metals, including gold. Now, this entire theory, taking in a highly summarized context might seem about as fantastical as some alchemist figuring out how to spin gold with magical spells and ingredients in a tower somewhere. However, when all the above is described in the framework of physics and mathematics, that’s when it shifts from insanely imaginative to the highly formulated theoretical work of astrophysics as we know it today.

Is this idea of gold from nuclear fusion silly nonsense? We have the proof on our own planet. In fact, much of it can still be found in the deserts of Egypt. Centuries ago, a massive meteor plowed into the desert area which, as we know today, had a significant amount of sand, better known as silicon on the elemental charts. When sand is heated to tremendously hot temperatures, it turns to glass. When it gets superheated in the nuclear blast of a colliding meteor with earth, and all that energy suddenly released, it produces what is known today as Libyan Desert Glass. One of the most famous pieces of it was installed in ancient times as a scarab sculpture in a breastplate decoration that was worn by King Tutankhamen. So, if the energy of a meteor blast can produce glass from sand, it is quite possible for a supernova to create metals from hot gasses and free-flowing atoms in space.

Back to our astro-theory story, as the gravity of our home star, better known as the Sun, pulled material in a swirl around it, balls of material and eventually clumps begin to form, coalesce and become the first prototypes of planets that eventually make up the Solar System today. This process included lots of other material floating around in the System, including a couple of million meteorites that get pulled into the chaos and slammed together with Earth as well. Many of those include metals in them. The heavier material moved towards the center of the planetary clump while the lighter material stayed on the periphery. Ergo, metals start to concentrate inside the proto-Earth. This is all still being heated at incredible temperatures by energy release, melting, and re-melting metals again and again. The results end up being the high concentrations of metals flowing inside the earth’s center, to occasionally be pushed to the top through new crust formation or volcanic bursts and depositing the same inside rock on the earth’s crust.

The above, however, is not the only theory of how gold came about through astronomical forces. If one spends any amount of time in theoretical science about what things might have been like 4.5 billion years ago, he or she is going to find there are lots of well, thought-out theories and ten times as many not-so-well-through-out ideas as well floating around. From the more classic side of the theoretical arena, there is also the idea that gold was created by two neutron stars colliding with each other like a stellar car accident at high speed. When one star slammed into another, presumably a much bigger one, the smaller star was stripped and collapsed. As that occurred, the core of the consumed star is barreling into the bigger start with an incredible amount of additional energy. Some have tried to liken the idea of crushing and density-smashing that this would mean as stuffing Mount Everest into a soda cup or similar smaller size. The idea of that much force and energy release is beyond anything we have calculated possible to date. Yet that would be the gravity effect of a neutron star. The energy being released at the same time is what is referred to as gamma-ray bursting, which in essence is a huge solar-level explosion. When released, the event has the capability and power to create elements, like gold, easily among everything else that happens.

Mythical Originations

The ancient Greeks believed that gold was a product of purity on par with the gods. No surprise, they often adorned many of their idols and statues of Greek deities with gold. However, it was also seen as an extremely valuable commodity, and quite a bit of metal goods from cups and artwork to plates were made from gold as well. They were not the first, however. The Egyptians had been using gold long before, also as jewellery, decoration, art, and special items of value. In fact, because the Egyptians were so prolific users of gold for tombs and statues put in death storage with those that moved to the afterlife, their tombs centuries late became highly prized targets for looting and smashing to get to the same yellow metal. Thousands of tombs and their Egyptian cultural heritage have been destroyed as a result, with some of the most famous being highlighted by the earliest archaeological work done in the region during the 19th and 20th centuries.

In the New World, gold was frequently used for decoration, adornment, and status of high rank among indigenous cultures. The skills were highly prized, and crafters had social status protected by the ruling and warrior classes. It is not clearly known among Mesoamerican cultures whether the Olmec used gold, but the Maya definitely did. They traded it on a regular basis when it was not hammered and re-formed into jewellery and trinkets. The same skill and trade passed on to the Toltecs as well as many other tribes and peoples. By the time the Aztecs began to establish themselves in Mexico centuries later, gold was well understood as a usable and precious metal, rare in frequency and quite malleable for art and craft. The Aztecs often referred to gold as the perspiration or sweat from the Sun. The rest of the New World’s curse with gold is well documented in the annals of Spanish conquistador exploration both into Central and Southern America chasing indigenous gold.

Across the Pacific, the ancient Chinese were busy working with gold in a hammered, thin decorative fashion. The first records of gold being used were during the Shang dynasty, but it wasn’t considered quite as valuable as perhaps jade or even bronze, both every hard to come by even if one was a very powerful warlord at the time. The ancient Chinese eventually moved beyond brute force and realized that gold, when mixed with other metals, could produce form. Some of the earliest uses of gold found in Chinese archaeology includes cast gold mixed with silver for an alloying effect when creating earrings.

In the Russian steppes, the Scythians were the most famous for their ancient use of gold in that part of the world. Nomadic by nature and bonded with the use of the horse to be able to travel great distances, Scythians were well-known for their fighting process and frequently conquered neighboring people as well as each other, looting and taking what was available in the process. That produced a concentration of gold among the Scythians that ended up being prized as a material they could work with. A number of Scythian dignitaries and royalty buried with treasure and valuable items are now being found with multiple gold pieces among their funerary inventory, including worn jewellery and medallions. There is no record remaining of what the Scythians thought was the origin of gold, but they were quite adept at using it. Some of the most sought-after pieces of goldwork from the 7th to the 3rd century B.C. are Scythian and museums scramble as they can to obtain samples for their own collections when these become available.

With So Much Gold Dug Up, Has It All Been Found?

In a word, hardly. The amount of gold dug up and harvested today totals some 197,576 tonnes as of 2020, and 66 percent of that amount has been accessed since 1950 with greater automation and digging systems that were not present in earlier years. Overall, another 57,000 tonnes are known in location and kept in reserve but not yet actually dug up. So, give or take, the identified gold measures approximately 245,000 tonnes. That figure represents, by shared estimate, some 70 percent of the gold possible in the earth’s crust that can be accessed by people. In turn, that leaves 105,000 tonnes possible and left to be dug up. That does not include what might be in the oceans.

It is safe to say that most of the big gold lodes possible have likely been found and removed, leaving only those big gold deposits that take significant strip-mining or earth moving capability to get the rest of it out. Among the large mines available, the largest is in South Africa, which contains by estimate 30 percent of the remaining gold possible and available to dig up.

However, in the 21st century and the last 10 years, one of the biggest gold recoveries has not been from the ground but from our obsolete technology. Gold has been and continues to be used in an industrial sense in high tech. As those pieces and equipment become old and unusable, they go into the trash heap. Yet enterprising companies are realizing there’s money to be made finding and recovering the gold of old motherboards and similar, as well as other metals and materials. So tech recycling is starting to become a bit of a “mining” operation on its own and is likely to continue to increase as gold demand keeps going higher.

Fortunately, New Zealanders don’t need to swing a pickaxe, chisel, or sign on with a company in the middle of the boondocks to find gold locally. Gold Smart has a wide and diverse inventory of gold available to Kiwi buyers interested in the precious metal in all forms. To find out more give us a call or visit us online.